PBOC Pressures USD Hegemony; Starts Yuan-Denominated Gold & Oil Trading

Apr 25, 2014 16:14:55 #

With 23 foreign central banks diversifying from US Dollars to Renminbi and the PBOC actively aiding numerous major financial hubs around the world with bilateral currency swap agreements, it seems yet another nail in the coffin of US dollar hegemony just got hit...

*PBOC AIMS TO SET UP GLOBAL PAYMENT SYSTEM FOR YUAN: SEC. NEWS

*PBOC TO MAKE GOLD, OIL FUTURES YUAN DENOMINATED: SEC. NEWS

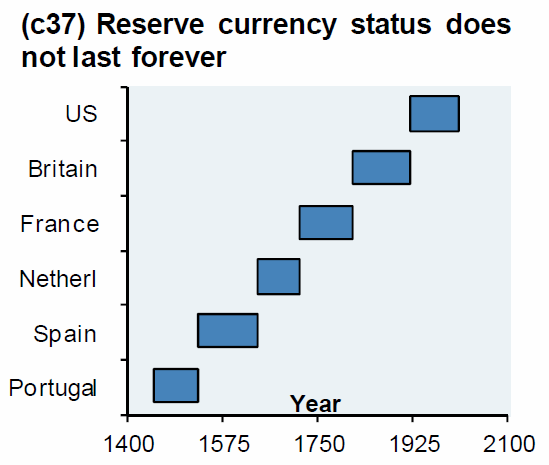

Nothing lasts forever, no matter how much you believe...

PBOC plans to start yuan-denominated gold and oil futures to help establish a global payment system for the Chinese currency, Guo Jianwei, deputy director of the second monetary policy department of the Peoples Bank of China, is cited by Shanghai Securities News as saying.

PBOC will continue to push reform of interest rates, exchange rates and the capital account

The pace of Renminbi use is accelerating...

"In the first quarter, the RMB settlement of trade in goods amounted to 1.0871 trillion, accounting for the proportion of total import and export customs of 18.4% over the same period," said Guo Jianwei, 18.4% and 11.7%, two figures, hidden vitality, accounting for just three months time improved 6 percentage points, indicating that the use of the renminbi is growing internal demand.

It seems the level of interest in diversifying away from the US Dollar is growing...

At the end of last year, China's total with 23 foreign central banks or monetary authorities signed bilateral currency swap agreements, the total size of more than 2.5 trillion yuan.

Recently, the central bank after another with Britain and Germany signed a memorandum of agreement RMB clearing and settlement central bank, the European offshore RMB business to accelerate.

It is noteworthy that, in addition to London, Paris, Frankfurt, Luxembourg, Singapore, striving for offshore yuan trading center with only the United States "sitting on the sidelines."

The goal seems clear...

"Renminbi is a new bright spot in the next cross-border RMB business development." Guo Jianwei, said the central bank will continue to advance the future of interest rates, exchange rate reform, capital projects, and expand the range of RMB payment using to promote the yuan-denominated policies, thereby establishing renminbi The global payment system and so on.

*PBOC AIMS TO SET UP GLOBAL PAYMENT SYSTEM FOR YUAN: SEC. NEWS

*PBOC TO MAKE GOLD, OIL FUTURES YUAN DENOMINATED: SEC. NEWS

Nothing lasts forever, no matter how much you believe...

PBOC plans to start yuan-denominated gold and oil futures to help establish a global payment system for the Chinese currency, Guo Jianwei, deputy director of the second monetary policy department of the Peoples Bank of China, is cited by Shanghai Securities News as saying.

PBOC will continue to push reform of interest rates, exchange rates and the capital account

The pace of Renminbi use is accelerating...

"In the first quarter, the RMB settlement of trade in goods amounted to 1.0871 trillion, accounting for the proportion of total import and export customs of 18.4% over the same period," said Guo Jianwei, 18.4% and 11.7%, two figures, hidden vitality, accounting for just three months time improved 6 percentage points, indicating that the use of the renminbi is growing internal demand.

It seems the level of interest in diversifying away from the US Dollar is growing...

At the end of last year, China's total with 23 foreign central banks or monetary authorities signed bilateral currency swap agreements, the total size of more than 2.5 trillion yuan.

Recently, the central bank after another with Britain and Germany signed a memorandum of agreement RMB clearing and settlement central bank, the European offshore RMB business to accelerate.

It is noteworthy that, in addition to London, Paris, Frankfurt, Luxembourg, Singapore, striving for offshore yuan trading center with only the United States "sitting on the sidelines."

The goal seems clear...

"Renminbi is a new bright spot in the next cross-border RMB business development." Guo Jianwei, said the central bank will continue to advance the future of interest rates, exchange rate reform, capital projects, and expand the range of RMB payment using to promote the yuan-denominated policies, thereby establishing renminbi The global payment system and so on.

Apr 26, 2014 11:32:47 #

Patty wrote:

With 23 foreign central banks diversifying from US... (show quote)

So much new evidence is brought to light every day, yet there are still those with their book knowledge that refuse to believe what is happening. They just don't seem to understand that the world runs on common sense, not book smarts.

Apr 26, 2014 11:46:08 #

rickdri wrote:

So much new evidence is brought to light every day, yet there are still those with their book knowledge that refuse to believe what is happening. They just don't seem to understand that the world runs on common sense, not book smarts.

Sadly most don't even remember the last dollar crash in the 1970's when confidence in the USD was so bad that Carter had to back bonds by putting them in Swiss Francs. I really do try to get people to see what is going on and that it wont end well despite the name calling by a few. I hope even a few are listening out there.

Thanks for your replying Rick. Lets me know there is someone out there reading these posts.

:thumbup:

Apr 26, 2014 13:20:26 #

Patty wrote:

Sadly most don't even remember the last dollar crash in the 1970's when confidence in the USD was so bad that Carter had to back bonds by putting them in Swiss Francs. I really do try to get people to see what is going on and that it wont end well despite the name calling by a few. I hope even a few are listening out there.

Thanks for your replying Rick. Lets me know there is someone out there reading these posts.

:thumbup:

Thanks for your replying Rick. Lets me know there is someone out there reading these posts.

:thumbup:

True but this crash will be worse by far than the 70's. This time we will lose the reserve status. Maybe that's why people don't seem to fear this one. The 70's crash was mild compared to what we have coming now.

Apr 26, 2014 13:56:10 #

rickdri wrote:

True but this crash will be worse by far than the 70's. This time we will lose the reserve status. Maybe that's why people don't seem to fear this one. The 70's crash was mild compared to what we have coming now.

:thumbup: :thumbup:

If you want to reply, then register here. Registration is free and your account is created instantly, so you can post right away.