Here's Why ALL Incomes Need To Be Taxed For Social Security

Feb 25, 2019 09:42:57 #

Morgan wrote:

No, it doesn't, a separate fund. SSI financing comes from general revenues, not Social Security taxes.SSI makes monthly payments to people who are age 65 or older or who are blind or disabled.

Not exactly correct...SSI benefits:

Supplemental Security Income is a federally funded program administered by the U.S. Social Security Administration (SSA). SSI provides financial help to disabled adults and children who have limited income and assets...

People, including children, who have little income and few resources, and who have a disability, may be eligible for disability payments through the Supplemental Security Income (SSI) program...

It is paid through separate funding, not through Social Secuity..

Feb 25, 2019 09:50:41 #

Larry the Legend wrote:

Better still, what if, instead of giving it the the government, you invested your SS contributions in your own account? What would it look like then?

A hell of a lot better than it is right now or ever would be..

It will never be given back to us to invest as we see fit... The government needs that slush fund!!!

Probably will be so robbed in the legislative changes they make or are considering right now I won’t qualify which is what they hope.. That we will die off before having to pay us anything...

Feb 25, 2019 09:57:34 #

buffalo wrote:

Your right...the GENERAL FUND of the USTreasury.

Exactly~~ drawn through and administered by the SSA...Paid by the US Treasury..

Feb 25, 2019 09:59:01 #

lindajoy wrote:

Not exactly correct...SSI benefits: br Supplementa... (show quote)

You are correct in that SS, SSDI, and SSI (for those poor that never paid into SS. But in reality it all goes into and is paid out of the general Treasury. They are merely accounting entries.

"The Treasury both receives the payroll taxes (and income taxes that higher-income retirees pay on their Social Security benefits) and pays monthly benefits on behalf of the Social Security Administration (SSA). The money stays in the Treasury's hands until it is either paid out as Social Security benefits or otherwise spent by the government. In fact, no money ever goes into the trust fund. Instead, the trust fund balance is the result of two accounting entries by the Treasury.

First, the Treasury estimates how much of the aggregate tax receipts are Social Security taxes and "credits" the Social Security trust fund with that amount. Then the Treasury "subtracts" the total amount paid in monthly Social Security benefits from the trust fund balance. No money actually changes hands; these are strictly accounting entries.

Any "money" remaining in the trust fund is converted into special-issue Treasury bonds, which are really nothing more than IOUs. In addition, the Treasury pays interest on the trust fund's balance by crediting the trust fund with additional IOUs. These are also strictly accounting entries, and again no money changes hands. After crediting the trust fund with the proper amount in IOUs, the government spends the extra Social Security tax collections just like any other tax revenue--to finance anything from aircraft carriers to education research."

http://www.heritage.org/social-security/report/misleading-the-public-how-the-social-security-trust-fund-really-works

Feb 25, 2019 10:03:59 #

buffalo wrote:

You see, payroll tax applies to all earned income ... (show quote)

>>>

This should answer all your questions about the Unconstitutionality and Criminality of Taxing your Personal Income, time and labor:

Trickery of the 16th...

https://www.onepoliticalplaza.com/t-153505-1.html

Feb 25, 2019 10:21:32 #

buffalo wrote:

LOL! I bet I know more about economics in my littl... (show quote)

Well hush my mouth, I failed to realize that you knew it all!

Feb 25, 2019 10:23:10 #

tophat wrote:

Well hush my mouth, I failed to realize that you knew it all!

>>>

The Truth is here:

Trickery of the 16th...

https://www.onepoliticalplaza.com/t-153505-1.html

Feb 25, 2019 11:53:34 #

tophat wrote:

Well hush my mouth, I failed to realize that you knew it all!

You still cannot answer my questions regarding your statement. You said corporations do not pay taxes, they pass that "along to the consumer as a cost of doing business!!!!" IF that is true then 1) why haven't prices come down when corporations are given TAX CUTS? They didn't when raygun got his massive corporate TAX CUT in 1986 and prices have not come down since trumpy's TAX CUTS for the wealthy and corporations. WHY? 2)If corporations do not pay taxes the why do they need a TAX CUT? If you have a different, even better answer, then prey TELL!

Here's another question. If corporations do not pay taxes, then why do federal revenues go down when they are given TAX CUTS?

Remember, corporate profits were at all time highs and they were flush with lots of cash. Why weren't prices coming down and wages rising before trumpy's unnecessary, deficit increasing TAX CUTS?

Feb 25, 2019 12:51:56 #

buffalo wrote:

Then why don't you answer the questions and enlighten me? IF, as you (and I know others have) contend that corporations don't pay taxes, then why did trumpy and the repulsives "cut" the corporate "tax rate" from 35% to 20%? By your logic prices for their products should have dropped by the same percentage and wages for their workers should have risen as promised. Or is what your contending just BULLSHIT and corporations own the politicians in DC and are just greedy mfers?

