Based on the Non-Massaged Data, the US is Back in Recession

Jul 25, 2014 16:31:46 #

Based on the Non-Massaged Data, the US is Back in Recession

Phoenix Capital Research's pictureSubmitted by Phoenix Capital Research on 07/25/2014 15:37 -0400

Nominal GDPRealityRecessionStagflation

.

inShare.0

.

Beneath all of the bogus economic data, the US economy is tanking again.

One of the biggest games played by the bean counters in Washington in the US is the overstatement of GDP growth by understating inflation.

Consider this simple example. Lets say that the US GDP grew by 10% last year. Now lets say that inflation also grew by 10%. In this scenario, real inflation adjusted GDP growth was ZERO. However, announcing ZERO GDP growth is a major problem politically.

So what do the Feds do? They claim that inflation was just 8%, and BOOM youve got 2% GDP growth announced for a year in which real GDP growth was actually zero.

This game is played all the time via a metric called the GDP deflator. Technically what this is meant to do is remove the effects of inflation from the GDP growth numbers to show what real growth was.

However, what it actually ends up being is an accounting gimmick that allows the numbers to overstate GDP growth.

For this reason, when I look at the US economys growth I prefer to use its nominal GDP numbers. These numbers do not include a deflator metric. As such theyre much closer to showing the actual growth as opposed to the gimmicked real GDP numbers.

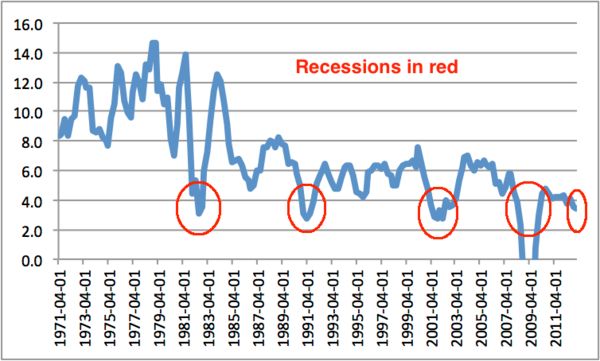

With that in mind, take a look at the chart below:

As you can see, the US economy is once again slowing down rapidly with a sub-4 reading. Ive circled all of the other times the US economy has registered a reading like this in the last 40 years.

ALL of them were periods that were later identified as recessions.

So the Fed is once again facing a recession at a time when it has already cut interest rates to zero and engaged in just about every monetary loosening imaginable. To top it off, inflation is already appearing due to the Feds previous actions.

There is a term for slow growth and high inflation: its stagflation. Sure it doesnt show up in the official data. But then again, when was the last time reality did show up there?

Phoenix Capital Research's pictureSubmitted by Phoenix Capital Research on 07/25/2014 15:37 -0400

Nominal GDPRealityRecessionStagflation

.

inShare.0

.

Beneath all of the bogus economic data, the US economy is tanking again.

One of the biggest games played by the bean counters in Washington in the US is the overstatement of GDP growth by understating inflation.

Consider this simple example. Lets say that the US GDP grew by 10% last year. Now lets say that inflation also grew by 10%. In this scenario, real inflation adjusted GDP growth was ZERO. However, announcing ZERO GDP growth is a major problem politically.

So what do the Feds do? They claim that inflation was just 8%, and BOOM youve got 2% GDP growth announced for a year in which real GDP growth was actually zero.

This game is played all the time via a metric called the GDP deflator. Technically what this is meant to do is remove the effects of inflation from the GDP growth numbers to show what real growth was.

However, what it actually ends up being is an accounting gimmick that allows the numbers to overstate GDP growth.

For this reason, when I look at the US economys growth I prefer to use its nominal GDP numbers. These numbers do not include a deflator metric. As such theyre much closer to showing the actual growth as opposed to the gimmicked real GDP numbers.

With that in mind, take a look at the chart below:

As you can see, the US economy is once again slowing down rapidly with a sub-4 reading. Ive circled all of the other times the US economy has registered a reading like this in the last 40 years.

ALL of them were periods that were later identified as recessions.

So the Fed is once again facing a recession at a time when it has already cut interest rates to zero and engaged in just about every monetary loosening imaginable. To top it off, inflation is already appearing due to the Feds previous actions.

There is a term for slow growth and high inflation: its stagflation. Sure it doesnt show up in the official data. But then again, when was the last time reality did show up there?

Jul 25, 2014 17:10:49 #

Patty wrote:

Based on the Non-Massaged Data, the US is Back in ... (show quote)

Good post.

