Team Trump’s assurances about the deficit suddenly look quite a bit worse

Jul 20, 2018 22:39:49 #

By Steve Benen

A couple of months ago, Larry Kudlow, the director of the Trump White House’s National Economic Council, boasted that the U.S. budget deficit “is coming down, and it’s coming down rapidly.” This was, of course, spectacularly wrong. Though the deficit shrunk during Barack Obama’s presidency, it’s grown considerably larger since Donald Trump took office.

Asked soon after how he managed to get reality backwards, Kudlow conceded that the deficit isn’t really coming down now, but he believes it will start shrinking in the near future as Republican economic policies continue to kick in.

Maybe he ought to take a fresh look at this. The Wall Street Journal reported yesterday:

The Trump administration expects annual budget deficits to rise nearly $100 billion more than previously forecast in each of the next three years, pushing the federal deficit above $1 trillion starting next year. […]

The White House budget office now estimates that the deficit will rise to nearly $1.1 trillion in the fiscal year that begins this October, or 5.1% of gross domestic product, up from $984 billion projected in February’s budget proposal.

According to the White House budget blueprint from February, the Trump administration expected to add $7.1 trillion in cumulative deficits to the national debt over the next 10 years. This new revision has increased that total to $8 trillion.

These latest figures tell us a few important things. First, Larry Kudlow’s track record for accuracy on issues like these really is embarrassing. Second, Donald Trump’s campaign commitments about balancing the budget should probably be near the top of the list of his broken promises.

Third, every Republican who said the GOP tax breaks for the wealthy would pay for themselves ought to face some renewed questioning about how very wrong they were.

I should emphasize that I’m not a deficit hawk, and I firmly believe that larger deficits, under some circumstances, are absolutely worthwhile and necessary.

These are not, however, the proper circumstances. When the economy is in trouble, it makes sense for the United States to borrow more, invest more, cushion the blow, and help strengthen the economy.

The Trump White House and the Republican-led Congress, however, decided to approve massive tax breaks for the wealthy and big corporations when the economy was already healthy – not because they were addressing a policy need, but because they were fulfilling an ideological goal.

A couple of months ago, Larry Kudlow, the director of the Trump White House’s National Economic Council, boasted that the U.S. budget deficit “is coming down, and it’s coming down rapidly.” This was, of course, spectacularly wrong. Though the deficit shrunk during Barack Obama’s presidency, it’s grown considerably larger since Donald Trump took office.

Asked soon after how he managed to get reality backwards, Kudlow conceded that the deficit isn’t really coming down now, but he believes it will start shrinking in the near future as Republican economic policies continue to kick in.

Maybe he ought to take a fresh look at this. The Wall Street Journal reported yesterday:

The Trump administration expects annual budget deficits to rise nearly $100 billion more than previously forecast in each of the next three years, pushing the federal deficit above $1 trillion starting next year. […]

The White House budget office now estimates that the deficit will rise to nearly $1.1 trillion in the fiscal year that begins this October, or 5.1% of gross domestic product, up from $984 billion projected in February’s budget proposal.

According to the White House budget blueprint from February, the Trump administration expected to add $7.1 trillion in cumulative deficits to the national debt over the next 10 years. This new revision has increased that total to $8 trillion.

These latest figures tell us a few important things. First, Larry Kudlow’s track record for accuracy on issues like these really is embarrassing. Second, Donald Trump’s campaign commitments about balancing the budget should probably be near the top of the list of his broken promises.

Third, every Republican who said the GOP tax breaks for the wealthy would pay for themselves ought to face some renewed questioning about how very wrong they were.

I should emphasize that I’m not a deficit hawk, and I firmly believe that larger deficits, under some circumstances, are absolutely worthwhile and necessary.

These are not, however, the proper circumstances. When the economy is in trouble, it makes sense for the United States to borrow more, invest more, cushion the blow, and help strengthen the economy.

The Trump White House and the Republican-led Congress, however, decided to approve massive tax breaks for the wealthy and big corporations when the economy was already healthy – not because they were addressing a policy need, but because they were fulfilling an ideological goal.