Both are true. S corps do not pay taxes as an entity, all profit passes through to owners via a K1 to be claimed as their personal income. Regular corporations are considered a taxable entity and do pay taxes

Feb 25, 2019 13:22:42 #

debeda wrote:

Both are true. S corps do not pay taxes as an entity, all profit passes through to owners via a K1 to be claimed as their personal income. Regular corporations are considered a taxable entity and do pay taxes

I know the small community bank I worked for from 1974-1985 was a Sub S corporation.

Now the claim that corporations do not pay income tax can be true. Amazon paid no income tax on the 11.2 BILLION 2018 profit. Amazon actually reported a $129 million 2018 federal income tax rebate—making its tax rate -1%. According to The Week, Amazon ended up paying an 11.4% effective federal income tax rate between 2011 and 2016. So, did they actually need the TAX CUT? Are they going to increase worker compensation or lower prices with their $129 MILLION windfall?

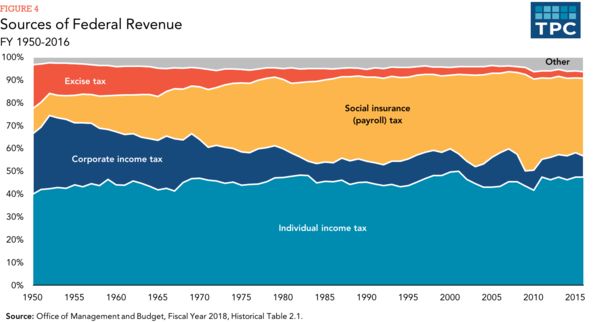

Look at what increase in payroll taxes as a source of federal revenue.

Look into the shenanigans GE has played with the tax loopholes for years. Did they really need a tax break?

Corporate taxes as a source of federal revenue have been declined from over 30% in the 1950s to less than 10% as of 2015. Now with trumpy's TAX CUTS for the wealthy and corporations I would bet that corporate taxes as a source of federal revenue declines even further.

We might ask tophat. He claims to be the expert.

Feb 25, 2019 14:29:37 #

lindajoy wrote:

Not exactly correct...SSI benefits: br Supplementa... (show quote)

WTF that's exactly what I said

we were talking about SS and federal funding when I referred to general funding it was still in reference to federal funding. SS is a separate account.

we were talking about SS and federal funding when I referred to general funding it was still in reference to federal funding. SS is a separate account.Feb 25, 2019 15:20:25 #

buffalo wrote:

You still cannot answer my questions regarding you... (show quote)

>>>

The Truth is here if you can stomach it...

The Truth is here:

Trickery of the 16th...

https://www.onepoliticalplaza.com/t-153505-1.html

Feb 25, 2019 18:20:48 #

buffalo wrote:

You are correct in that SS, SSDI, and SSI (for tho... (show quote)

The way you are stating this you're unintentionally confusing things here, yes the US Treasury collects and disperses funds to separate accounts, some of these funds are collected and allocated to the Social Security Trust Fund which only "pays out" to people who have put into it,( which also includes a spouse) but it is separate to other fundings as in SSI which is more of another welfare account, which others do not have to be put into but rather become eligible for. This was my original point to debeda who stated people did not have to contribute to SS to get it, which isn't true.

http://www.ssa.gov/ssi/

Supplemental Security Income (SSI) is a Federal income supplement program funded by general tax revenues (not Social Security taxes):

It is designed to help aged, blind, and disabled people, who have little or no income; and

It provides cash to meet basic needs for food, clothing, and shelter.

Feb 25, 2019 20:02:07 #

buffalo wrote:

You are correct in that SS, SSDI, and SSI (for tho... (show quote)

We agree, see my post right above yours here.. Although your informative facts here certainly go into much more detail as you have more knowledge of this than I...The learning process always welcomed and appreciated..Thank You...

Feb 25, 2019 20:10:12 #

Morgan wrote:

WTF that's exactly what I said img src="https://... (show quote)

The post speaks for itself..my god why so testy in furthering your own comment?? I also said it was seperate funding..

In this particular post you referenced SSI not SS.. I clarified it was not just as you said but covered more than you described...

~~~~~~~~~~

Morgan wrote:

No, it doesn't, a separate fund. SSI financing comes from general revenues, not Social Security taxes.SSI makes monthly payments to people who are age 65 or older or who are blind or disabled.

Lindajoy wrote:

Not exactly correct...SSI benefits:

Supplemental Security Income is a federally funded program administered by the U.S. Social Security Administration (SSA). SSI provides financial help to disabled adults and children who have limited income and assets...

People, including children, who have little income and few resources, and who have a disability, may be eligible for disability payments through the Supplemental Security Income (SSI) program...

It is paid through separate funding, not through Social Secuity..

If you want to reply, then register here. Registration is free and your account is created instantly, so you can post right away.