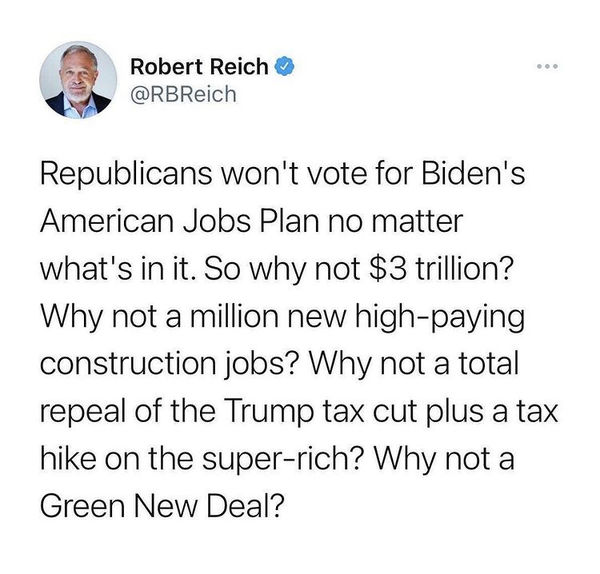

He makes a good point as always

Apr 2, 2021 14:42:18 #

A wide majority of Americans support the Biden infrastructure rebuilding plan building back better. McConnell has pledged to fight it every step of the way. Why not tell the republicans to cooperate or pound sand. Run it through reconciliation without Republican support and grant full rights to the Americans in DC and Puerto Rico statehood.

Apr 2, 2021 14:47:01 #

Kevyn wrote:

A wide majority of Americans support the Biden infrastructure rebuilding plan building back better. McConnell has pledged to fight it every step of the way. Why not tell the republicans to cooperate or pound sand. Run it through reconciliation without Republican support and grant full rights to the Americans in DC and Puerto Rico statehood.

Why?

Apr 2, 2021 14:51:02 #

Apr 2, 2021 15:21:10 #

Kevyn wrote:

A wide majority of Americans support the Biden infrastructure rebuilding plan building back better. McConnell has pledged to fight it every step of the way. Why not tell the republicans to cooperate or pound sand. Run it through reconciliation without Republican support and grant full rights to the Americans in DC and Puerto Rico statehood.

Mitch McConnell gave us free rein to do wh**ever we want!

Apr 2, 2021 16:13:34 #

Kevyn wrote:

To give Americans what we v**ed for.

You wanted higher taxes, higher gas prices, increased poverty, constant racial strife, anti-white r****m, r**ting and l**ting for over a year now, the rule of the elite, child abuse at the border, senile president, etc, etc????

Apr 2, 2021 16:20:21 #

dtucker300

Loc: Vista, CA

Kevyn wrote:

A wide majority of Americans support the Biden infrastructure rebuilding plan building back better. McConnell has pledged to fight it every step of the way. Why not tell the republicans to cooperate or pound sand. Run it through reconciliation without Republican support and grant full rights to the Americans in DC and Puerto Rico statehood.

He makes no sense because he is another c*******t. It's everything your little pinko heart could desire.

9 Crazy Examples of Unrelated Waste and Partisan Spending in Biden’s $2 Trillion ‘Infrastructure’ Proposal

https://fee.org/articles/9-crazy-examples-of-unrelated-waste-and-partisan-spending-in-biden-s-2t-infrastructure-proposal/

Biden's 'infrastructure' bill spends more on electric vehicles than highways, bridges, and roads

https://www.theblaze.com/news/bidens-not-so-infrastructure-bill

Biden’s Proposed Tax Increases Would Be Largest Since LBJ’s in 1968

https://www.heritage.org/taxes/commentary/bidens-proposed-tax-increases-would-be-largest-lbjs-1968

Biden Infrastructure Bill’s Corporate Tax Hikes Will Cripple The Economy

https://thefederalist.com/2021/04/02/biden-infrastructure-bills-corporate-tax-hikes-will-cripple-the-economy/?utm_campaign=ACTENGAGE

Jobs report blows past expectations as payrolls boom by 916,000 in March

https://www.cnbc.com/2021/04/02/us-jobs-report-march-2021.html

Apr 2, 2021 16:23:16 #

jim_oldman

Loc: Lexington, SC

Kevyn wrote:

A wide majority of Americans support the Biden infrastructure rebuilding plan building back better. McConnell has pledged to fight it every step of the way. Why not tell the republicans to cooperate or pound sand. Run it through reconciliation without Republican support and grant full rights to the Americans in DC and Puerto Rico statehood.

