President tax story

Sep 29, 2020 08:27:45 #

Go here and read this unless you are scared of the truth. https://www.newsmax.com/morris/refund-withheld-paychecks/2020/09/28/id/989227/?ns_mail_uid=4e3f3c20-c921-423f-8b80-2de3c8d48dca&ns_mail_job=DM150250_09292020&s=acs&dkt_nbr=010504hlhc06

Sep 29, 2020 08:51:26 #

EN Submarine Qualified wrote:

Go here and read this unless you are scared of the truth. https://www.newsmax.com/morris/refund-withheld-paychecks/2020/09/28/id/989227/?ns_mail_uid=4e3f3c20-c921-423f-8b80-2de3c8d48dca&ns_mail_job=DM150250_09292020&s=acs&dkt_nbr=010504hlhc06

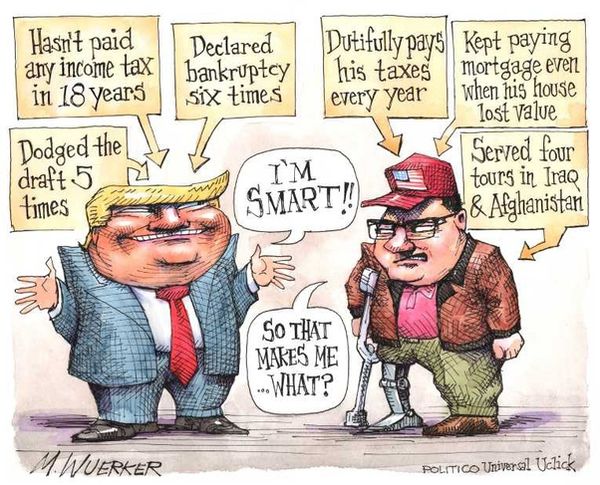

At first glance at trumps taxes is he's 1 comiting massive tax fraud or he's the world's worse business man, its one or the other.

As more and more is released over the coming weeks,

The fact that he owes 400 million makes him a national security risk.

So trump has said over and over he's so smart he uses all the loopholes to avoid paying taxes and you expect me to believe he prepaid his taxes LOL

Sep 29, 2020 08:58:48 #

Lonewolf wrote:

At first glance at trumps taxes is he's 1 comiting massive tax fraud or he's the world's worse business man, its one or the other.

As more and more is released over the coming weeks,

The fact that he owes 400 million makes him a national security risk.

So trump has said over and over he's so smart he uses all the loopholes to avoid paying taxes and you expect me to believe he prepaid his taxes LOL

As more and more is released over the coming weeks,

The fact that he owes 400 million makes him a national security risk.

So trump has said over and over he's so smart he uses all the loopholes to avoid paying taxes and you expect me to believe he prepaid his taxes LOL

Bottom line. No one expects you to believe anything that might upset your childish stupid rhetoric against the President of the United States.

Can't upset our resident troll, now can we?

Sep 29, 2020 09:52:54 #

EN Submarine Qualified wrote:

Go here and read this unless you are scared of the truth. https://www.newsmax.com/morris/refund-withheld-paychecks/2020/09/28/id/989227/?ns_mail_uid=4e3f3c20-c921-423f-8b80-2de3c8d48dca&ns_mail_job=DM150250_09292020&s=acs&dkt_nbr=010504hlhc06

=================

I believe that. The IRS requires to pay quarterly, in advance the estimated tax called 1040-ES. These is to cover all balance of the taxes withheld and due from the revenue received for the year. I am doing it myself.

Every quarter, I pay $3,200 for the 1040-ES to cover the shortage of withheld taxes due for the year. The withheld taxes from my income, and retirement distributions each year, could not accurately cover all the tax due at year end. Thus this 1040-ES every quarter is required. There are 4 quarters to pay in each year. If that is not done, IRS penalize and collect interest for unpaid due at year-end. Total taxes I pay annually average to $ 37,000. My withheld taxes from retirement income, plus the 1040-ES cover that.

And president Trump has been doing that also. It is required by IRS.

Dumb democrats don't pay a dime of taxes, so they don't even understand about that. All they do is free loading from taxpayers.

Sep 29, 2020 10:03:15 #

Radiance3 wrote:

================= br i I believe that. b The IRS... (show quote)

I also pay quarterly to avoid a big bill at the end of the year. Also, in my state if you owe more than a certain amount at the end of the year there is a penalty. Of course, Democrats do not care about truth.

Sep 29, 2020 10:04:23 #

EN Submarine Qualified wrote:

Bottom line. No one expects you to believe anything that might upset your childish stupid rhetoric against the President of the United States.

Can't upset our resident troll, now can we?

Can't upset our resident troll, now can we?