:thumbup: :thumbup: :thumbup: :thumbup: :thumbup:

Jul 25, 2014 17:14:08 #

Jul 25, 2014 17:20:48 #

grace scott wrote:

The Clinton years look pretty good.

That was because of the dot com boom, which actually started under Bush Sr., but Clinton gets credit for it. That boom, when it popped, handed a recession to G.W. Bush as Clinton left office. Also, the Republicans taking the House in 94 helped keep spending down and eventually lead to the balanced budget (which wasn't actually balanced, but that's for another discussion).

Jul 25, 2014 17:22:49 #

Ricko

Loc: Florida

grace scott wrote:

The Clinton years look pretty good.

grace scott-not bad at all, thanks to Newt Gingrich and the Contract with America. At least Clinton was smart enough to take advice. The fraud we now have thinks he knows it all when,in reality, he is not capable of running a hot dog stand at a profit. Couple that with a democrat Senate led by a mentally challenged Harry Reid and we have what liberals view as utopia. Good Luck America !!!

Jul 25, 2014 17:24:25 #

JMHO wrote:

That was because of the dot com boom, which actually started under Bush Sr., but Clinton gets credit for it. That boom, when it popped, handed a recession to G.W. Bush as Clinton left office. Also, the Republicans taking the House in 94 helped keep spending down and eventually lead to the balanced budget (which wasn't actually balanced, but that's for another discussion).

Glad to see someone giving Bush Sr. credit for something.

Jul 25, 2014 17:26:44 #

JMHO wrote:

Good post.

:thumbup: :thumbup: :thumbup: :thumbup: :thumbup:

:thumbup: :thumbup: :thumbup: :thumbup: :thumbup:

This don't look to good for the US.

Jul 25, 2014 17:33:48 #

I read a short book years ago called "Fiat Money Inflation in France" by Andrew Dickson White. It was written in the late 1800's but the similarities and exact policies that we have followed for the last 10-15 years are eerily similar.

Its like looking in a mirror and shows us exactly how this ends.

If anyone is interested it can be read here.

http://oll.libertyfund.org/titles/1948

excerpt: "it will bind the interests of the citizens to the public good.

The report appealed to the patriotism of the French people with the following exhortation: Let us show to Europe that we understand our own resources; let us immediately take the broad road to our liberation, instead of d**gging ourselves along the tortuous and obscure paths of fragmentary loans: it concluded by recommending an issue of paper money, carefully guarded, to the amount of four hundred million francs. The next day the debate begins. M. Martineau is loud and long for paper money. His only fear is, that the committee has not authorized enough of it; he declares that business is stagnant, and that the sole cause is a want of more of the circulating medium; that paper money ought to be made a legal tender; that the Assembly should rise above the prejudices which the failure of John Laws paper money had caused."

Sound familiar.

Its like looking in a mirror and shows us exactly how this ends.

If anyone is interested it can be read here.

http://oll.libertyfund.org/titles/1948

excerpt: "it will bind the interests of the citizens to the public good.

The report appealed to the patriotism of the French people with the following exhortation: Let us show to Europe that we understand our own resources; let us immediately take the broad road to our liberation, instead of d**gging ourselves along the tortuous and obscure paths of fragmentary loans: it concluded by recommending an issue of paper money, carefully guarded, to the amount of four hundred million francs. The next day the debate begins. M. Martineau is loud and long for paper money. His only fear is, that the committee has not authorized enough of it; he declares that business is stagnant, and that the sole cause is a want of more of the circulating medium; that paper money ought to be made a legal tender; that the Assembly should rise above the prejudices which the failure of John Laws paper money had caused."

Sound familiar.

Jul 25, 2014 17:55:32 #

Ricko

Loc: Florida

JMHO wrote:

That was because of the dot com boom, which actually started under Bush Sr., but Clinton gets credit for it. That boom, when it popped, handed a recession to G.W. Bush as Clinton left office. Also, the Republicans taking the House in 94 helped keep spending down and eventually lead to the balanced budget (which wasn't actually balanced, but that's for another discussion).

Patty-great post. Unfortunately for the 47 million on food stamps and the 20 million or so who are unemployed the recession never ended. When your neighbor loses his/her job it is a recession but when you lose yours it becomes a depression. Good Luck America !!!!