As usual Kevyn pulls a statement out of his ass such as "A wide majority of Americans support the Biden infrastructure rebuilding plan." Rite, "we that wide majority" really support ONLY spending 5% of

$2,000,000,000, 000 on infrastructure & a measly 95% on social engineering! Would really to see dimwit K try to explain in his own words what the hell social engineering is & how it's worth $1,900,000,000

Apr 2, 2021 16:29:36 #

ChJoe wrote:

You wanted higher taxes, higher gas prices, increased poverty, constant racial strife, anti-white r****m, r**ting and l**ting for over a year now, the rule of the elite, child abuse at the border, senile president, etc, etc????

Higher taxes is not higher taxes for normal eveyday americans, so stop with the rhetoric like it is. I think billionaires need to be hit with a 40% real tax, no breaks beyond the write offs that go toward the effective taxable income.

Every time Biden talks about raising taxes he is careful to say for those making more than $400k, and then that is a marginal increase to where the full pop wouldn't happen until more like ten million. There is nothing wrong with people who have made lots of money in the from of profits not to pay taxes.

There is nothing wrong with no more subsidies for the oil industry that they do not return to americans ever.

Apr 2, 2021 16:35:43 #

woodguru wrote:

Higher taxes is not higher taxes for normal eveyda... (show quote)

Tax the rich at 99% and you won't even dent the debt. It will come from the middle class one way or the other. They are already paying more for many things much more so than they used to have to pay. Steady increases so as not to be noticed. But even actual taxes will eventually increase, especially as the dollar becomes more and more devalued. Of course China c***ting us in the trade arena won't help the middle class either.

Apr 2, 2021 17:09:36 #

dtucker300

Loc: Vista, CA

woodguru wrote:

Higher taxes is not higher taxes for normal eveyda... (show quote)

Which is a big lie! Yes, get rid of subsidies and eliminate crony capitalism. However, now Biden has said $400,000 per household. So a married couple each earning $200,000 will see tax increases. Businesses, because they are individuals as the SCOTUS has ruled, will see tax increases on their gross. None of these are millionaires. Unemployment has dropped to 6% and business will be booming. The economy is red hot and Biden's tax plans will strangle the recovery. It is not needed and will only do more harm than good. Read the piece below.

Which is a big lie! Yes, get rid of subsidies and eliminate crony capitalism. However, now Biden has said $400,000 per household. So a married couple each earning $200,000 will see tax increases. Businesses, because they are individuals as the SCOTUS has ruled, will see tax increases on their gross. None of these are millionaires. Unemployment has dropped to 6% and business will be booming. The economy is red hot and Biden's tax plans will strangle the recovery. It is not needed and will only do more harm than good. Read the piece below.Biden’s Proposed Tax Increases Would Be Largest Since LBJ’s in 1968Mar 18th, 2021 4 min read

COMMENTARY BY

Adam Michel

Former Senior Policy Analyst, Grover M. Hermann Center

Adam N. Michel focused on tax policy and the federal budget as a Senior Policy Analyst in the Grover M. Hermann Center.

KEY TAKEAWAYS

Biden’s proposed tax hike could amount to as much as a $2 trillion tax increase, the largest increase since 1968.

High corporate taxes hurt workers. As much as 100% of the tax cost is passed on to workers in the form of lower wages.

Raising the capital gains rate much higher than it already is could decrease—rather than increase—tax revenues.

Faithful to his campaign promises, President Joe Biden is eyeing steep tax hikes, but despite the claim that the tax increases will hit only the wealthy, they have the potential to slow the p******c recovery for every American and make workers less competitive.

Biden’s proposed tax hike could amount to as much as a $2 trillion tax increase, the largest increase since 1968, when President Lyndon Johnson’s administration imposed a 10% surtax on business profits and high-income individuals.

The year after those tax hikes, the U.S. economy entered a recession, and personal savings decreased significantly. Had the tax increase been permanent, it could have lowered the gross domestic product by eight times more than the increased revenue.

In the years preceding the Johnson tax hikes, President John F. Kennedy had cut taxes, successfully boosting investment and employment.

We saw similar trends after the 2017 tax cuts, signed into law by President Donald Trump. Investment increased, wage growth accelerated, and job openings soared.

By hiking taxes, Biden could be making the same mistakes as those of the late 1960s.

There are obvious differences, too. Today, the global economy is reeling from one of the most significant economic disruptions in U.S. history, and Congress has authorized an unprecedented $6 trillion in new deficit-financed spending. Not to mention potentially several trillion more dollars for infrastructure projects being teed up next.

