Art Laffer: “It’s A Slam Dunk”

Apr 27, 2017 23:44:26 #

President trump outlined his tax reform proposals on a single sheet of paper. Nancy Pelosi and her 'Resistance' buddies went totally ballistic. The rest of the world cheered. Famed economist Art Laffer (of Laffer curve fame) called it a "slam dunk". Proof once again, if Nancy Pelosi et al don't like it, it's probably a good idea.

"On the eve of the tax reform plan’s release, famed economist Art Laffer made it clear he was bullish on cutting America’s sky-high corporate income tax rates because doing so would kick-start economic growth."

"We would bring people back and we would create jobs without tariffs and without protectionism," Laffer told the New York Times.

http://www.frontpagemag.com/fpm/266528/trumps-big-tax-reform-plan-matthew-vadum

"On the eve of the tax reform plan’s release, famed economist Art Laffer made it clear he was bullish on cutting America’s sky-high corporate income tax rates because doing so would kick-start economic growth."

"We would bring people back and we would create jobs without tariffs and without protectionism," Laffer told the New York Times.

http://www.frontpagemag.com/fpm/266528/trumps-big-tax-reform-plan-matthew-vadum

Apr 28, 2017 03:14:49 #

Larry the Legend wrote:

President trump outlined his tax reform proposals ... (show quote)

You do realize that the two times we cut taxes debt went through the roof don't you. If it's such a slam dunk why is it it's never worked?

Apr 28, 2017 03:32:36 #

Its not cutting taxes PeterS, its cutting the rates. This is where those that talk about this stuff in the MSM to include FOX on occasion get their audience somtimes confused. There is a HUGE difference between TAX CUTTING and CUTTING THE RATE of taxation.

PeterS wrote:

You do realize that the two times we cut taxes debt went through the roof don't you. If it's such a slam dunk why is it it's never worked?

Apr 28, 2017 04:12:37 #

2bltap wrote:

Its not cutting taxes PeterS, its cutting the rates. This is where those that talk about this stuff in the MSM to include FOX on occasion get their audience somtimes confused. There is a HUGE difference between TAX CUTTING and CUTTING THE RATE of taxation.

And what's the difference from cutting taxes and cutting the rate of taxation? If you are going to correct someone at least have the courtesy of explaining why you are right...

Apr 28, 2017 10:54:37 #

PeterS wrote:

You do realize that the two times we cut taxes debt went through the roof don't you. If it's such a slam dunk why is it it's never worked?

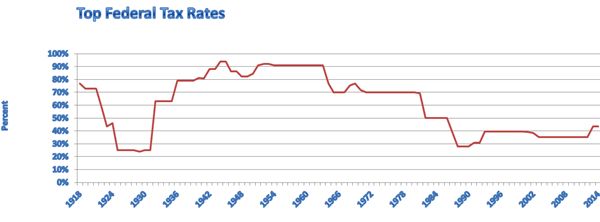

Cut taxes two times, you say? Only two? Since IRS inception in 1913, there have only been two cuts in taxes? OK. How do you explain this then?

Apr 28, 2017 15:10:56 #

PeterS wrote:

And what's the difference from cutting taxes and cutting the rate of taxation? If you are going to correct someone at least have the courtesy of explaining why you are right...

If a lower tax rate spurs GDP, the result would be increased gross revenue. A higher gross taxed at a lower rate could bring in more money as the bottom line.

ie: $10 @ 10% = $1.

$15 @ 8% = $1.20

Apr 28, 2017 16:37:12 #

Docadhoc wrote:

If a lower tax rate spurs GDP, the result would be increased gross revenue. A higher gross taxed at a lower rate could bring in more money as the bottom line.

ie: $10 @ 10% = $1.

$15 @ 8% = $1.20

ie: $10 @ 10% = $1.

$15 @ 8% = $1.20

Rates and revenue in one easy lesson:

https://en.wikipedia.org/wiki/Laffer_curve

Apr 28, 2017 21:38:05 #

Larry the Legend wrote:

Cut taxes two times, you say? Only two? Since IRS inception in 1913, there have only been two cuts in taxes? OK. How do you explain this then?

