some idea of the concept of tax cuts..

Jul 31, 2023 19:37:43 #

Why did Trump's tax cut fail to have any visible effect on U.S. investment?

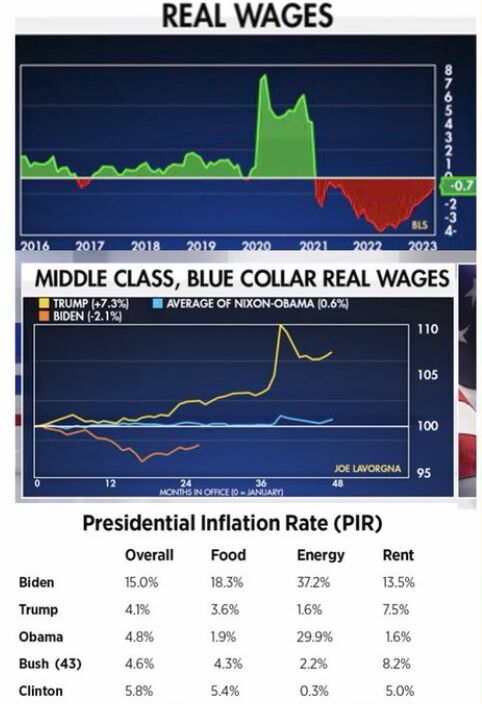

It had a tremendous effect. Prior to his tax bill, the Dow was growing at 16.2% annually going back to Obama’s recovery act. From his tax bill until the economy’s peak before C***d, the Dow grew at an unimpressive 5.8% annually. By 2019, the economy had slowed so much that the Fed lowered interest rates for the first time since Bush was President, and Trump himself complained that they didn’t commit to do more to prevent a recession. So the rate of investment growth slowed by about 2/3 before the p******c, and lower interest rates meant low-risk investments like savings accounts also were less profitable.

It had a tremendous effect. Prior to his tax bill, the Dow was growing at 16.2% annually going back to Obama’s recovery act. From his tax bill until the economy’s peak before C***d, the Dow grew at an unimpressive 5.8% annually. By 2019, the economy had slowed so much that the Fed lowered interest rates for the first time since Bush was President, and Trump himself complained that they didn’t commit to do more to prevent a recession. So the rate of investment growth slowed by about 2/3 before the p******c, and lower interest rates meant low-risk investments like savings accounts also were less profitable.

Jul 31, 2023 19:54:56 #

LostAggie66

Loc: Corpus Christi, TX (Shire of Seawinds)

permafrost wrote:

Why did Trump's tax cut fail to have any visible e... (show quote)

Interesting post Perm

Jul 31, 2023 20:07:23 #

permafrost wrote:

Why did Trump's tax cut fail to have any visible e... (show quote)

🤪🤪🤪🤪🤪Yeah everything’s running like a well oiled machine

Jul 31, 2023 20:25:30 #

permafrost wrote:

IRS data proves Trump tax cuts benefited middle, working-class Americans most.Why did Trump's tax cut fail to have any visible e... (show quote)

IRS Data: Middle Class Americans Saw Significant Tax Reduction from Trump Tax Cuts

