Biden’s economy keeps messing up Trump’s message

Feb 4, 2024 17:33:10 #

Feb 4, 2024 17:36:12 #

Bad Bob wrote:

https://www.yahoo.com/news/trump-allies-adjust-messaging-economy-002441547.html

Imagine that you had a “rich” friend. The guy lives in a massive house. He owns several fancy sports cars. He’s always dressed to the nines. He is among the first to buy the latest, coolest gadgets.

Now imagine that it turns out that he isn’t rich. He’s borrowed hundreds of thousands of dollars for a construction project, has spent a lot of the money on himself, and will be soon going bankrupt. He going to have to sell the cars. The bank will eventually repossess his house and he’ll have to end up selling a lot of his fancy toys.

Well… he is the personification of the U.S. economy.

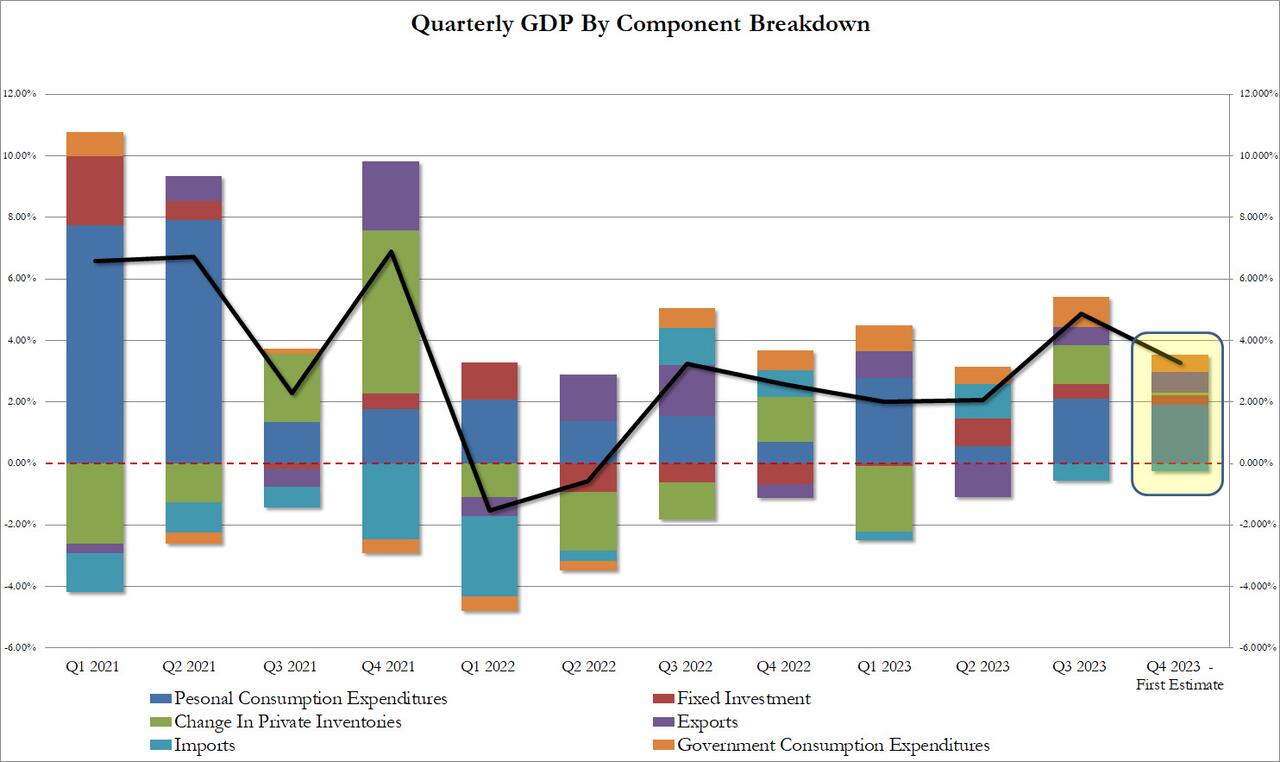

Fourth quarter GDP came in much better than expected at 3.28 percent. This set off waves of celebration at the White House. Nothing makes presidents happier than solid economic data in an election year. (Come to think of it, this might be a reason to be skeptical of government-generated numbers.)

But when you put the GDP growth into a broader context, the celebration isn’t warranted.

This “booming” economy is built on debt. It looks good now, but riches built on borrowing have a limited shelf life. Just ask our friend from the beginning of this post.