Jul 20, 2018 22:58:52 #

JFlorio

Loc: Seminole Florida

For those who want some t***h. Tax cuts don't wreck the deficit. Spending wrecks the deficit. Always has, always will.

https://www.investors.com/politics/editorials/trump-tax-cuts-revenues-deficits-paying-for-themselves/

https://www.investors.com/politics/editorials/revenues-climb-5-2-in-first-month-of-gop-tax-cuts/

https://www.bloomberg.com/news/articles/2018-05-10/u-s-posts-record-monthly-budget-surplus-as-economy-picks-up

https://www.investors.com/politics/editorials/trump-tax-cuts-revenues-deficits-paying-for-themselves/

https://www.investors.com/politics/editorials/revenues-climb-5-2-in-first-month-of-gop-tax-cuts/

https://www.bloomberg.com/news/articles/2018-05-10/u-s-posts-record-monthly-budget-surplus-as-economy-picks-up

Jul 21, 2018 00:09:08 #

You can spin this anyway you want and forecast wh**ever but the debt was 9 trillion when Obama took office (no but here) when he left it was 20 trillion. That debt (that liberals weren't concerned about) is now 21.2 trillion, Obama took in too little and Trump is taking in 3 times as much with those crumbs that Nancy wants back

.

.

Nickolai wrote:

By Steve Benen br br A couple of months ago, Larr... (show quote)

Jul 21, 2018 01:20:34 #

bmac32 wrote:

You can spin this anyway you want and forecast wh**ever but the debt was 9 trillion when Obama took office (no but here) when he left it was 20 trillion. That debt (that liberals weren't concerned about) is now 21.2 trillion, Obama took in too little and Trump is taking in 3 times as much with those crumbs that Nancy wants back

.

.

https://www.thebalance.com/current-u-s-federal-budget-deficit-3305783

This is the deficit at the present time

Jul 21, 2018 01:34:15 #

bmac32 wrote:

You can spin this anyway you want and forecast wh**ever but the debt was 9 trillion when Obama took office (no but here) when he left it was 20 trillion. That debt (that liberals weren't concerned about) is now 21.2 trillion, Obama took in too little and Trump is taking in 3 times as much with those crumbs that Nancy wants back

.

.

And how much did government grow under Obama?

2009: 3,517.7

2010: 3,457.1

2011: 3,603.1

2012: 3,536.9

2013: 3,454.6

2014: 3,506.1

2015: 3,688.4

2016: 3,852.6

2017: 3,981.6

............464

Now here's my question: if spending only goes up by 464 Billion dollars how can our debt increase 11 trillion dollars? Now I know you cons fancy yourselves as financial geniuses so how can spending only increase by 464 billion dollars but debt increase by 11 trillion dollars? Well, since I know you will never get it, the answer comes from a loss of revenue--part from the deep recession of 08 but we also cut taxes in 2002 and 4 which reduced the rate of revenue growth in revenue even more coming into 09 and beyond. So did Obama cut taxes or did he cause the deep recession of 08? If so, then you are welcome to blame Obama for the increase in the deficit, a deficit growth that was actually positive when Obama's predecessor took office...

Oh, and for those of you who are going to claim that it's spending that causes debt well here we only increased spending by 464 Billion dollars and debt increased by 11 Trillion dollars which pretty much proves that myth false.

You can't cut the rate of revenue growth and then expect revenue to increase. It didn't under Reagan, it didn't under Bush, and it sure as hell isn't doing it under Donald J Trump.

And what was your last claim about revenue--that Trump is taking in 3 times as much? Well in Obama's last budget revenue was 3316 Trillion. So your argument is that revenue today is 9,948 Trillion dollars? So explain how the hell we can have a deficit of -1.27 Trillion dollars when the government budget only 4 Trillion or thereabouts? I mean, do you guys use a different math than we do because I come up with a surplus of 5,948 of thereabouts, correct?

