This ain't gonna fly

Dec 20, 2017 13:39:10 #

whitnebrat

Loc: In the wilds of Oregon

This ain't gonna fly

OK, so the new tax cut bill has passed and the Repubs will own it, lock, stock and barrel.

Here's what it does:

Makes health care insurance unavailable to at least thirteen million people.

Makes insurers even more leery of offering insurance to non-urban areas, which in turn, makes rural hospitals uneconomic to operate. Result: more people without health care at all in rural areas.

Drives up premiums for the rest of us that are left in the exchanges by 10-20%.

Gives billions to the already rich hedge fund managers and real estate developers via the 'pass-through' loophole.

Rate cuts are disproportionately aimed at the rich by twenty-to-one ratio, meaning that the wealthy get twenty times more money from the cuts than all of the lower one-third of the wage-earners in the country.

Drives up the debt (which is already at twenty TRILLION dollars) by one-and-a-half trillion more. They claim that this figure will be offset by the economic gains given to the wealthy and corporations. They claim that the middle class is bolstered by the fact that these companies will use the money to expand and hire more workers at higher wages.

This is wrong in a number of areas, and those job increases and wage hikes will never materialize.

First, when the Treasury Secretary asked a roomful of CEO's the other day what they would do with the increased profits due to the tax reduction. Only a small handful said that they would use it to expand. The rest said that it would go either to stock buybacks or as dividends to the stockholders.

Second, if they were to expand, they would invest in automation for a number of reasons. The investment in automation is a capital expense that can now be deducted right away from any taxable income.

Any investment in more people is an operating expense that cannot be deducted. That includes higher wages, better benefits, and a host of other costs. Robotics and automation works twenty-four/seven and doesn't complain or take days off or vacations.

There has to be more goodies for special interests buried in a thousand-page bill that very few people have any idea what's in it.

In addition, because of the huuuuuuuuuuuuuuuge deficiet, look for the Repubs to hypocritically start clamoring for massive cuts to Social Security, Medicare, Medicaid, and any other leftover New Deal programs that are still in existance. This means you, retirees that get SS benefits and Medicare (of which I am one). Watch out, they're coming for you next.

All in all, this is a REALLY bad idea, and should never have been passed.

OK, so the new tax cut bill has passed and the Repubs will own it, lock, stock and barrel.

Here's what it does:

Makes health care insurance unavailable to at least thirteen million people.

Makes insurers even more leery of offering insurance to non-urban areas, which in turn, makes rural hospitals uneconomic to operate. Result: more people without health care at all in rural areas.

Drives up premiums for the rest of us that are left in the exchanges by 10-20%.

Gives billions to the already rich hedge fund managers and real estate developers via the 'pass-through' loophole.

Rate cuts are disproportionately aimed at the rich by twenty-to-one ratio, meaning that the wealthy get twenty times more money from the cuts than all of the lower one-third of the wage-earners in the country.

Drives up the debt (which is already at twenty TRILLION dollars) by one-and-a-half trillion more. They claim that this figure will be offset by the economic gains given to the wealthy and corporations. They claim that the middle class is bolstered by the fact that these companies will use the money to expand and hire more workers at higher wages.

This is wrong in a number of areas, and those job increases and wage hikes will never materialize.

First, when the Treasury Secretary asked a roomful of CEO's the other day what they would do with the increased profits due to the tax reduction. Only a small handful said that they would use it to expand. The rest said that it would go either to stock buybacks or as dividends to the stockholders.

Second, if they were to expand, they would invest in automation for a number of reasons. The investment in automation is a capital expense that can now be deducted right away from any taxable income.

Any investment in more people is an operating expense that cannot be deducted. That includes higher wages, better benefits, and a host of other costs. Robotics and automation works twenty-four/seven and doesn't complain or take days off or vacations.

There has to be more goodies for special interests buried in a thousand-page bill that very few people have any idea what's in it.

In addition, because of the huuuuuuuuuuuuuuuge deficiet, look for the Repubs to hypocritically start clamoring for massive cuts to Social Security, Medicare, Medicaid, and any other leftover New Deal programs that are still in existance. This means you, retirees that get SS benefits and Medicare (of which I am one). Watch out, they're coming for you next.

All in all, this is a REALLY bad idea, and should never have been passed.

Dec 20, 2017 14:15:26 #

Dec 20, 2017 14:32:33 #

Boo_Boo

Loc: Jellystone

May I ask a few questions, please? How will insurance be unavailable to 13 million people? Are you saying that,

without the tax write off, these people will not be able to afford insurance? If I have read the bill correctly,

it seems to me that people will now have a choice with employee offered insurance, they can opt out. This is about 2 million people. Is it true that repealing mandate penalties would not change Medicaid eligibility, meaning that anybody who didn't sign up would still qualify, and could be signed up if they ever needed medical care. Similarly, repealing the mandate penalties would not mean that those employees would lose their offer of coverage. Did I read this wrong? Also, it is worth mentioning, about 6.5 million people elected to pay a penalty rather than signing up for ACA. So, when I read the bill, about 5 million people may (and the emphasis is on may) have to pay higher premiums because healthy people may (and there is that crystal ball to predict what people may or may not do) decide to pay per visit rather than supporting those who must have, due to their failing health, insurance. This is a long distance from 13 million....

