The new home sells stats came out today Guess what?

Jan 28, 2014 17:54:50 #

Jan 28, 2014 18:37:13 #

Can you do anything but lie?

Read the Realtors Report, and then choke on you lies

http://www.realtor.org/topics/existing-home-sales

Read the Realtors Report, and then choke on you lies

http://www.realtor.org/topics/existing-home-sales

pana wrote:

Not pretty.

Jan 28, 2014 19:14:37 #

Oh Bo. Please compare Pana's new vs your existing and tell me how you justify the comparison. Apples and Oranges just don't compare as the old saying goes.

Jan 28, 2014 19:25:04 #

New home sales were the highest since 2008. The peak of sales was in 2005, and all conservativerepublicans cried about the housing bubble and then the real estate crash, which happened under which president?

Posters like pana always slant their posts to make the republican mess look less so.

http://abcnews.go.com/Business/wireStory/us-sales-homes-drop-percent-december-22233701

Posters like pana always slant their posts to make the republican mess look less so.

http://abcnews.go.com/Business/wireStory/us-sales-homes-drop-percent-december-22233701

kegler299 wrote:

Oh Bo. Please compare Pana's new vs your existing and tell me how you justify the comparison. Apples and Oranges just don't compare as the old saying goes.

Jan 29, 2014 05:06:36 #

Bo seems to be pretty gullible.

First, the rise in December 2013 sales, again, was in the context of revisions and a developing downhill slide.

Second, indeed the annual level of existing-home sales in 2013 was reported at 5,090,000, the strongest annual reading since 2006, which was the second-year of the housing downturn. Yet, the 2013 annual number still was 21.4% below the 2006 sales level of 6,477,000, and 28.1% below the 2005 annual peak in the series of 7,080,000. More narrowly, the December 2013 reading of an annualized 4,870,000 sales pace was 33.0% below the historic monthly peak annual sales pace of 7,270,000, in June of 2005.

First, the rise in December 2013 sales, again, was in the context of revisions and a developing downhill slide.

Second, indeed the annual level of existing-home sales in 2013 was reported at 5,090,000, the strongest annual reading since 2006, which was the second-year of the housing downturn. Yet, the 2013 annual number still was 21.4% below the 2006 sales level of 6,477,000, and 28.1% below the 2005 annual peak in the series of 7,080,000. More narrowly, the December 2013 reading of an annualized 4,870,000 sales pace was 33.0% below the historic monthly peak annual sales pace of 7,270,000, in June of 2005.

Jan 29, 2014 05:46:33 #

pana wrote:

Bo seems to be pretty gullible. br First, the ris... (show quote)

So f***ing what?....Boat sales for last year were below the 2005 levels as well. Easy money is gone, todays economy is different, so you think that might have something to do with your figures? Duh!

I could probably find a number of items that the sales numbers are down from years ago not counting the ones that have went out of business during and after the bush recession.

Jan 29, 2014 05:55:03 #

Retired669 wrote:

So f***ing what?....Boat sales for last year were below the 2005 levels as well. Easy money is gone, todays economy is different, so you think that might have something to do with your figures? Duh!

I could probably find a number of items that the sales numbers are down from years ago not counting the ones that have went out of business during and after the bush recession.

I could probably find a number of items that the sales numbers are down from years ago not counting the ones that have went out of business during and after the bush recession.

Perhaps this will help you.

http://www.nickjr.com/printables/dora-ice-skate-connect-the-dots.jhtml

If you don't understand how new home construction effects almost every economic category in our system ranging from trade with Canada for pine to construction workers wages then you really do have your.........

Jan 29, 2014 06:10:20 #

BoJester wrote:

Can you do anything but lie?

Read the Realtors Report, and then choke on you lies

http://www.realtor.org/topics/existing-home-sales

Read the Realtors Report, and then choke on you lies

http://www.realtor.org/topics/existing-home-sales

Apology accepted. :thumbup:

Jan 29, 2014 06:16:07 #

pana wrote:

Perhaps this will help you.

http://www.nickjr.com/printables/dora-ice-skate-connect-the-dots.jhtml

If you don't understand how new home construction effects almost every economic category in our system ranging from trade with Canada for pine to construction workers wages then you really do have your.........

http://www.nickjr.com/printables/dora-ice-skate-connect-the-dots.jhtml

If you don't understand how new home construction effects almost every economic category in our system ranging from trade with Canada for pine to construction workers wages then you really do have your.........