Look, you proved beyond a doubt that you cons don't know what the hell you are talking about. When Bush cut taxes he cut the hell out of yearly revenue growth going from over 7% per year to under 1% per year and anemic throughout most of Obama's years. Now it's fine to blame Obama if he was responsible for the recession and for the tax cut but he didn't do it so why are you blaming him for what happened under George Bush's administration and will be repeated under Trump...

Jul 21, 2018 01:40:07 #

bmac32 wrote:

You can spin this anyway you want and forecast wh**ever but the debt was 9 trillion when Obama took office (no but here) when he left it was 20 trillion. That debt (that liberals weren't concerned about) is now 21.2 trillion, Obama took in too little and Trump is taking in 3 times as much with those crumbs that Nancy wants back

.

.

http://thehill.com/policy/finance/264027-analysis-trump-tax-plan-would-cost-95-trillion

Liberals worry about deficits, When Obama took office he was handed a $1.3 trillion deficit. With the collapse of the housing bubble the economy lost almost $1 trillion in consumer spending over night The Obama administration tried to be spender of last resort to avoid a great depression with the potential of being greater and deeper than the great depression of the 1930's with a $750, billion stimulus plan. Still in 8 years Obama reduced the deficit to around $550 billion. That's a reduction of $750 billion in the size of the deficit, The biggest contributor to the $20 trillion debt was G W Bush's two tax cuts to people who didn't need a tax cut and two wars in Iraq and Afghanistan. Bush had been handed a balanced budget in 2001 and an economy that had made an all time record of 120 months. Corn and soy bean farmers are being driven out of business by Trumps trade war that is escalating. Harley Davidson is moving to Europe and BMW is moving its operations to China The biggest nail manufacturer has had to lay off 200 employees because of the tariffs on steel

Jul 21, 2018 01:47:50 #

JFlorio wrote:

For those who want some t***h. Tax cuts don't wreck the deficit. Spending wrecks the deficit. Always has, always will.

https://www.investors.com/politics/editorials/trump-tax-cuts-revenues-deficits-paying-for-themselves/

https://www.investors.com/politics/editorials/revenues-climb-5-2-in-first-month-of-gop-tax-cuts/

https://www.bloomberg.com/news/articles/2018-05-10/u-s-posts-record-monthly-budget-surplus-as-economy-picks-up

https://www.investors.com/politics/editorials/trump-tax-cuts-revenues-deficits-paying-for-themselves/

https://www.investors.com/politics/editorials/revenues-climb-5-2-in-first-month-of-gop-tax-cuts/

https://www.bloomberg.com/news/articles/2018-05-10/u-s-posts-record-monthly-budget-surplus-as-economy-picks-up

So Trump increased spending by 1.1 to 1.27 trillion dollars? If a growth in the economy t***slates into a growth in revenue why isn't that revenue showing up in the budget and reducing what is expected of the deficit? How it is the deficit is going to be over a trillion a year in perpetuity and the tax cut is supposed to have caused revenue growth to increase not turn the other way around? Something tells me your experts missed something because even if spending increased this years budget future budgets would turn a surplus yet that isn't what the CBO, nor anyone else, seems to be projecting to happen. So what gives?

Jul 21, 2018 02:25:12 #

Nickolai wrote:

By Steve Benen br br A couple of months ago, Larr... (show quote)

Both the prediction the deficit will go down in the future, and the prediction it will go up in the future; are PREDICTIONS. Now you can say you believe certain predictions will be wrong and others correct. Only time will tell which predictions are wrong or not. Pointing at one prediction as proof another is wrong is....wrong.

Now as to some of your statements' accuracy.

1) The promise to get the economy on track is not identical to a promise to balance the budget. To not do something which was never promised, is not breaking a promise.