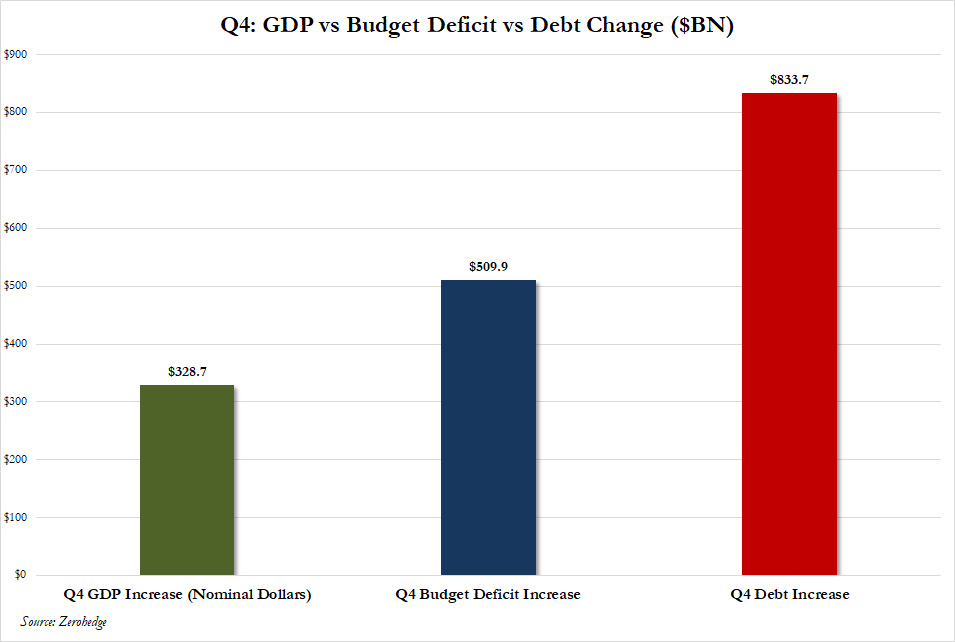

If you think GDP growth in Q4 was impressive, check out the growth in the national debt. In just three months, the U.S. government added $833.7 billion to the debt.

In other words, the U.S. government borrowed $833.7 billion to buy $328.7 billion in economic growth.

Government was one of the biggest contributors to GDP growth, accounting for more than half a percent of the 3.28 percent increase. In other words, if you remove government spending borrowed money, GDP drops to 2.72 percent.

The national debt topped $34 trillion on December 29. On its way to the third-largest budget deficit in U.S. history, the Biden administration spent $6.46 trillion in fiscal 2023. That was an 8.8 percent year-over-year increase in actual spending.

When you put GDP growth into that perspective, it doesn't seem so grand.

According to the U.S. Debt Clock, the debt-to-GDP ratio currently stands at 122.47 percent. In 2000, it was a mere 59.43 percent

Any discussion of GDP growth needs to be viewed through the debt prism.

In fact, the massive level of debt is hindering real economic growth. According to a study by the World Bank, countries with a debt-to-GDP of over 77 percent for prolonged periods experience significant slowdowns in economic growth.

If debt rises above this threshold, each additional percentage point of debt costs 0.017 percentage points of annual real growth.

Consumer spending was the biggest contributor to the GDP print in Q4. Personal consumption added 1.91 percent to the GDP increase, more than half of the 3.28 percent growth.

So, where did Americans get the money to go on this spending spree?

They raided savings and borrowed it.

Personal savings as a percentage of disposable personal income was 4.0 percent in the fourth quarter That dropped 4.2 percent in the third quarter.

Meanwhile, consumer debt eclipsed $5 trillion for the first time ever in November. That same month, revolving credit, primarily made up of credit card debt, rose by $19.1 billion, a whopping 17.7 percent increase. To put the percentage increase into perspective, the annual increase in 2019, prior to the pandemic, was 3.6 percent.

As of the end of November, Americans owed just over $1.3 trillion in revolving credit.

We’ll get the December consumer credit data early in February, but it will almost certainly show another big jump in consumer debt.

Meanwhile, U.S. nonfinancial corporate debt has surged to $13.7 trillion, according to data compiled by the Federal Reserve. Business debt has increased by 18.3 percent since 2020.

So, yes, we’re seeing economic growth. But everybody is borrowing to the hilt to drive it.