I meant by Reagan and Bush Junior. Sorry for not being specific...

Apr 28, 2017 22:05:51 #

Docadhoc wrote:

If a lower tax rate spurs GDP, the result would be increased gross revenue. A higher gross taxed at a lower rate could bring in more money as the bottom line.

ie: $10 @ 10% = $1.

$15 @ 8% = $1.20

ie: $10 @ 10% = $1.

$15 @ 8% = $1.20

And in what world do you get a 50% rate in economic growth by cutting taxes from 10% to 8%? That's the problem with the world of conservative economics, it has no basis in the real world.

Tax cuts equate to economic growth only if there is pent up aggregate demand and a lack of capital to service it. Is that the case doc? The 80's were a perfect example of where that was true. And guess what, even then the Reagan tax cut brought in less cash then if we hadn't cut taxes. The notion that tax cuts pay for themselves has never been true. If that were true then it's us liberals who would be cutting taxes so we could have more money to spend and you conservatives who were raising taxes because you wanted to stop government growth.

Apr 28, 2017 22:06:32 #

Larry the Legend wrote:

When has the Laffer curve ever proved to be true? Economic theories are wonderful if they are true but even when we cut taxes in the 80's the year over year rate of growth in revenue declined instead of increased as would have happened if it were true...

Apr 28, 2017 22:11:59 #

PeterS wrote:

When has the Laffer curve ever proved to be true? Economic theories are wonderful if they are true but even when we cut taxes in the 80's the year over year rate of growth in revenue declined instead of increased as would have happened if it were true...

I give up. You win. It's all yours. Enjoy your victory. Geeze.

Apr 28, 2017 22:24:50 #

Larry the Legend wrote:

I give up. You win. It's all yours. Enjoy your victory. Geeze.

Hey it's true, when Reagan cut taxes long term revenue growth declined from 9% to about 6%. It's hard for a tax cut to pay for itself when it brings in less cash then before taxes were cut...

Apr 28, 2017 22:40:20 #

PeterS wrote:

Hey it's true, when Reagan cut taxes long term revenue growth declined from 9% to about 6%. It's hard for a tax cut to pay for itself when it brings in less cash then before taxes were cut...

I really don't want to get into this, but I will say this, Reagan cut taxes well in excess of the Laffer optimal level on purpose. He was not trying to maximize government income, he was cutting government down and reducing the burden of taxation. Government income was reduced drastically and so was government need of that income. Understand, Reagan knew exactly what he was doing. And it worked. The 'Reagan years' are fondly remembered as a time of freedom and prosperity. Now, can we please put this to bed, I'm s**k of it already.

Apr 28, 2017 22:56:08 #

PeterS wrote:

And in what world do you get a 50% rate in economi... (show quote)

"ie" means example. Need I actually explain?

Is your problem that.you take everything literally and don't apply examples? It would explain many of your comments.

Why don't you provide the next 4 years of your expected economic growth, the new tax rates you expect, and how they will impact the tax revenue.

I don't have a crystal ball. I provided an example for your question. If you cannot provide all the actual future rates and the impact on revenue collected, you'll have to accept the example.

As I said prior, you have become obtuse.

And do you understand the meaning of the word "IF"?

Apr 28, 2017 23:02:58 #

PeterS wrote:

Hey it's true, when Reagan cut taxes long term revenue growth declined from 9% to about 6%. It's hard for a tax cut to pay for itself when it brings in less cash then before taxes were cut...

Not if the amount of money being taxed increases. A lower tax rate on more money can generate more tax revenue.

Trump wants to abolish regulations preventing business growth, which means increased business income, which means more money being taxed. And it means more jobs which means more money in circulation, more taxable incomes, and more tax revenue.

But you know all this. You just love being obtuse.

If you want to reply, then register here. Registration is free and your account is created instantly, so you can post right away.