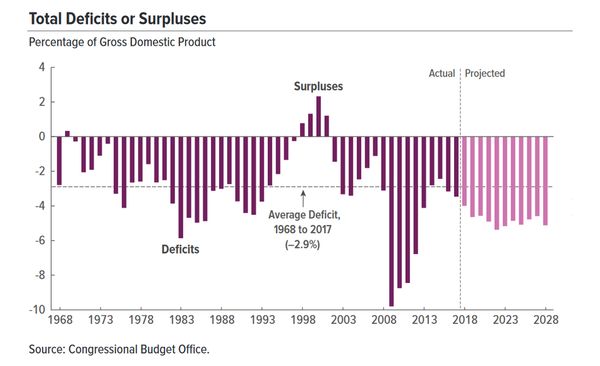

2) The deficit went down considerably from 2008 to 2014. Then it began to climb. The rate of climb has remained about the same since 2014. (see graph)

3) A tax break for all, while reducing regulations and requiring tariffs for those American companies who outsource production and jobs, yet want to sell in the American market; is hardly the same thing as a tax break for the wealthy. The best way to know whether it is good or bad for Americans is not by listening to talking heads and experts pontificating on the subject. It is by looking at the results. Are there more jobs? Yes. Is there more business start up? Yes. Is there more construction? Yes. Have closures of small businesses continued to increase? No. Are businesses expanding and creating more jobs? Yes. Have the average American employees paychecks continued to shrink? No. To increase? Yes. Is the GDP higher? Yes.

4) The economy has been improving.

a] Jobs are at record highs for decades and for some demographic groups they are higher than ever. And these are not government subsidized jobs paid for by taxpayers, nor part time jobs.

b] The GDP is up. When Obama was elected the GDP was at a low of 2.3%. By the time Trump was elected the GDP had reached 1.2%.

It has hovered near 3% so far under Trump.

And borrowing more does NOT strengthen the economy. Increasing debt by borrowing more stifles growth.

Jul 21, 2018 03:12:38 #

PeterS wrote:

And how much did government grow under Obama? br ... (show quote)

Having higher taxes to increase revenue sounds workable until you take into account how businesses are either large enough to avoid those taxes by outsourcing, or if small must downsize or close. Both result in many people losing their jobs or working for less and therefor paying less taxes. And collecting less revenue from businesses as well when they leave, close, or downsize. Job growth has a definite positive affect on revenue growth. Look at how in less than 2 years the rate of deficit growth has lessened. The deficit itself is still increasing. It would take a miracle to turn our deficit into a surplus in so short a time. Either that or take economic sleight of hand as Clinton did when revenues did not increase yet the deficit decreased due to gutting National Defense, the military, and other expenditures. But the rate of deficit under Trump is decreasing gradually.

Both Bush and Reagan cut taxes for the wealthy with no strings attached while doing nothing for small business or the average American. This is called trickle down economics. It won't work all by itself. Trump has cut taxes for all while providing a business friendly environment to inshore and consequences for outsourcing. Instead of taxing and regulating away our jobs, make it worthwhile for business to stay, come back, expand, or start-up. Then add a consequence for getting rich by selling in the American market without using American labor or paying American taxes. The consequence Trump included in his tax plan is called a tariff. The tariff is not a tax which is paid by all but only by those whose goods are produced outside of the US and then brought in to our market. The companies may increase prices to compensate, but then they will be competing with American companies who don't outsource and don't therefor pay tariffs. And there is another factor. Having production outside the US has become more and more risky and there are more and more unstable regimes, increased terrorism, and increasing incidences of nationalization confiscating business property and resources. Reducing taxes from the highest in the world to an average amount, while reducing regulations to a manageable amount instead of having to comply with hundreds of new regulations a month; can make operating within the US attractive to business again.

It is a pleasant surprise when a big corporation does the right thing for the sake of doing the right thing. But I wouldn't hold my breath waiting for it. Instead make it a win/win for both business and employees by making it profitable to do business in a way which benefits Americans.

Jul 21, 2018 03:40:38 #

Nickolai wrote:

Steel and aluminum plants are reopening. But to get up to peak production can't be done overnight. So there will be a temporary need to continue to buy imported materials. This will change when American steel and aluminum production is back up to speed as it will be both cheaper to buy (no tariff expense) and american steel is one of the highest quality steel in the world. US Steel is reopening plants in Illinois, Pittsburgh, and other locations.

https://www.cnbc.com/2018/03/07/us-steel-reopening-plant-and-bringing-back-jobs-ceo-on-trump-tariffs.html

Alcoa Corp. AA -2.98% plans to reopen part of an idle smelter in southern Indiana this spring. Luxembourg-based Tenaris SA opened a mill near Houston late last year to make pipe for natural-gas and oil fracking wells. Startup Big River Stee l LLC, in Osceola, Ark., accelerated production in 2017 at one of the largest sheet mills to be built in the U.S. in years.