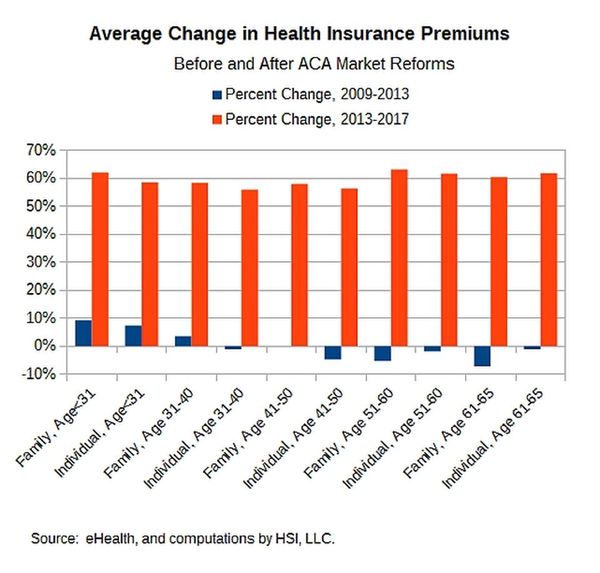

Second question, where did you find the projected premium increase? Forbes ran an article on the increases under ACA... were you aware that premiums were declining the four years before ACA and actually increased an average of 46 percent after ACA? "Overall, Health Maintenance Organization (HMO) premiums actually decreased 4.6% in the four years before the ACA reforms came into effect (that is, from 2009 to 2013), but increased 46.4% in the first four years under the ACA. Point-of-Service (POS) premiums decreased 14.9% before the ACA, and increased a whopping 66.2% afterwards. Premiums for the more common Preferred Provider Organization (PPO) plans increased 15% in the four years before the ACA, and 66.2% afterwards." https://www.forbes.com/sites/theapothecary/2017/03/22/yes-it-was-the-affordable-care-act-that-increased-premiums/#3a0b6ce811d2

Now then the Pass Through Loophole..... this will not affect many business. Pass-through businesses are companies organized as sole proprietorships, partnerships, LLCs, or S corporations that don't pay the corporate income tax and instead are taxed at individual rates. So, what you are saying is this handful of business who elect to pay 39.6 percent taxes rather than a corporate rate tax is somehow bad. I would be interested in reading how you came to this conclusion. The "rich" will still pay more than 85 percent of the taxes.

Superficially it looks as if our National Debt will increase. But, this does not take in consideration the rider... that of Jobs act. The Tax Cuts and Jobs Act is a pro-growth tax plan, which would spur an additional $1 trillion in federal revenues from economic growth, with approximately $600 billion coming from the bill's permanent provisions and approximately $400 billion from the bill's temporary provisions over the budget window. These new revenues would reduce the cost of the plan substantially. Depending on the baseline used to score the plan, current policy or current law, the new revenues could bring the plan closer to revenue neutral. In my opinion, this is a wait and see. Personally, after crunching the numbers, I think that this will grow the economy. But, I do not have a crystal ball to see the final fall out from this overdue reform. https://taxfoundation.org/final-tax-cuts-and-jobs-act-details-analysis/

without the tax write off, these people will not be able to afford insurance? If I have read the bill correctly,

it seems to me that people will now have a choice with employee offered insurance, they can opt out. This is about 2 million people. Is it true that repealing mandate penalties would not change Medicaid eligibility, meaning that anybody who didn't sign up would still qualify, and could be signed up if they ever needed medical care. Similarly, repealing the mandate penalties would not mean that those employees would lose their offer of coverage. Did I read this wrong? Also, it is worth mentioning, about 6.5 million people elected to pay a penalty rather than signing up for ACA. So, when I read the bill, about 5 million people may (and the emphasis is on may) have to pay higher premiums because healthy people may (and there is that crystal ball to predict what people may or may not do) decide to pay per visit rather than supporting those who must have, due to their failing health, insurance. This is a long distance from 13 million....