Yahoo Finance: Trump tax cuts and the middle class: Here are the facts

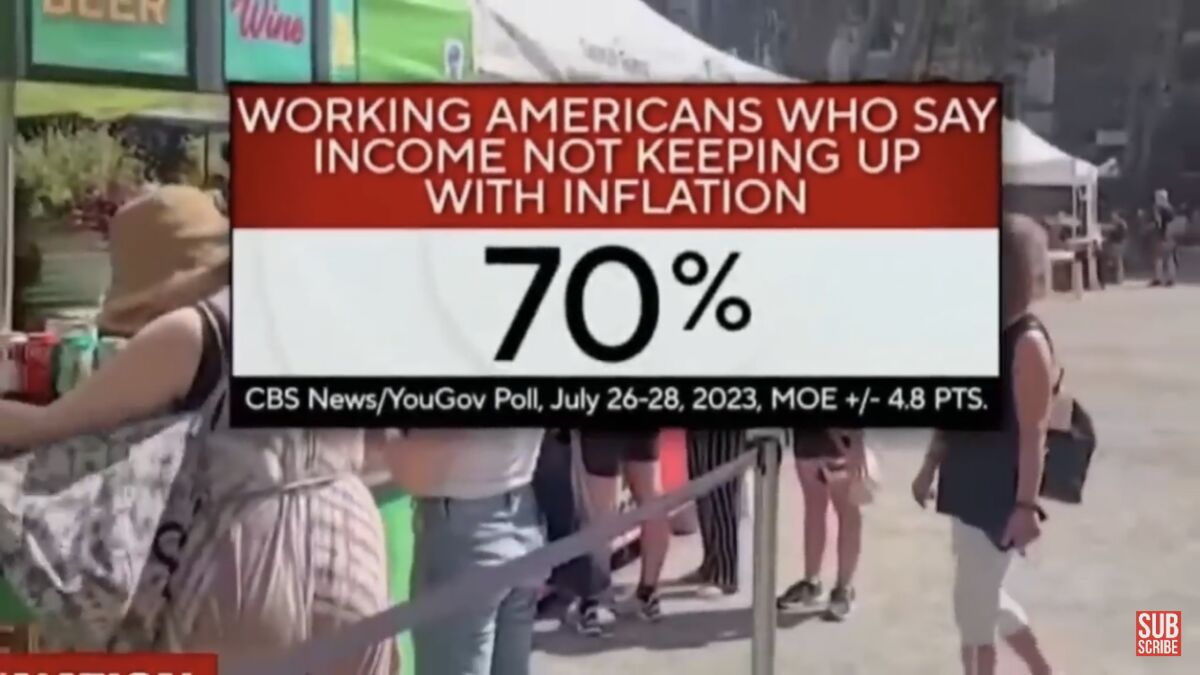

Now that they have taken back Congress, Democrats on Capitol Hill are holding a hearing on Wednesday to “examine how the middle class is faring.” While they will undoubtedly use this hearing to score political points, the fact is the tax cuts have created unprecedented prosperity for the middle class in the form of higher wages, more take-home pay, more jobs and new employee benefits.

Rather than disputing these facts, Democrats argue that the bill was a “s**m” for American families. They have seized on the news that the average tax refund is slightly down at the start of tax season as proof that the tax cuts have left families worse off. This criticism is misleading on various fronts.

>SNIP<

Economics 101:

Tax cuts allow individuals, families, and businesses to keep more of their money to spend and invest.

Individuals and families might buy some new clothes, a washer and dryer, a new car, build an addition to their home or take an extended vacation, maybe even start a business.

Businesses can expand, upgrade tooling, build a new facility, create more jobs putting more people to work.

When more individuals, families and businesses spend and invest money, more people are paying taxes, the result is more revenue flows into the government coffers.

Jul 31, 2023 20:34:38 #

Blade_Runner wrote:

I know you understand that the majority of these opinion pieces are written by the supporters of such a thing..

And I would bet you also know that what savings were enjoyed are all temporary and end with the 2025 tax..

Then the middle and working class truly will have to heavily pay for the very rich getting the mountain of cash courtesy of trumpstan..

Jul 31, 2023 20:42:08 #

permafrost wrote:

I know you understand that the majority of these opinion pieces are written by the supporters of such a thing..

And I would bet you also know that what savings were enjoyed are all temporary and end with the 2025 tax..

Then the middle and working class truly will have to heavily pay for the very rich getting the mountain of cash courtesy of trumpstan..

And I would bet you also know that what savings were enjoyed are all temporary and end with the 2025 tax..

Then the middle and working class truly will have to heavily pay for the very rich getting the mountain of cash courtesy of trumpstan..

Then why didn’t Democrats change it then they ran everything for two years

Jul 31, 2023 20:51:52 #

permafrost wrote:

STFU, will ya. Had enough of your hardass left wing bulls**t.I know you understand that the majority of these opinion pieces are written by the supporters of such a thing..

