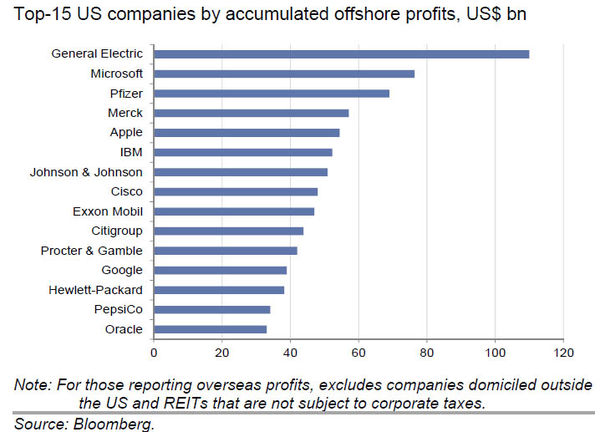

These Are The 15 US Companies With The Most Offshore Profits

May 4, 2014 07:09:22 #

"In the aftermath of several recent events such as i) the issuance of new mega batch of $12 billion in bonds by a suddenly domestic-cash strapped Apple, ii) the repatriation of $9 billion in offshore profits (and payment of $3 billion in taxes) by eBay, iii) the flurry of pharma M&A deals and reverse mergers in which US companies are redomiciled offshore (in low corporate tax hosts like Ireland) to avoid paying US taxes, and iv) the outright use of offshore funds to buy offshore companies such as the GE-Alstom deal which bypasses the US treasury entirely, two questions emerge: who has the most offshore cash, and who is most likely to be the next US corporation to engage in one or all of the above listed t***sactions which merely seek to optimize a company's offshore cash holdings.

The answer is shown on the chart below: this is the list of the top 15 US companies that have the bulk of accumulated offshore profits, amounting to roughly $1 trillion in cash, which is never subjet to US taxation, and which financial engineers try to generate the highest shareholder returns on. "

The answer is shown on the chart below: this is the list of the top 15 US companies that have the bulk of accumulated offshore profits, amounting to roughly $1 trillion in cash, which is never subjet to US taxation, and which financial engineers try to generate the highest shareholder returns on. "

May 4, 2014 07:32:37 #

Patty wrote:

"In the aftermath of several recent events su... (show quote)

Who can blame them,Obama will get his grubby hands on it and give it away to buy v**es.

May 4, 2014 07:38:16 #

Off shoring goes back 20 years when they convinced the stupid that manufacturing jobs were beneath Americans and the New Economy was in high tech jobs. This was of course encouraged and paid for by the corps to change the laws they need to make cheap labor over seas even more profitable for the large CEO bonuses. I blame both sides for this.

May 4, 2014 07:51:30 #

Patty wrote:

"In the aftermath of several recent events su... (show quote)

Patty,

Isn't the GE chairman/CEO Obama's financial advisor or something like that?

The answer seems obvious to me, Lower the US tax rate to make it competitive. Let the US shareholders get a high return (reduced taxes) and still get the benefit of tax revenue. DUH !

In case you haven't noticed, the ACA levies about 100 new taxes....The problem is; "we" are buying more than we can afford, we have a spending problem, taxing more at some point reduces revenue, could we already be there?.

Especially when you look at the labor participation rate now at an all time low..the latest 6.3% unemployment rate is a deceptive number put out by the Obama admin.

1oldgeezer

May 4, 2014 07:55:32 #

I don't know if GE CEO is an adviser. I know they were a top donor though.

I think there should be a special tax for American owned companies that produce in other countries and want to bring those products back here to profit from. It should be much higher than other countries tax rate. Also I think there should be a cap on CEO bonuses so that it is not encouraged to offshore for personal gain from publically owned , stockholder funded companies.

I think there should be a special tax for American owned companies that produce in other countries and want to bring those products back here to profit from. It should be much higher than other countries tax rate. Also I think there should be a cap on CEO bonuses so that it is not encouraged to offshore for personal gain from publically owned , stockholder funded companies.

May 4, 2014 07:56:50 #

Patty wrote:

Off shoring goes back 20 years when they convinced the stupid that manufacturing jobs were beneath Americans and the New Economy was in high tech jobs. This was of course encouraged and paid for by the corps to change the laws they need to make cheap labor over seas even more profitable for the large CEO bonuses. I blame both sides for this.

Taxes are a cost of dong business and therefore added into the product or service of that company! In other words corporations only collect taxes and pass them onto the government. Im not concerned with how much taxes any company pays or avoids, my concern is the trillions wasted by our elected officials.

