Gold $4000 anyone?

Apr 12, 2024 14:18:37 #

"Gold has been a sought-after commodity for centuries, valued not only for its beauty and rarity but also for its role as a store of wealth and a hedge against economic uncertainty. However, gold prices are influenced by more than just supply and demand; psychological factors also play a significant role in shaping the market. In this article, we will explore the various psychological factors that drive gold prices and how understanding these influences can help investors make more informed decisions.

Fear and Uncertainty

One of the most prominent psychological factors that drive gold prices is fear and uncertainty. Gold has long been considered a "safe haven" asset, attracting investors during times of economic turmoil or geopolitical unrest. When there is a perceived threat to the stability of the global economy, such as a financial crisis, a terrorist attack, or escalating geopolitical tensions, investors often flock to gold as a way to protect their wealth. This increased demand drives up gold prices, reflecting the collective anxiety of the market."

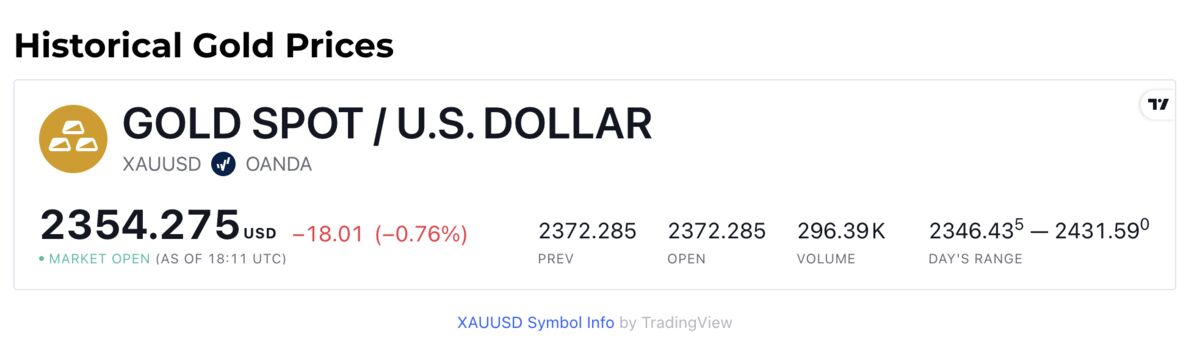

MY COMMENT: As of 2:11 this date (Friday 12th) Gold's spot price is $2,354. If Fear and Uncertainty are what is driving up the price of Gold, and UBS stating that Gold could double, what is that telling you about the state of world events?

https://www.focusontheuser.org/buy-gold/psychological-factors-that-drive-gold-prices/

Fear and Uncertainty

One of the most prominent psychological factors that drive gold prices is fear and uncertainty. Gold has long been considered a "safe haven" asset, attracting investors during times of economic turmoil or geopolitical unrest. When there is a perceived threat to the stability of the global economy, such as a financial crisis, a terrorist attack, or escalating geopolitical tensions, investors often flock to gold as a way to protect their wealth. This increased demand drives up gold prices, reflecting the collective anxiety of the market."

MY COMMENT: As of 2:11 this date (Friday 12th) Gold's spot price is $2,354. If Fear and Uncertainty are what is driving up the price of Gold, and UBS stating that Gold could double, what is that telling you about the state of world events?

https://www.focusontheuser.org/buy-gold/psychological-factors-that-drive-gold-prices/

Apr 12, 2024 14:22:23 #

ACP45 wrote:

"Gold has been a sought-after commodity for c... (show quote)

There will be a breakout price point that will send metals to the moon. The pressure is building to absurd levels now.

Once silver passes the 30 dollar per ounce then everyone will jump in.

Just my opinion.

Apr 12, 2024 14:22:34 #

ACP45 wrote:

"Gold has been a sought-after commodity for c... (show quote)