And I would bet you also know that what savings were enjoyed are all temporary and end with the 2025 tax..

Then the middle and working class truly will have to heavily pay for the very rich getting the mountain of cash courtesy of trumpstan..

And I would bet you also know that what savings were enjoyed are all temporary and end with the 2025 tax..

Then the middle and working class truly will have to heavily pay for the very rich getting the mountain of cash courtesy of trumpstan..

Jul 31, 2023 21:31:45 #

BIRDMAN wrote:

Then why didn’t Democrats change it then they ran everything for two years

That is a question I have asked no less than 3 of my reps and truly h**e to say... I got no satisfactory answer..

I think they did/do have the power to do so but never gotten a full explanation.

Maybe tomorrows research assignment?... It really does puzzle me..

Now you did it Bird,, I did a 3 min looky look, found this and the article, now I am truly PO and swear I will never like any politician again.. I said this once before about 1970, but this time I truly mean it.. the turds...

https://prospect.org/economy/the-impossible-inevitable-survival-of-the-trump-tax-cuts/

The Trump tax cuts rolled back the estate tax, eliminated the alternative minimum tax, slashed the corporate tax rate, and created a new loophole, used mostly by the rich, for “pass-through” businesses.

Repealing those measures alone could net you around $3 trillion—and all you would have to do is go back to the pre-Trump tax code circa fall 2017. Every Democrat in office at the time opposed the Trump tax cuts: Joe Manchin, Kyrsten Sinema, Josh Gottheimer, and Kurt Schrader; every single one of the cast of characters that has become so familiar today. They all opposed it, and presumably would all be satisfied with a 2017-era tax code.

n the next p**********l e******n, I surmised, all Democratic candidates would have to do is to say “I will repeal the Trump tax cuts,” and that could finance most if not all of their ambitions for their first term. There were $3 trillion in unpopular giveaways to the wealthy just waiting to be re-channeled into important priorities on energy and environment, health and family care, housing and t***sit, and more.

Jul 31, 2023 21:36:05 #

Blade_Runner wrote:

STFU, will ya. Had enough of your hardass left wing bulls**t.

What???!!!! More BS by something called the tax foundation.. what gop backwater did you pull this out of??

There are seven tax rates: 10%, 12%, 22%, 24%, 32%, 35% and 37%, the same as in tax year 2022.

Jul 31, 2023 21:42:47 #

Blade_Runner wrote:

STFU, will ya. Had enough of your hardass left wing bulls**t.

Still no markers on how much money they made ?

You’re still being lied to .

Jul 31, 2023 21:46:05 #

permafrost wrote:

That is a question I have asked no less than 3 of ... (show quote)

Don’t worry with all the jobs Brandon created from build back better tax revenue will Wipe out national debt

Jul 31, 2023 22:25:51 #

permafrost wrote:

GOP backwater? What???!!!! More BS by something called the tax foundation.. what gop backwater did you pull this out of??

Pull your stupid head out of your polluted ass.

The Tax Foundation is an American think tank based in Washington, D.C. It was founded in 1937 by a group of businessmen in order to "monitor the tax and spending policies of government agencies". The Tax Foundation collects data and publishes research studies on U.S. tax policies at both the federal and state levels. Its stated mission is to "improve lives through tax policy research and education that leads to greater economic growth and opportunity".

The Tax Foundation is organized as a 501(c)(3) tax-exempt non-profit educational and research organization, with three primary areas of research: the Center for Federal Tax Policy, the Center for State Tax Policy, and the Center for Legal Reform. The group is known for its annual reports such as Facts & Figures: How Does Your State Compare, which was first produced in 1941, and its "Tax Freedom Day" brochures,[9] which it has produced since the early 1970s.