Steelmakers Nucor Corp. and Commercial Metals Co. are planning to build small mills in Missouri and Oklahoma to supply the steel reinforcing bar used in concrete for construction. Rebar and well pipe are among the steel products that have faced some of the heaviest competition recently against cheap imports from countries, particularly South Korea and Turkey.

https://www.wsj.com/articles/u-s-steel-to-restart-illinois-plant-operations-to-handle-demand-1520430223

Jul 21, 2018 04:20:48 #

JoyV wrote:

Both the prediction the deficit will go down in th... (show quote)

What you missed is that those predicting debt to go down were ideologues who are paid to tell people what they want and the group that was predicting that debt will go up are economist who get paid to tell the t***h whether those who listen want to hear it or not...

As for GDP--we have an infusion from debt of about 1.27 Trillion this year plus a massive infusion from the tax cut so how is it the economy is only hovering below 3%. Do you know what would happen to the economy if it didn't have a massive amount of debt and a tax cut? We would have a recession deeper than under George W Bush...

Jul 21, 2018 05:14:27 #

JoyV wrote:

Having higher taxes to increase revenue sounds wor... (show quote)

I don't know where you are pulling your numbers for the deficit. Below is debt, by year, that Obama was president. From what I can tell is that debt was in constant decline until Trump took over with 2018 projected to be a 1.1 to 1.27 Trillion deficit.

2009: -1,412.7

2010: -1,294.4

2011: -1,299.6

2012: -1,087.0

2013: ...-679.5

2014: ...-484.6

2015: ...-438.5

2016: ...-584.7

2017: ...-665.4

2018:-1,100.00 projected.

Now mind you Obama was dealing with one of the deepest recessions we've had in modern history whereas Trump was handed a stable economy so there is no excuse for Trumps fumbling of the economy...though I am sure you will make one.

Quote:

Both Bush and Reagan cut taxes for the wealthy wit... (show quote)

Trumps tax cuts didn't include low income, low middle, only a few penny's for the middle, and a latte a day for the upper middle. That's hardly a broad based tax cut. Where it was targeted was at the uber wealthy, the extremely wealthy, the very wealthy, the wealthy, and the upper income--but only a pittance for all the rest. And if you are a teacher in Texas you lost money because your insurance premiums increased whereas your pay remained the same and Trump took away the $500 dollars teachers received for the money they spent buying supplies for your degenerate children. When you add it all up if you teach in Texas Trumps tax cut cost you money so thanks a lot...

Quote:

It is a pleasant surprise when a big corporation does the right thing for the sake of doing the right thing. But I wouldn't hold my breath waiting for it. Instead make it a win/win for both business and employees by making it profitable to do business in a way which benefits Americans.

I think I missed something. I've got an MBA and I certainly know big corporations as well as the next man and the primary responsibility a corporation has is to it's share holders. Everything else is a very distant number two so I'm not sure what type of altruism you are referring here but I can assure you, you don't have the slightest idea what you are talking about.

And one last thing. You got all giddy about a steel mill being propped up by tariffs. How is that something to celebrate when the only reason the company exists is because government is taxing it's citizens to supplement the price steel is produced at? You people are conservatives remember and you are 1) opposed to government taxing it's citizens and 2) you are against government propping up businesses instead of allowing market forces to govern. Now I know you are going to argue that China has an unfair advantage but they are the biggest baddest steel producers in the world. China accounted for a whopping 49% of the 1.7 billion metric tonnes of steel produced globally last year. In comparison the United States produced 88 million tons of steel or a drop in the bucket compared to what China produced. And in addition to that Trump is targeting all of our allies even though we have a favorable trading position with them. Trump tariffs are designed to gain an advantage were none can be gained. They mark the most extreme in ignorance and even if they were to succeed--you cons would say they worked--they can only fail...