Jul 26, 2014 09:30:23 #

despite all my years of economic study my humble opinion is we are in a full-fledged depression since 2007 at least.

of course we have a lot of cheap junk ffffflooding in the market making us sick but I consider that manipulation of our mental emotional and physical health. this includes what used to be called journalism and is actually fairy tale. Imho...

of course we have a lot of cheap junk ffffflooding in the market making us sick but I consider that manipulation of our mental emotional and physical health. this includes what used to be called journalism and is actually fairy tale. Imho...

Jul 26, 2014 10:50:14 #

http://www.zerohedge.com/news/2014-07-25/economic-laws-are-not-optional

Obama wrote:

despite all my years of economic study my humble opinion is we are in a full-fledged depression since 2007 at least.

of course we have a lot of cheap junk ffffflooding in the market making us sick but I consider that manipulation of our mental emotional and physical health. this includes what used to be called journalism and is actually fairy tale. Imho...

of course we have a lot of cheap junk ffffflooding in the market making us sick but I consider that manipulation of our mental emotional and physical health. this includes what used to be called journalism and is actually fairy tale. Imho...

Jul 26, 2014 14:30:12 #

Patty wrote:

Based on the Non-Massaged Data, the US is Back in ... (show quote)

>>>>>>>>>>>>>>>>>>>>

Yep and try to imagine it staying like this for a Decade longer...

People have no idea what is unfolding !

Another 10 years !

Jul 26, 2014 22:48:07 #

jonhatfield

Loc: Green Bay, WI

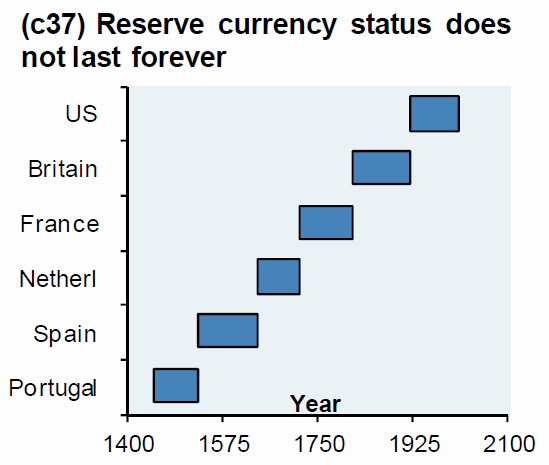

Wow, zerohedge on the American economy! Now it's stagflation, Patty? What happened to the more dramatic end of the petrodollar, the collapse of American fiat currency, the end of the dollar as main reserve currency, the evil conspiracy of the Fed Reserve system story lines? Or is this just another chapter to the general overall pretense to economic expertise?Well, this chapter may not be quite so dramatic or conspiratorial as the other chapters...and could even be realistic perhaps considering the decade-long stagflation of the Japanese economy. At least this story line is not the-sky-is-falling category...although Sicg it's "People have no idea what is unfolding! Another 10 years!" Actually it's somewhat larger than that...remember the "industrial revolution" situation? We are at the point of another economic and social sea change for which we do not presently have a name, much less an understanding of where it will all end up. Or at least I myself don't quite understand how the new economic consolidation and bignesses changes that have been taking place since WWII will turn out for good and bad.

Anyone can predict this or that economic happening and claim to be 100% accurate since tomorrow or in 6 months or 2 years or 20 years something similar is bound to develop so that the prophet can crow about predicting it. ha. Sic is perhaps right in stating "People have no idea what is unfolding"...without the exclamation point because they really don't know. ha.

Anyone can predict this or that economic happening and claim to be 100% accurate since tomorrow or in 6 months or 2 years or 20 years something similar is bound to develop so that the prophet can crow about predicting it. ha. Sic is perhaps right in stating "People have no idea what is unfolding"...without the exclamation point because they really don't know. ha.

Jul 27, 2014 05:25:22 #

Post proof of my source being unreliable or quit making an ass of yourself. Pick one or the other or we will all have continue to consider you the forum i***t.

jonhatfield wrote:

Wow, zerohedge on the American economy! Now it's s... (show quote)

Jul 27, 2014 11:42:26 #

jonhatfield

Loc: Green Bay, WI

Patty wrote:

Post proof of my source being unreliable or quit making an ass of yourself. Pick one or the other or we will all have continue to consider you the forum i***t.

I point out that your sources are biased sites with no credibility because they are Russian internet propaganda sites. I point out that you are the forum propagandist and apologist for Putin's NovoRussia f*****m. So you call me an i***t for pointing out the obvious? :-P

If you want to reply, then register here. Registration is free and your account is created instantly, so you can post right away.