May 4, 2014 08:01:39 #

I agree but you haven't followed that scenario to the shelf. If their products cost more (due to taxes)on the shelf than American manufactured products which do think people will pick?

joe1941 wrote:

Taxes are a cost of dong business and therefore added into the product or service of that company! In other words corporations only collect taxes and pass them onto the government. Im not concerned with how much taxes any company pays or avoids, my concern is the trillions wasted by our elected officials.

May 4, 2014 08:14:47 #

Patty wrote:

I agree but you haven't followed that scenario to the shelf. If their products cost more (due to taxes)on the shelf than American manufactured products which do think people will pick?

You point out that our government is forcing companies offshore and then seem to indicate that people shouldnt purchase what they can afford? It seems to me that your distain should be directed at our government and not companies that are being forced to increase their bottom line by moving. I think you should be asking why our government policies are encouraging companies to relocate outside the country?

May 4, 2014 08:21:33 #

Ummm what?

"people shouldnt purchase what they can afford"

It is tied together by e******n donations and lobbyists. They are paying them to keep import taxes on certain products low.

"people shouldnt purchase what they can afford"

It is tied together by e******n donations and lobbyists. They are paying them to keep import taxes on certain products low.

joe1941 wrote:

You point out that our government is forcing companies offshore and then seem to indicate that people shouldnt purchase what they can afford? It seems to me that your distain should be directed at our government and not companies that are being forced to increase their bottom line by moving. I think you should be asking why our government policies are encouraging companies to relocate outside the country?

May 4, 2014 08:26:52 #

"With over 21 per cent unemployment as measured by the methodology of 1980, with American jobs, GDP, and technology having been given to China and India, with war being Washingtons greatest commitment, with the dollar over-burdened with debt, with civil liberty sacrificed to the war on terror, the liberty and prosperity of the American people have been thrown into the trash bin of history."

PCR

PCR

May 4, 2014 08:31:15 #

It isn't just taxes. It is also the very high cost of federal regulation and litigation in this nation that does not happen in most other nations. The taxation is also triple taxation of profits for US corporations with overseas profits. They pay the tas of the host nation. To repadriate those profits to the US the would pay a federal income tax of 35 percent, the state tax and a local tax in NYC and other places. Any rational CEO would reinvest those funds overseas and so would you, if you are rational.

If the USA wants to ever recover, the nation must be run to encourage business not run it away. The US will not recover until The Beltway is in deep economic depression.

If the USA wants to ever recover, the nation must be run to encourage business not run it away. The US will not recover until The Beltway is in deep economic depression.

May 4, 2014 10:21:44 #

Coos Bay Tom

Loc: coos bay oregon

Patty wrote:

Off shoring goes back 20 years when they convinced the stupid that manufacturing jobs were beneath Americans and the New Economy was in high tech jobs. This was of course encouraged and paid for by the corps to change the laws they need to make cheap labor over seas even more profitable for the large CEO bonuses. I blame both sides for this.

:thumbup:

May 4, 2014 10:32:21 #

Patty wrote:

"In the aftermath of several recent events su... (show quote)

That darn W-he could have fixed this too, where was he...oh that's right he likes big corporations too. Corporations are pretty pragmatic about corporate profits, that is they go and take jobs away fromt the US if the taxes get too high. And presidents are flexible too, since their campaigns depend entirely on them to "pay the bills" for campaigning. No wonder most v**ers feel powerless: because they are. Go on....keep griping it's really taken us far.

May 4, 2014 10:40:16 #

Yes educating ones self is only for the stupid.

:roll:

Dummy Boy wrote:

That darn W-he could have fixed this too, where was he...oh that's right he likes big corporations too. Corporations are pretty pragmatic about corporate profits, that is they go and take jobs away fromt the US if the taxes get too high. And presidents are flexible too, since their campaigns depend entirely on them to "pay the bills" for campaigning. No wonder most v**ers feel powerless: because they are. Go on....keep griping it's really taken us far.

:roll:

May 4, 2014 20:51:16 #

saveamerica

Loc: Texas

Patty wrote:

"In the aftermath of several recent events su... (show quote)

For one, P****r is a German owned company. You have to understand, with Obama trying to grab everyone's money you have to hid it, it's the same as stealing by our government. Just stop for a minute and think about all the companies Obama and Holder has shaken down and got millions if not billions from them. Don't worry, Obama is trying to figure out how to get your saving account.

If you want to reply, then register here. Registration is free and your account is created instantly, so you can post right away.