The top 0.01% owns as much as the bottom 90%.

Jun 7, 2018 16:59:25 #

Jun 7, 2018 17:14:47 #

Chocura750 wrote:

I hope they spent their tax cut wisely.

I'm sure that they did how did you spend yours Choc?

Jun 7, 2018 17:17:23 #

Jun 7, 2018 17:19:56 #

bahmer wrote:

I'm sure that they did how did you spend yours Choc?

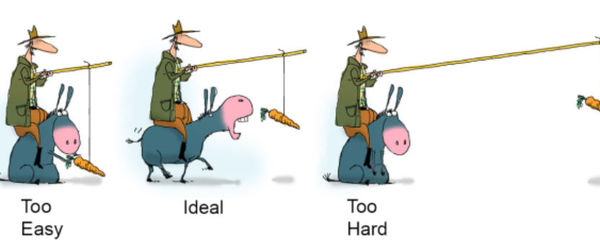

The .01% monopolized all the carrots...

Jun 7, 2018 18:07:37 #

Chocura750 wrote:

Get a job and stop whining about what other people have.I hope they spent their tax cut wisely.

Jun 7, 2018 18:24:15 #

Super Dave wrote:

Get a job and stop whining about what other people have.

I've had a good job for many years now... I've even acquired a few carrots throughout the years with the use of a shorter than average stick & shared...

Jun 7, 2018 18:47:38 #

If that ain't a kommiecrat statement of class envy!

Yeah, everyone should have exactly the same amount as the government decides to distribute.

One uniform, one feed trough, one housing structure, one language, Islam as the policing religion.

Utopia.

Yeah, everyone should have exactly the same amount as the government decides to distribute.

One uniform, one feed trough, one housing structure, one language, Islam as the policing religion.

Utopia.

Jun 7, 2018 19:10:14 #

JFlorio

Loc: Seminole Florida

Chocura750 wrote:

I hope they spent their tax cut wisely.

I did. Thanks for asking. Jamaica was wonderful.

Jun 8, 2018 02:30:53 #

There must be an Aesop table which covers the situation where one person acquires all the property of the others in the group, or is that the French or Russian Revolutions I'm thinking of.

Jun 8, 2018 06:06:46 #

emarine wrote:

I've had a good job for many years now... I've even acquired a few carrots throughout the years with the use of a shorter than average stick & shared...

That's great.

It's amazing how some children tend to just sit in their in dirty diaper and cry about what other people accomplish instead of trying to accomplish something themselves.

Jun 8, 2018 06:44:19 #

I was going to say the same freaking thing. Getting mad at the rich don't cut it. Some of them got started on a shoe string and grew their business. While they prospered others sat on their laurels waiting for opportunity instead of getting off their asses and going for it.

Google started in a garage. Tyler Perry was once homeless! JK Rowling started writing about hobbits on a PAPER NAPKIN while wondering how she was going to pay her bills and now lives in a castle.

I've started writing fiction myself and had a few articles published. There's all kinds of ways to make money if we put our minds to it.

Life is what we make it. It takes hard work, blood, sweat, sleepless nights and lots of tears to be successful in life and it's damn worth it.

I'm with you in telling folks to stop whining about what others have. Find how they did it and get busy!

Google started in a garage. Tyler Perry was once homeless! JK Rowling started writing about hobbits on a PAPER NAPKIN while wondering how she was going to pay her bills and now lives in a castle.

I've started writing fiction myself and had a few articles published. There's all kinds of ways to make money if we put our minds to it.

Life is what we make it. It takes hard work, blood, sweat, sleepless nights and lots of tears to be successful in life and it's damn worth it.

I'm with you in telling folks to stop whining about what others have. Find how they did it and get busy!

Super Dave wrote:

Get a job and stop whining about what other people have.

Jun 8, 2018 06:59:55 #

Jun 8, 2018 07:07:15 #

D**gnet wrote:

And they pay 90% of of the tax burden as well !!!

MAGA

MAGA

Hahaha more like the middle-class pays most of the tax burden.

Jun 8, 2018 08:08:22 #

D**gnet wrote:

And they pay 90% of of the tax burden as well !!!