History

The Tax Foundation was organized on December 5, 1937, in New York City by Alfred P. Sloan Jr., Chairman of the General Motors Corporation; Donaldson Brown, GM Financial Vice President; William S. Farish, President of Standard Oil Company of New Jersey (Exxon); and Lewis H. Brown, President of Johns-Manville Corporation, who later became the first chairman of the board of The Tax Foundation. The organization's stated goal was "to monitor the tax and spending policies of government agencies". Its offices were located at 50 Rockefeller Plaza and later 30 Rockefeller Plaza.

The Tax Foundation's first project was a successful effort to stop a tax increase in Westchester County, New York, where they provided research and analysis (including an "Expenditure Survey" of state spending) to local activists.

By 1943, the Tax Foundation had helped set up taxpayers associations and expenditure councils in 35 states.

During World War II, Tax Foundation research emphasized restraining government spending domestically to finance wartime expenditures. In 1948, the Tax Foundation opened an office in Washington, D.C., and in 1978 relocated there completely. Its research and analysis has historically emphasized publicizing federal and state financial information, arguing against the use of tax systems for "social engineering," and urging "broad bases and low rates" tax reform.

Beginning in 1990, the Tax Foundation "operate[d] as a separate unit" of Citizens for a Sound Economy. By July 1991, it was again operating as an independent 501(c)(3) organization.

Beginning in 2009, the Tax Foundation's offices were located in the National Press Building in Washington, D.C. In 2015, the organization moved to its current location on G Street.

Goals and principles

The Tax Foundation states that its research is guided by what it calls the principles of sound tax policy: simplicity, t***sparency, neutrality, and stability.

Tax Foundation research is generally critical of tax increases, high business taxes, excise taxes, tax preferences for the housing industry, and use of tax credits, which the Foundation views as "picking winners and losers". The Foundation has spoken favorably of efforts to balance the federal budget with tax reform and significant spending cuts, such as the Bowles-Simpson plan, the Ryan Plan, and the Wyden-Coats plan.

Jul 31, 2023 22:38:26 #

Blade_Runner wrote:

GOP backwater? br Pull your stupid head out of yo... (show quote)

The tax foundation must be on hard times if they can not make a graph with the tax brackets correct.. sorry bunch of wh**ever they are..

Jul 31, 2023 23:01:42 #

permafrost wrote:

The tax foundation must be on hard times if they can not make a graph with the tax brackets correct.. sorry bunch of wh**ever they are..

The ostrich

Jul 31, 2023 23:36:50 #

permafrost wrote:

Yeah, I know, the tax foundation isn't populated by corrupt democrats, socialists, progressives and c*******ts. The tax foundation must be on hard times if they can not make a graph with the tax brackets correct.. sorry bunch of wh**ever they are..