V*****e-driven economic reopening, alongside a flood of federal funds entering the economy, will likely turbocharge some sectors of the economy, resulting in unknowable side effects that could materialize as asset bubbles, inflation, or fiscal crises.

Slapping historically large tax increases on top of those already uncharted waters risks another recession or return to the slow, decade-long recovery Americans endured after the Great Recession.

To sustain the economic recovery, American taxpayers and businesses will need more than just checks from Washington. Productive, private sector investments in new factories, better tools, and innovative research are crucial to any robust economy that benefits workers and drives wage growth.

The Biden tax plan targets these essential sources of investment funds with punitive new taxes, targeting the fuel that will be necessary to sustain our economic recovery.

First, they propose a 7 percentage-point increase in the U.S. corporate income tax. Such a tax hike would vault American employers from paying tax rates similar to other countries back to one of the world’s highest rates.

High corporate taxes hurt workers. As much as 100% of the tax cost is passed on to workers in the form of lower wages, as their employers invest less in the U.S. and investments flow to other, more welcoming countries.

Second, Biden wants to increase the top tax rate to almost 40%, up from 37%. Others want to push it to as high as 70%. Tax increases on high-income earners may seem innocuous, but they have real-world costs.

When the government taxes something, we get less of it. Higher income-tax rates mean that some of the most entrepreneurial and high-performing workers will produce a bit less.

But these rate changes will also hit family-owned businesses that pay taxes at their owner’s income-tax rates. Paired with a proposal to cut back a special deduction for these pass-through businesses, the Biden plan could raise taxes on millions of small and medium-sized employers.

Third, Biden proposes doubling the capital gains tax from 20% to almost 40% for those who make more than $1 million a year. The capital gains tax creates a double tax on saving and investment.

High capital gains taxes reduce companies’ ability to raise funds for new investments through equity offerings. They also impose disproportionately higher taxes on riskier investments, such as startups that run losses in the initial years with a small probability of success.

Additionally, raising the capital gains rate much higher than it already is could decrease—rather than increase—tax revenues by creating a destructive incentive to hold on to investments, rather than sell them, to delay paying the tax.

Finally, Biden wants to dramatically expand the death tax. Restoring the estate tax to 2009 levels, as has been proposed, could mean that more than 17,000 estates, many of them small businesses, would be hit by the tax, costing more than 1.5 million jobs—as the levy did in 2008 and 2009.

The tax increases now under consideration are just the start. In the absence of spending reform, taxes will have to increase much higher than is currently being proposed—and not just tax increases on the “rich.” Just look to Europe, where funding big government requires high taxes on everyone.

In fact, it is mathematically impossible to pay for significantly larger government with tax increases only on high-income earners and corporations. That’s why a lower-income European earning $40,000 pays $6,000 more in taxes—an extra 15% of their income—than they would in America.

If Congress wants to help more Americans find jobs and economic opportunity, they should focus on constraining spending growth and keeping taxes low, rather than hiking taxes on the economic recovery.

This piece originally appeared in The Daily Signal.

Apr 2, 2021 17:42:42 #

ChJoe wrote:

Tax the rich at 99% and you won't even dent the debt. It will come from the middle class one way or the other. They are already paying more for many things much more so than they used to have to pay. Steady increases so as not to be noticed. But even actual taxes will eventually increase, especially as the dollar becomes more and more devalued. Of course China c***ting us in the trade arena won't help the middle class either.

Those rich folks sure have you bamboozled.

Apr 2, 2021 17:49:54 #

Apr 2, 2021 19:37:54 #

jim_oldman

Loc: Lexington, SC

Kevyn wrote:

Those rich folks sure have you bamboozled.

Everybody is being bamboozled but Kevyn cuz he's so far in the dark.

Apr 2, 2021 20:17:52 #

LogicallyRight

Loc: Chicago

Kevyn wrote:

Those rich folks sure have you bamboozled.

Yeah, but you're to smart for that. HAHAHAHAHAHAHAHAHAHAHAHA

Apr 2, 2021 20:26:52 #

Bad Bob

Loc: Virginia

Kevyn wrote:

A wide majority of Americans support the Biden infrastructure rebuilding plan building back better. McConnell has pledged to fight it every step of the way. Why not tell the republicans to cooperate or pound sand. Run it through reconciliation without Republican support and grant full rights to the Americans in DC and Puerto Rico statehood.

If you want to reply, then register here. Registration is free and your account is created instantly, so you can post right away.