Jul 21, 2018 05:43:48 #

PeterS wrote:

What you missed is that those predicting debt to g... (show quote)

These expert economists have been wrong far more often than right. But as I stated, I don't rely on forecasts whether from the left or right, or from economists or ideologues. I believe what I see for myself which has already happened. If I went by predictions I would either believe the economy is almost the worst its ever been or that the economy is the best its ever been. Neither it correct. If you opened your door to a rainy day, but the weather forecast from the top respected meteorologist predicted a sunny day; would you say it must really be sunny because the expert predicted it? People are working and for higher wages. Small businesses are rehiring and new businesses starting. Construction is booming. And for the first time since 1999 I am able to charge full price for training guide dogs from people from around the country (MI, NV, OK, FL, NY) instead of reduced price of half off which barely covers my expenses and only then because I cut back on medical prevention and on top nutrition. You ask how is it the economy is hovering below 3%? Do you mean the GDP? How was it that after 8 years of Obama it went from 2.3% when the 2008 e******n took place, to 1.2% when the 2016 e******n took place.

Here are some links regarding economists and their predicting accuracy including from left wing, right wing, and neutral sites.

https://www.washingtonpost.com/opinions/why-economists-cant-forecast/2017/03/08/4cad0644-041f-11e7-b1e9-a05d3c21f7cf_story.html?utm_term=.441b9997bcba

https://www.theguardian.com/money/2017/sep/02/economic-forecasting-flawed-science-data

https://www.economist.com/finance-and-economics/2016/01/09/a-mean-feat This last says "THE only function of economic forecasting is to make astrology look respectable,"

Jul 21, 2018 06:02:02 #

PeterS wrote:

I think I missed something. I've got an MBA and I ... (show quote)

That is just the point I made. Don't hold your breath that big corporations will make decisions for altruistic reasons. Give them a profitable reason to produced within our country and to expand production which will produce more jobs. This is a win/win. A win for business and a win for employees.

A tariff isn't a subsidy from taxpayers to the corporations. A tariff is a specific tax to import product for sale in our country. The corporations pay. In the case of the Trump tariff for American companies, instead of getting a free pass to produce outside our country with non American labor, then bring the product in for sale without paying any tax or tariff to do so (as was the case before the Trump tariffs); Trump specifically targets American businesses who outsource {As well as countries with unfair trade arrangements}.

To truly totally leave it up to the market, you'd first have to equal the conditions which favor outsourcing. Extremely reduce taxes. Eliminate all or nearly all regulations. And impoverish the work force. Either do all that or charge tariffs specifically for outsourced products.

Jul 21, 2018 06:42:19 #

JoyV wrote:

That is just the point I made. Don't hold your br... (show quote)

When you are talking about a steel company that is only here because of the tariffs Trump placed on steel from other countries then you are talking about a company that exists because it is propped up by the American Tax payer. You are an ideologue Joy who's in love with anything that Trump does. Trump is trying to punish China, with world wide tariffs on steel, for producing fully half of the world wide market. No one wins here Joy. Americans pay higher prices for any and all good made with steel and in addition to that have to support a business that only exists because the American Taxpayer is propping it up.

And as jaded as you are Joy I wouldn't trust you as far as I could spit when it comes to economics. Supply Side theory was tried under Reagan, brushed off under GW Bush, and now under Donald J. It's failed two times in the past with each time producing world record debt yet you think the third time is the charm because it's being implemented by a man who wouldn't know his economic ass from a hole in the ground. You cannot put a tariff on steel world wide and then somehow think that China will be forced to do anything they don't want to do with their steel companies. All you are doing is forcing up the price on steel world wide and profits remain the same so no one has any motivation to act to bring prices down. This is why government should stay out of the market because with out exception they only Fuk it all up for everyone...

If you want to reply, then register here. Registration is free and your account is created instantly, so you can post right away.