MAGA

MAGA

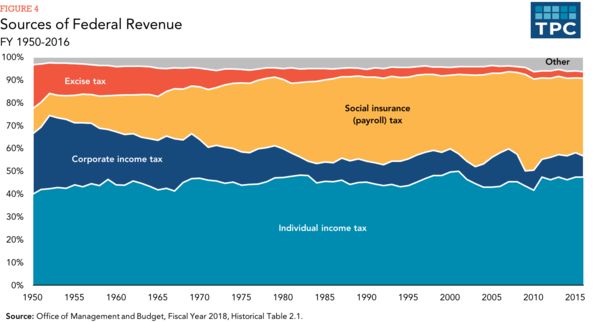

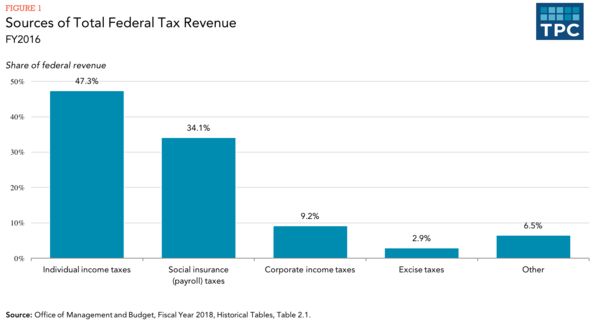

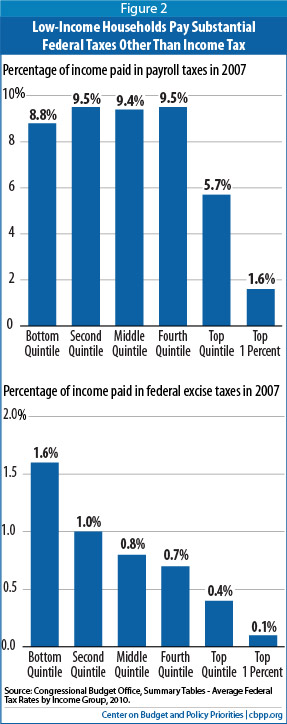

While the rich pay most FEDERAL PERSONAL INCOME TAXES, they do not pay 90% of ALL TAXES. Even to make the claim that they pay 90% of federal personal personal income taxes you must really expand your definition of "rich". To come to that conclusion you have to include the top 40% group which includes single people with incomes as low as $51,100 and couples with incomes of $72,300. Those people aren't poor but it's a real stretch to say they're rich.

But when ALL taxes (state and local, payroll taxes, federal excise taxes, sales taxes...) are considered the top 10% wealthiest do not pay most of the taxes.

"A new study finding an "unfair," rich-poor balance in state and local taxes has been getting big traction on the Web this week.

The study, from the Institute on Taxation and Economic Policy, found that "virtually every state's tax system is fundamentally unfair, taking a much greater share of income from low- and middle-income families than from wealthy families." It added that state and local tax systems are "indirectly contributing to growing income ine******y by taxing low- and middle-income households at significantly higher rates than wealthy taxpayers."

In other words, it said the tax systems are "upside down," with the poor paying more and the rich paying less. Overall, the poorest 20 percent of Americans paid an average of 10.9 percent of their income in state and local taxes and the middle 20 percent of Americans paid 9.4 percent. The top 1 percent, meanwhile, pay only 5.4 percent of their income to state and local taxes.

Washington state had the most regressive state tax system, taxing the poorest residents at 16.8 percent while taxing the top 1 percent at only 2.4 percent, the study said. Florida ranked number two, with the poor paying 12.9 percent of their income to taxes, while the top 1 percent pay 1.9 percent. Texas ranked third, with the bottom playing 12.5 percent and the top 1 percent paying 2.9 percent. The main reason: None of those states have personal income taxes, which tend to be progressive.

California is the most progressive state, with the poorest residents paying 10.5 percent and the top 1 paying 8.7 percent."

http://www.cnbc.com/2015/01/15/do-the-wealthy-pay-lower-taxes-than-the-middle-class.html

Look at the charts below and see that Social Security is the second largest source of federal revenue. Who pays Social Security taxes? Incomes over $120,700 are exempt from SS taxes. The other incomes of mostly the rich, capital gains and dividends, are exempt from SS taxes. So, middle class and working poor pay a larger percentage of their incomes in SS taxes.

Notice how little corporate taxes are a share of federal revenues.

It is a bulls**t claim that the wealthiest 1% or even 10% pay a larger percentage of their incomes in taxes. Using only federal personal income taxes is not only misleading, it is disingenuous.

I predict, now with trumpy's and the repulsives Tax Cut and Jobs Act, that the wealthy and big corporations will now pay an even smaller percentage of federal income taxes and that the deficit will grow even bigger and that programs like Social Security, Medicare, and Medicaid will be blamed while ignoring the ever growing outrageous $1.3 TRILLION military budget.

Jun 8, 2018 10:15:17 #

JFlorio

Loc: Seminole Florida

You are correct, but be that as it may the top 10% pay the majority of Federal tax's as you stated. I find it amazing that the biggest whiners are the ones that generally get most of the government benefits paid for by the top earners. It is the Middle Class that always takes it on the chin where state and local tax's are involved. I am so for the Fair (flat) Tax.

buffalo wrote:

While the rich pay most FEDERAL PERSONAL INCOME TA... (show quote)

If you want to reply, then register here. Registration is free and your account is created instantly, so you can post right away.