Second question, where did you find the projected premium increase? Forbes ran an article on the increases under ACA... were you aware that premiums were declining the four years before ACA and actually increased an average of 46 percent after ACA? "Overall, Health Maintenance Organization (HMO) premiums actually decreased 4.6% in the four years before the ACA reforms came into effect (that is, from 2009 to 2013), but increased 46.4% in the first four years under the ACA. Point-of-Service (POS) premiums decreased 14.9% before the ACA, and increased a whopping 66.2% afterwards. Premiums for the more common Preferred Provider Organization (PPO) plans increased 15% in the four years before the ACA, and 66.2% afterwards." https://www.forbes.com/sites/theapothecary/2017/03/22/yes-it-was-the-affordable-care-act-that-increased-premiums/#3a0b6ce811d2

Now then the Pass Through Loophole..... this will not affect many business. Pass-through businesses are companies organized as sole proprietorships, partnerships, LLCs, or S corporations that don't pay the corporate income tax and instead are taxed at individual rates. So, what you are saying is this handful of business who elect to pay 39.6 percent taxes rather than a corporate rate tax is somehow bad. I would be interested in reading how you came to this conclusion. The "rich" will still pay more than 85 percent of the taxes.

Superficially it looks as if our National Debt will increase. But, this does not take in consideration the rider... that of Jobs act. The Tax Cuts and Jobs Act is a pro-growth tax plan, which would spur an additional $1 trillion in federal revenues from economic growth, with approximately $600 billion coming from the bill's permanent provisions and approximately $400 billion from the bill's temporary provisions over the budget window. These new revenues would reduce the cost of the plan substantially. Depending on the baseline used to score the plan, current policy or current law, the new revenues could bring the plan closer to revenue neutral. In my opinion, this is a wait and see. Personally, after crunching the numbers, I think that this will grow the economy. But, I do not have a crystal ball to see the final fall out from this overdue reform. https://taxfoundation.org/final-tax-cuts-and-jobs-act-details-analysis/

whitnebrat wrote:

This ain't gonna fly br br OK, so the new tax cut... (show quote)

Dec 20, 2017 14:41:05 #

Pennylynn wrote:

May I ask a few questions, please? How will insur... (show quote)

Good effort Penny. I predict your facts will be rejected and an alternate reality installed in their place. Really, though, good try.

Dec 20, 2017 14:48:36 #

Boo_Boo

Loc: Jellystone

Larry,

Thank you....One can only try.... The current tax plan is overdue for reform.

Thank you....One can only try.... The current tax plan is overdue for reform.

Larry the Legend wrote:

Good effort Penny. I predict your facts will be rejected and an alternate reality installed in their place. Really, though, good try.

Dec 20, 2017 15:16:09 #

whitnebrat

Loc: In the wilds of Oregon

Pennylynn wrote:

May I ask a few questions, please? How will insurance be unavailable to 13 million people? Are you saying that,

without the tax write off, these people will not be able to afford insurance?

without the tax write off, these people will not be able to afford insurance?

My point was that without the individual mandate, that far fewer healthy people will buy insurance on the open market, which will increase the premiums for those remaining. Those increases would effectively price that thirteen million out of the market over a ten year period.

Pennylynn wrote:

If I have read the bill correctly,

it seems to me that people will now have a choice with employee offered insurance, they can opt out. This is about 2 million people.

it seems to me that people will now have a choice with employee offered insurance, they can opt out. This is about 2 million people.

This may very well be true. I was referring only to the repeal of the individual mandate.

Pennylynn wrote:

Is it true that repealing mandate penalties would not change Medicaid eligibility, meaning that anybody who didn't sign up would still qualify, and could be signed up if they ever needed medical care. Similarly, repealing the mandate penalties would not mean that those employees would lose their offer of coverage.

Also probably true. The thirteen million, as I understand it (subject to error) are people that want to buy individual policies on the exchanges, not employees where the employer was offering insurance at the workplace.

Pennylynn wrote:

Did I read this wrong? Also, it is worth mentioni... (show quote)

The thirteen million is over a ten year period with more and more individual purchasers on the exchanges being priced out of the market because of higher premiums. Again, basic insurance theory says that when you decrease the pool of insured people, once it is skewed to the sicker group of policy holders, the premiums have to go up to cover the increased costs per person.

Pennylynn wrote:

Second question, where did you find the projected ... (show quote)

There are conflicting studies on this. I have myself only heard generalities, but it seems logical that with fewer policy holders that are sicker, the premiums have to go up to cover them.

Pennylynn wrote:

Now then the Pass Through Loophole..... this will ... (show quote)

You are correct as to the overall number of businesses that utilize this loophole. But it is the incredible amount of money that passes through these 'small businesses' and the amount of wealth that becomes immune to taxation. It isn't the taxes that they will eventually pay, it is the amount of income that will evade the tax process completely that is the problem. Yes, they pay much of the total tax burden, but in a deficit spending situation, is it fair that this amount of money is exempted from the system, when most of the middle and low income taxpayers see not much relief and cannot take advantage of these exemptions.

