Here's Why ALL Incomes Need To Be Taxed For Social Security

Feb 26, 2019 05:15:59 #

lindajoy wrote:

The post speaks for itself..my god why so testy in... (show quote)

Please,

If I had been from the right you'd be stroking me that I even brought up the SSI, but rather you start your post to me that I'm not exactly correct, you've could have simply said good point and let me add... but that didn't happen, you a very transparent. Funny, I never remeber you bringing this up ever before and with me you're an expert, like I said Please...

If I had been from the right you'd be stroking me that I even brought up the SSI, but rather you start your post to me that I'm not exactly correct, you've could have simply said good point and let me add... but that didn't happen, you a very transparent. Funny, I never remeber you bringing this up ever before and with me you're an expert, like I said Please...Feb 26, 2019 06:52:17 #

The ponzy scheme known as SSI is just that, a ponzy scheme. The whole thing needs to be scrapped and replaced with something that is accountable. I am about ready to file for SSI and there isn’t a way in hell I’ll get anything near what I and my employers have put in in my name. And no, you can’t keep taxing everything to make it work. Less taxes, with actual personal identifiers, and no robing from the accounts to use for other programs. No getting benefits unless you have paid into the program. Interest should be paid on the money that is put into the accounts. No payments to be made to any foreign nationals. All foreign aide to be suspended until the SSI accounts are fully funded.

Feb 26, 2019 07:25:39 #

Oldsalt wrote:

The ponzy scheme known as SSI is just that, a ponz... (show quote)

Oldsalt, I think your confusing SSI with SSDI.

Supplemental Security Income is a program that is strictly need-based, according to income and assets, and is funded by general fund taxes (not from the Social Security trust fund). SSI is called a "means-tested program," meaning it has nothing to do with work history, but strictly with financial need. To meet the SSI income requirements, you must have less than $2,000 in assets (or $3,000 for a couple) and a very limited income.

Social Security Disability Insurance is funded through payroll taxes. SSDI recipients are considered "insured" because they have worked for a certain number of years and have made contributions to the Social Security trust fund in the form of FICA Social Security taxes. SSDI candidates must be younger than 65 and have earned a certain number of "work credits."

SSI benefits will begin on the 1st of the month you submit your application. With SSDI is a five-month waiting period for benefits, meaning that the SSA won't pay you benefits for the first five months after you become disabled. The amount of the monthly benefit after the waiting period is over depends on your earnings record, much like the Social Security retirement benefit.

My wife was diagnosed with cancer in January 2009 at 53. She worked for 3M for 26 years but had quit to go into business for herself at 50. She was immediately approved for SSDI afrter being diagnosed with cancer but was not going to begin to receive it until July. Her disability also qualified her for Medicare (we had to many assets to qualify for Medicaid. Little did I know that there is a 2 year waiting period before Medicare kicks in when one is not yet 65. I told the lady at the Social Security office that she would be dead before 2 years. She died in January 2010 at 54. She drew exactly 6 months of SSDI after paying into the Social Security system for 35 years. Politicains hope that is what happens to people that they die before being eligible to draw SS or they die shortly there after. THAT is why they keep increasing the age qualifications.

Feb 26, 2019 07:32:03 #

buffalo wrote:

Oldsalt, I think your confusing SSI with SSDI. br... (show quote)

You are correct, I did have the two mixed up. But I still think the whole thing needs to be scraped and replaced with something more equatable. As tax paying citizens we shouldn’t be getting screwed like this.

Feb 26, 2019 08:06:01 #

Oldsalt wrote:

You are correct, I did have the two mixed up. But I still think the whole thing needs to be scraped and replaced with something more equatable. As tax paying citizens we shouldn’t be getting screwed like this.

I agree. I almost laugh at those constantly claim that the wealthy pay most of the tax and 47% of the people pay no tax. Any working person making $132, 400 or less annually will be taxed 15.3% of their income for Social Security and Medicare. Those taxes go into the general fund just as other federal revenues.