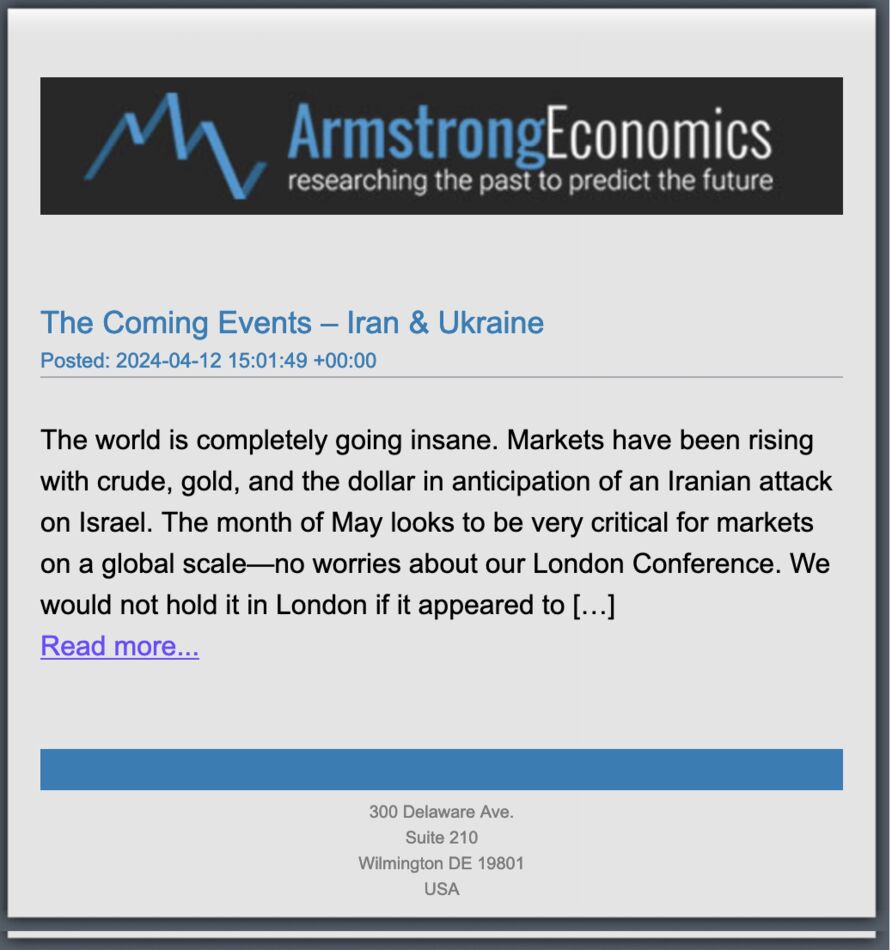

Case in point:

"We have a critical turning point on May 7th, which happens to be Putin’s inauguration day in Russia. The Ukrainians do as they are told, and even the Moscow attack was organized by the West, and they did not even try to hide it. They have been praying that Putin will retaliate and attack anything in NATO so they can launch WWIII. But Putin is very smart and he can see what they are trying to do. They need him to attack so they can claim it was unprovoked, as they did to Japan to get the USA into WWII. I fear that Ukraine will follow orders and attempt a stupid stunt against Putin directly for May 7th."

Apr 12, 2024 14:34:19 #

ACP45 wrote:

Case in point: br "We have a critical turning... (show quote)

I would not argue with you at all .

A plausible analysis.

Apr 15, 2024 07:20:21 #

ACP45 wrote:

"Gold has been a sought-after commodity for c... (show quote)

ACP45, gold is nice, but you can't eat it. No nutritional value. There are other precious metals that are just as good or better than gold. Lead and brass can protect you, feed you and it works real well as batrer when cash money is worthless. Back in the late 90's, a 50 round box of .22LR was $0.97 a box at Walmart. Today it costs $4 - $6 or more for the same 50 round box. Pretty good return on investment. When the SHTF, that price will skyrocket.

Apr 15, 2024 07:42:25 #

TruePatriot49 wrote:

ACP45, gold is nice, but you can't eat it. No nutritional value. There are other precious metals that are just as good or better than gold. Lead and brass can protect you, feed you and it works real well as batrer when cash money is worthless. Back in the late 90's, a 50 round box of .22LR was $0.97 a box at Walmart. Today it costs $4 - $6 or more for the same 50 round box. Pretty good return on investment. When the SHTF, that price will skyrocket.

Your point is well taken. No, you can't eat gold (but then again, you would best be advised not to eat lead either!).

There is really no "one solution" fits all here. You need a balanced approach to deal the problems that we as a people are going to face in the near future.

Food, water, personal self-protection, beer and wine (just kidding), and financial security, are all important.

Just as you may be able to barter a box of 22's, junk silver coins will also serve that purpose well. Cash on hand, as well as some gold coins all have their place. Stay safe!

Apr 15, 2024 13:24:57 #

ACP45 wrote:

Your point is well taken. No, you can't eat gold (... (show quote)

ACP45, the lead and brass is useful for harvesting game to feed yourself and your family. Hard liquor is easier to store than beer and not taxed in Rhode Island. If you purchase the 200 ML size bottles, they are great for bartering too. Having gold and silver, real money, is also good to have.

If you want to reply, then register here. Registration is free and your account is created instantly, so you can post right away.