Pennylynn wrote:

Superficially it looks as if our National Debt wil... (show quote)

This is a variation on trickle-down economics which has never worked in the past and shows little hope of working in the future. As I stated originally, much of the savings in taxes for the corporations will not go to workers, but to stockholders or just in retained cash. Little to no expansion was predicted by the CEO's that the Treasury Secretary was talking to. To me, that means that the promised job gains and wage increases most likely won't increase, and any expansion will be with automation for the reasons I stated before.

Dec 20, 2017 15:46:50 #

Pennylynn wrote:

Larry,

Thank you....One can only try.... The current tax plan is overdue for reform.

Thank you....One can only try.... The current tax plan is overdue for reform.

Well, there is one specific tax reform I've been talking about for years but no-one seems to be interested in; how about abolishing the IRS and the Federal Reserve System altogether and returning the country to an honest money system based on specie, as mandated in the Constitution? No more need for 'plans' or 'forms', just reign in government and get on with our lives free of income taxes and currency inflation and all of the evils they visit upon us. While we're at it, let's cut up the 'Congressional credit card' and force them to operate within their means. Wouldn't that be so nice?

Dec 20, 2017 15:57:07 #

Boo_Boo

Loc: Jellystone

Well, first let me voice a gripe.... do not take this personally, there is at least one other individual who does the same thing....they split off comments so it is almost impossible to prepare or render points of debate. Notice, when I hit "quote reply" only the last quote is made available for future readers to follow the conversation? This leaves more than 90 percent of your and my comments behind and readers would need to go back to the original comment to make any sense the discussion at hand. So, I am left with making this a long reply, simply because I have to copy and paste your remarks.It waste my time and anyone else's who is trying to follow our discussion.

whitnebrat wrote:

This is a variation on trickle-down economics whic... (show quote)

Dec 20, 2017 16:04:10 #

whitnebrat wrote:

This ain't gonna fly br br OK, so the new tax cut... (show quote)

The 13 million are no longer FORCED to purchase health insurance or pay a fine. If they so desire, they may purchase health insurance, but only if they so desire.

Dec 20, 2017 16:52:27 #

PoppaGringo wrote:

The 13 million are no longer FORCED to purchase health insurance or pay a fine. If they so desire, they may purchase health insurance, but only if they so desire.

You mean they're... 'free to choose'?!!

Gadzooks! Someone, quick! Do something!!!

Dec 20, 2017 17:00:11 #

peter11937

Loc: NYS

PoppaGringo wrote:

The 13 million are no longer FORCED to purchase health insurance or pay a fine. If they so desire, they may purchase health insurance, but only if they so desire.

And once again catastrophic health care plans can be offered to the healthy at an actuarial rate. That will be low enough to make it both affordable and desired by the healthy prospect.

Dec 20, 2017 17:17:54 #

whitnebrat wrote:

This ain't gonna fly br br OK, so the new tax cut... (show quote)

Now we'll see if the GOP Passed a decent enough Tax Bill or not... And when it comes to "... huuuuuuuuuuuuuuuge deficits..." look no further than this last 8 years where Pres Obama's Administration increased the Debt by $8.335 Trillion... And let's not forget the 2008 and 2009 Debt increase of $2.902 combined when the Democrats led by Senator Obama had both Houses of Congress and the Rino Pres Bush signing them...

Dec 20, 2017 17:23:54 #

JimMe wrote:

And let's not forget the 2008 and 2009 Debt increase of $2.902 combined when the Democrats led by Senator Obama had both Houses of Congress and the Rino Pres Bush signing them...

Aaaaactually, that's not quite how I remember it. As I recall, then Senator Obama, the (ahem) 'Gentleman' from Illinois, v**ed 'present' almost 100% of the time. In other words, he was there, but he wasn't there, if you know what I mean. He certainly didn't 'lead' anyone anywhere, unless you're talking about leading i******s and dead people to the polls. (Hello, 'community organizer'...)

Dec 20, 2017 17:51:44 #

Larry the Legend wrote:

Aaaaactually, that's not quite how I remember it. As I recall, then Senator Obama, the (ahem) 'Gentleman' from Illinois, v**ed 'present' almost 100% of the time. In other words, he was there, but he wasn't there, if you know what I mean. He certainly didn't 'lead' anyone anywhere, unless you're talking about leading i******s and dead people to the polls. (Hello, 'community organizer'...)

You are correct regarding Sen Obama's abstaining on any Bill of importance... So, I shouldn't have said he "led" the Dems Spending... He merely supported it... And your commenting on his activist actions during General E******ns reminds me of a line from "Justified", a TV show a few years back when there was an e******n for Sheriff in a small county: "The e******n ain't over till all the dead have v**ed!!!"

Dec 20, 2017 18:08:37 #

JimMe wrote:

"The e******n ain't over till all the dead have v**ed!!!"

Community organizing at work!

If you want to reply, then register here. Registration is free and your account is created instantly, so you can post right away.