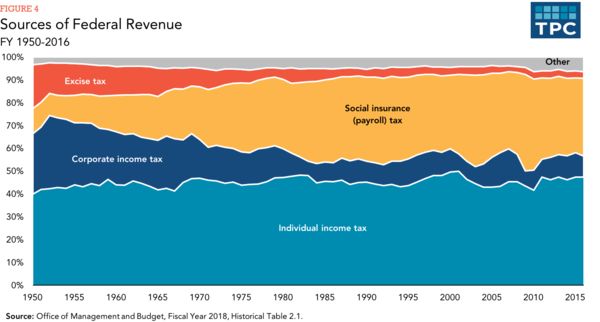

I will post the chart I posted earlier again and one can see that Social Security (payroll taxes) as a percent of total federal revenues has steadily increased from about 10% in the 1950s to over 35% as of 2015, while income tax revenue (you know the taxes that the wealthy claim they are burdened with paying) has remained fairly constant and corporate tax revenues have steadily declined as a percent of federal revenues from over 25 to less than 10%. I will wager that those figures will be get even worse after trumpy's and the repulsive TAX CUTS for the wealthy and corporations.

The rantings that the wealthy and corporations pay the bulk of taxes is becoming more and more bogus.

Feb 27, 2019 19:38:44 #

lindajoy wrote:

A hell of a lot better than it is right now or ever would be..

It will never be given back to us to invest as we see fit... The government needs that slush fund!!!

Probably will be so robbed in the legislative changes they make or are considering right now I won’t qualify which is what they hope.. That we will die off before having to pay us anything...

It will never be given back to us to invest as we see fit... The government needs that slush fund!!!

Probably will be so robbed in the legislative changes they make or are considering right now I won’t qualify which is what they hope.. That we will die off before having to pay us anything...

ss wasen't geared to paying out much.They set the age at 65 and life expectancy was 59. But they have added so much to ss early retirement and and disability and I'm sure much more we don't about.I don't know how much they have taken from ss but Obama took a trillion from medicare for aca then suddenly the medicare was struggling.

Feb 27, 2019 19:44:14 #

buffalo wrote:

I agree. I almost laugh at those constantly claim... (show quote)

What are social Taxes?

Feb 27, 2019 19:49:44 #

vernon wrote:

What are social Taxes?

Where and when did I say anything about "social" taxes?

Feb 28, 2019 07:06:50 #

vernon wrote:

ss wasen't geared to paying out much.They set the age at 65 and life expectancy was 59. But they have added so much to ss early retirement and and disability and I'm sure much more we don't about.I don't know how much they have taken from ss but Obama took a trillion from medicare for aca then suddenly the medicare was struggling.

It wasn’t set up as retirement income nor the fact there would be so many people living longer or the immigrants we have etc..

They have mismanaged it just as they do with anything they get involved in and we pay the price..

Mar 3, 2019 19:20:32 #

lindajoy wrote:

It wasn’t set up as retirement income nor the fact there would be so many people living longer or the immigrants we have etc..

They have mismanaged it just as they do with anything they get involved in and we pay the price..

They have mismanaged it just as they do with anything they get involved in and we pay the price..

The preamble of the Social Security Act of 1935 says what it is for:

https://www.ourdocuments.gov/doc.php?flash=false&doc=68&page=transcript

AN ACT to provide for the general welfare by establishing a system of Federal old-age benefits, and by enabling the several States to make more adequate provision for aged persons, blind persons, dependent and crippled children, maternal and child welfare, public health, and the administration of their unemployment compensation laws; to establish a Social Security Board; to raise revenue; and for other purposes.

This sounds like a continuation of the goal set forth in the preamble of the US Constitution:

We the People of the United States, in Order to form a more perfect Union, establish Justice, insure domestic Tranquility, provide for the common defence, promote the general Welfare, and secure the Blessings of Liberty to ourselves and our Posterity, do ordain and establish this Constitution...

I imagine at both times there were some in the US who were not too on board with providing for the general welfare of anyone other than themselves and those close to them. Some of the support of some of these people was needed to get anything that might provide for the general welfare, so compromises were made.

Mar 3, 2019 21:48:39 #

buffalo wrote:

Once again,vern, your full of it. Trumpy receives his salary and then donates it. And since he does not release his tax returns, YOU nor I know if he is drawing his Social Security or not. I would bet he is.

Social Security income is subject to the income tax. Why isn't unearned income of mainly the wealthy (dividends, rents, and capital gains) subject to Social Security and Medicare taxes?

Why don't you do the "patriotic thing" and forego your SS then?

Social Security income is subject to the income tax. Why isn't unearned income of mainly the wealthy (dividends, rents, and capital gains) subject to Social Security and Medicare taxes?

Why don't you do the "patriotic thing" and forego your SS then?

That ss is split between wounded warriors, and Shriner's hospital and St.Jude. Now since you were a big shot banker where do you put yours.

If you want to reply, then register here. Registration is free and your account is created instantly, so you can post right away.