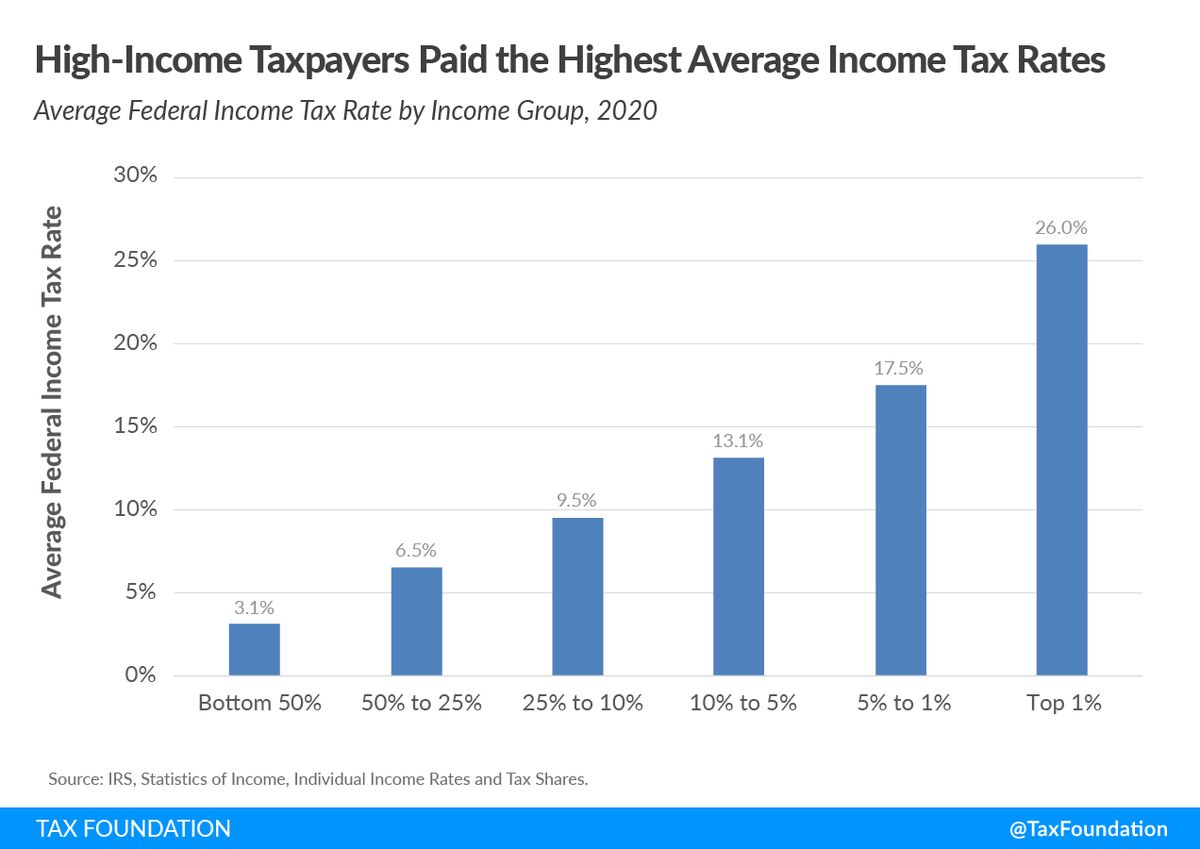

Summary of the Latest Federal Income Tax Data, 2023 Update

New Internal Revenue Service (IRS) data on individual income taxes for tax year 2020 shows the federal income tax system continues to be progressive as high-income taxpayers pay the highest average income tax rates.[1] Average tax rates for all income groups remained lower in 2020, three years after the Tax Cuts and Jobs Act, than they were in 2017 prior to the reform.

In 2020, taxpayers filed 157.5 million tax returns, reported earning nearly $12.5 trillion in adjusted gross income (AGI), and paid $1.7 trillion in individual income taxes.

The average income tax rate in 2020 was 13.6 percent. The top 1 percent of taxpayers paid a 25.99 percent average rate, more than eight times higher than the 3.1 percent average rate paid by the bottom half of taxpayers.

The top 1 percent’s income share rose from 20.1 percent in 2019 to 22.2 percent in 2020 and its share of federal income taxes paid rose from 38.8 percent to 42.3 percent.

The top 50 percent of all taxpayers paid 97.7 percent of all federal individual income taxes, while the bottom 50 percent paid the remaining 2.3 percent.

The 2020 figures include p******c-related tax items such as the non-refundable part of the first two rounds of Recovery Rebates and the $10,200 unemployment compensation exclusion.

Reported Income and Taxes Paid Increased in Tax Year 2020

Taxpayers reported more than $12.5 trillion in AGI on 157.5 million tax returns in 2020, an increase of $650 million in AGI and 9.3 million in returns above 2019.[2] Total income taxes paid rose by $129 billion to $1.7 trillion, an 8 percent increase above 2019. The average individual income tax rate inched up slightly from 13.29 percent in 2019 to 13.63 percent in 2020.

Summary of the Latest Federal Income Tax Data, 2023 Update

New Internal Revenue Service (IRS) data on individual income taxes for tax year 2020 shows the federal income tax system continues to be progressive as high-income taxpayers pay the highest average income tax rates.[1] Average tax rates for all income groups remained lower in 2020, three years after the Tax Cuts and Jobs Act, than they were in 2017 prior to the reform.