Like our “rich” friend, it is wealth created by smoke and mirrors. That’s all well and good until the smoke clears and the mirror cracks.

And there's something suspicious about the latest jobs report from the Bureau of Labor Statistics (BLS), which claims that the economy added 353,000 jobs in January—more than double what economists had predicted. Is it true? Most likely not, and I'll explain why.

For weeks now, there have been reports of mass layoffs in the tech industry, including at iRobot, Amazon, Google, and Meta, among several others. The news industry has also been plagued by mass layoffs in recent weeks. These layoffs weren't out of the blue, either. Newsweek predicted last month that "mass layoffs are in store for 2024, and it might end up affecting nearly half of companies."

But the Biden administration says everything is fine. Better than fine, actually.

"America’s economy is the strongest in the world," Joe Biden declared in a statement Friday. "Today, we saw more proof, with another month of strong wage gains and employment gains of over 350,000 in January, continuing the strong growth from last year."

But how legit are these numbers? Prior to the release of the report, Zero Hedge listed some (but not all) of the layoffs that were announced in recent months:

• Twitch (35% of workforce)

• Hasbro (20% of workforce)

• Spotify (17% of workforce)

• Levi's (15% of workforce)

• Zerox (15% of workforce)

• Qualtrics (14% of workforce)

• Wayfair (13% of workforce)

• Duolingo (10% of workforce)

• Washington Post (10% of workforce)

• eBay (9% of workforce)

• Business Insider (8% of workforce)

• Paypal (7% of workforce)

• Charles Schwab (6% of workforce)

• UPS (2% of workforce)

• Blackrock (3% of workforce)

• Citigroup (20,000 employees)

• Pixar (1,300 employees).

This is not a sign of a strong, growing economy.

How much can the Biden administration's numbers be trusted? Well, not much. As Zero Hedge noted after the release of the report, "Once again there was a huge dispersion between the Establishment and Household Surveys, and while the former indicated an increase of 353K, the latter reported a drop in Employment of 31K!"

A chart comparing the Establishment and Household Surveys shows that while the reports have generally been quite close, there has been a growing disparity between them since June 2022.

Moreover, in addition to the suspicious figure of 353,000 jobs added in January, Zero Hedge notes that overall employment actually dropped by 31,000, with full-time employment experiencing a decline of 63,000, while part-time positions saw a significant surge, increasing by 96,000.

Clearly none of that mattered to the BLS, however, which had just one mission: to make the Biden economy look double super good-good ahead of the November elections, and it wasn't just payrolls which blew away expectations, the unemployment rate also slipped, staying at 3.7%, vs expectations of an increase to 3.8%. That said, among the major worker groups, the unemployment rates for adult men (3.6 percent), adult women (3.2 percent), teenagers (10.6 percent), Whites (3.4 percent), Blacks (5.3 percent), Asians (2.9 percent), and Hispanics (5.0 percent) showed little or no change in January.

Even the alleged wage increase, the report boasted about is deceptive. A closer look reveals that this apparent wage growth is attributed to a decline in actual working hours rather than an authentic increase in wages. The average workweek for all employees on private nonfarm payrolls decreased by 0.2 hours to 34.1 hours in January—a 0.5-hour decline over the year, which is the lowest level observed since the thick of the pandemic.

It appears from the report that the BLS has been given the task of making the labor market appear strong and robust ahead of the election in November. Will it work? Did Biden's claiming for years that Bidenomics was working change attitudes about the economy?

Feb 4, 2024 17:36:20 #

Bad Bob wrote:

https://www.yahoo.com/news/trump-allies-adjust-messaging-economy-002441547.html

The average American knows the truth that Bidenomics is not working for them. Thay are not fooled by spin numbers.

Feb 4, 2024 19:26:39 #

Parky60 wrote:

Imagine that you had a “rich” friend. The guy live... (show quote)

Where would we be today ?

If Republican presidents had paid down the debt/deficit instead of always increasing it .

Trump could’ve paid down the debt instead giving $9trillion in tax breaks to morbidly rich people.

Clinton left Bush43 a surplus .

Bush43 left Obama a 2008 Recession and

a DOW AT 6,000 .

Reagan took an $800Million debt from Carter and ran it up to $16 Trillion .

Debt - it’s what republicans do !

No infrastructure spending ,Social program spending.

Just rich rrpunlicsns walking off with all the cash. !!!! .

If you want to reply, then register here. Registration is free and your account is created instantly, so you can post right away.