I understand a heck of a lot more than you do that's obvious. You think maybe this hard winter we've been having might have something to do with new construction and sales being lower? You need to get your own head out of your own ass or whom ever ass it's up. Trying to cherry pick the stats you want isn't going to work and if you were not so dumb you would have already realized that. No wonder bottom feeding cons like you are so GD stupid.....FI

:thumbup: :thumbup: :thumbup:

Jan 29, 2014 06:29:03 #

Because everyone knows this is the first time winter has brought cold weather her to the northern hemisphere.

Every other indicator supports a down turning trend. Don't be so gullible.

The problem for the housing market, along with much of the economy, ties directly to the severe, structural liquidity problems impairing consumer spending and consumption. There have been no developments in underlying economic fundamentals, consumer conditions or otherwise, that would suggest a pending housing-industry turnaround or an economic recovery. Underlying reality favors a renewed, broad downturn in the economy, as also increasingly suggested by the existing-home sales.

In June, 2009 happy talk appeared about the recovery, now 4.5 years old. As economist John Williams has made clear, the recovery is entirely the artifact of the understated measure of inflation used to deflate nominal GDP. By under-measuring inflation, the government can show low, but positive, rates of real GDP growth. No other indicator supports the claim of economic recovery.

Every other indicator supports a down turning trend. Don't be so gullible.

The problem for the housing market, along with much of the economy, ties directly to the severe, structural liquidity problems impairing consumer spending and consumption. There have been no developments in underlying economic fundamentals, consumer conditions or otherwise, that would suggest a pending housing-industry turnaround or an economic recovery. Underlying reality favors a renewed, broad downturn in the economy, as also increasingly suggested by the existing-home sales.

In June, 2009 happy talk appeared about the recovery, now 4.5 years old. As economist John Williams has made clear, the recovery is entirely the artifact of the understated measure of inflation used to deflate nominal GDP. By under-measuring inflation, the government can show low, but positive, rates of real GDP growth. No other indicator supports the claim of economic recovery.

Jan 29, 2014 06:38:38 #

pana wrote:

Never mind,, not enough coffee yet... ok got it now.... In 05 / 06 anyone could be approved for a home mortgage, not as easy in 2013... I wonder if there is data for percent of loans approved vs rejected to support the data?Bo seems to be pretty gullible. br First, the ris... (show quote)

Jan 29, 2014 07:36:41 #

emarine wrote:

Never mind,, not enough coffee yet... ok got it now.... In 05 / 06 anyone could be approved for a home mortgage, not as easy in 2013... I wonder if there is data for percent of loans approved vs rejected to support the data?

I totally agree. You would think that with 85 billion a month going directly to the central bank supposedly meant to be loaned out to the public to stimulate the economy that they would lower the bond interest rate and the acct set up for fed member banks to safely hold money (.5%) to a negative rate (-.5)to cause fiscal loss and force lending. That's how we know that QE is just a farce dished out to the public as economic stimulus but only a mirage to keep the banks spread sheets solvent.

Jan 29, 2014 14:41:11 #

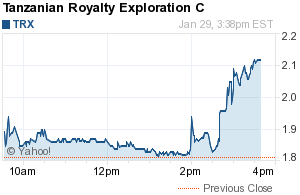

pana wrote:

Not pretty.

Chart looks like it'll have to allow for 10 Thousand or even 0 Thousand New Home Sales the way these Long-Term Fluctuation Trends seem to be Heading...

Jan 29, 2014 15:28:39 #

JimMe wrote:

Chart looks like it'll have to allow for 10 Thousand or even 0 Thousand New Home Sales the way these Long-Term Fluctuation Trends seem to be Heading...

Williams new report came out today

"Fed Policy, Household Income, Durable Goods, Home Sales, Money Supply "

Not looking so good out there. Got to love all these people who believe the headline economists who use the Government subsidized University studies as there article stats. How can people be so gullible?

Jan 29, 2014 15:40:27 #

I love when Bernanke speaks the last two announcements.

Im all in against the wall streeters.. When they go down I go up.

Im all in against the wall streeters.. When they go down I go up.

If you want to reply, then register here. Registration is free and your account is created instantly, so you can post right away.