In 2020, taxpayers filed 157.5 million tax returns, reported earning nearly $12.5 trillion in adjusted gross income (AGI), and paid $1.7 trillion in individual income taxes.

The average income tax rate in 2020 was 13.6 percent. The top 1 percent of taxpayers paid a 25.99 percent average rate, more than eight times higher than the 3.1 percent average rate paid by the bottom half of taxpayers.

The top 1 percent’s income share rose from 20.1 percent in 2019 to 22.2 percent in 2020 and its share of federal income taxes paid rose from 38.8 percent to 42.3 percent.

The top 50 percent of all taxpayers paid 97.7 percent of all federal individual income taxes, while the bottom 50 percent paid the remaining 2.3 percent.

The 2020 figures include p******c-related tax items such as the non-refundable part of the first two rounds of Recovery Rebates and the $10,200 unemployment compensation exclusion.

Reported Income and Taxes Paid Increased in Tax Year 2020

Taxpayers reported more than $12.5 trillion in AGI on 157.5 million tax returns in 2020, an increase of $650 million in AGI and 9.3 million in returns above 2019.[2] Total income taxes paid rose by $129 billion to $1.7 trillion, an 8 percent increase above 2019. The average individual income tax rate inched up slightly from 13.29 percent in 2019 to 13.63 percent in 2020.

Source: IRS, Statistics of Income, ”Individual Income Rates and Tax Shares.”

Because the Office of Management and Budget (OMB) classifies the refundable part of tax credits as spending, the IRS does not include it in tax share figures. The result overstates the tax burden of the bottom half of taxpayers.

P******c-Related Downturn and Relief Programs

The p******c-related downturn and relief programs both affect the 2020 data. The recession caused financial hardships for many lower- and middle-income households. Between 2019 and 2020, AGI dropped by 6.6 percent for the bottom half of taxpayers, while it increased by 7 percent for the top half of taxpayers. As unemployment rose to record highs, lawmakers expanded unemployment benefits beginning in early 2020 and created a $10,200 income tax exclusion for the 2020 tax year, available to taxpayers with modified AGI below $150,000.

Two rounds of Recovery Rebates also reduced tax liability for qualifying taxpayers. The first round of payments provided $1,200 for single filers, $2,400 for joint filers, and $500 for each qualifying child. The second provided $600 for single filers, $1,200 for joint filers, and $600 for each qualifying child. Credit amounts began phasing out at $75,000 for single filers, $112,500 for head of household filers, and $150,000 for joint filers.

The income dip for the bottom half of taxpayers combined with the tax credit boost unavailable to higher-income households led to lower average tax rates at the bottom and a greater share of taxes borne by households at the top, compared to a typical year.

High-Income Taxpayers Paid the Highest Average Income Tax Rates

In 2020, taxpayers with higher incomes paid much higher average income tax rates than taxpayers with lower incomes.

The bottom half of taxpayers, or taxpayers making under $42,184, faced an average income tax rate of 3.1 percent. As household income increases, average income tax rates rise. For example, taxpayers with AGI between the 10th and 5th percentiles ($152,321 and $220,521) paid an average income tax rate of 13.3 percent—almost four times the rate paid by taxpayers in the bottom half.

The top 1 percent of taxpayers (AGI of $548,336 and above) paid the highest average income tax rate of 25.99 percent—more than eight times the rate faced by the bottom half of taxpayers.

High-Income Taxpayers Paid the Majority of Federal Income Taxes

In 2020, the bottom half of taxpayers earned 10.2 percent of total AGI and paid 2.3 percent of all federal individual income taxes. The top 1 percent earned 22.2 percent of total AGI and paid 42.3 percent of all federal income taxes.

In all, the top 1 percent of taxpayers accounted for more income taxes paid than the bottom 90 percent combined. The top 1 percent of taxpayers paid $723 billion in income taxes while the bottom 90 percent paid $450 billion.

>SNIP<

If you want to reply, then register here. Registration is free and your account is created instantly, so you can post right away.