If you do not like what is clear about the tax papers, think it fake...

tell trump to end it in an hour.. all he has to do is release the tax records of his own.. show the world what they truly are..

Do you think he will ever do that??

So you think trump of people will resort to the truth on this subject??

The truth is in the NY times report. If not, trump can show proof.. but he has none.. the scum bag of the world is afraid that seeing more of the tax record will show the real worry.

Who he owes the money to...

For decades no US bank would touch him as a customer.. so who and why was any group willing to give him spending money?? And what is the payback..

In all the world, Putin has gained the most from trump being in the oval office.. is that a clue?

Sep 29, 2020 10:07:25 #

Liberty Tree wrote:

I also pay quarterly to avoid a big bill at the end of the year. Also, in my state if you owe more than a certain amount at the end of the year there is a penalty. Of course, Democrats do not care about truth.

================

You are right. I am glad someone like you could clarify what I mean.

Sep 29, 2020 10:08:34 #

permafrost wrote:

If you do not like what is clear about the tax pap... (show quote)

===============

Ah, frosty, you are becoming desperate.

Sep 29, 2020 10:12:21 #

Radiance3 wrote:

================= br i I believe that. b The IRS... (show quote)

You are correct.. I have a client, semi retired, who pays quarterly just as you say here so his net yearly is reduced given his fluctuating earnings each year...Last filing he paid 42k between state and federal, always paying more into state than federal..

Sep 29, 2020 10:12:27 #

Lonewolf wrote:

At first glance at Trump's taxes is he's 1 committing massive tax fraud or he's the world's worse businessman, it's one or the other.

As more and more are released over the coming weeks,

The fact that he owes 400 million makes him a national security risk.

So Trump has said over and over he's so smart he uses all the loopholes to avoid paying taxes and you expect me to believe he prepaid his taxes LOL

As more and more are released over the coming weeks,

The fact that he owes 400 million makes him a national security risk.

So Trump has said over and over he's so smart he uses all the loopholes to avoid paying taxes and you expect me to believe he prepaid his taxes LOL

You complain that Trump avoids paying taxes! But, totally forget Biden's avoidance of taxes!

Is it OK for the Bidens, but deplorable for Trump, to use legal deductions against taxation?

At least, Trump deducted paid taxes, over $30 Million in paid taxes, deducted from his taxes owed...

The Bidens avoids paying taxes on their $13 Million profit and pays taxes on less than 1/2 Million dollars from their win!

From American Truth Today:

“The Bidens have used their home state’s financial privacy laws to shield his income from public view, by setting up two tax- and transparency-avoidance vehicles known as S corporations,” Grim wrote. “He and his wife Jill Biden called them CelticCapri Corp. and Giacoppa Corp., respectively, and, according to the Wall Street Journal, have reported more than $13 million in profits the previous two years that weren’t subject to specific disclosure or self-employment taxes. As CNBC has described, money Biden made from book deals and speeches flowed into the S corporations and was then remitted to Biden and his wife as ‘distributions’ rather than salary. When money is funneled through an S corporation, the recipient doesn’t owe Social Security or Medicare taxes on it, nor can the source of revenue be traced. (In addition to the distributions, the Bidens drew relatively small salaries from the S Corporations: under half a million dollars, for which they owed self-employment taxes.)”

https://americantruthtoday.com/left-news/2020/09/28/joe-biden-exploited-s-corporation-loophole-to-avoid-payroll-tax/?utm_source=sprklst&utm_campaign=rightpatriot-joe-09_28-pm

Sep 29, 2020 10:17:35 #

Liberty Tree wrote:

I also pay quarterly to avoid a big bill at the end of the year. Also, in my state if you owe more than a certain amount at the end of the year there is a penalty. Of course, Democrats do not care about truth.

================

Communist democrats, liberals, don't know about 1040-ES. Cause about 85% of them are free loaders. Free college, free homes, free medical care, free abortions, free everything. And they want some more.

All Republicans pay taxes about 99.9%. Only .1 % could not afford to pay, but they are old folks.

Sep 29, 2020 10:25:23 #

Radiance3 wrote:

================

Communist democrats, liberals, don't know about 1040-ES. Cause about 85% of them are free loaders. Free college, free homes, free medical care, free abortions, free everything. And they want some more.

All Republicans pay taxes about 99.9%. Only .1 % could not afford to pay, but they are old folks.

Communist democrats, liberals, don't know about 1040-ES. Cause about 85% of them are free loaders. Free college, free homes, free medical care, free abortions, free everything. And they want some more.

All Republicans pay taxes about 99.9%. Only .1 % could not afford to pay, but they are old folks.

Right on. message to the freeloaders.

If I make it for another month, I will be 86 years old. 43 years in the service and industry. Retired in 1994. Live on pension and SS. Still pay both state and federal income taxes on both 'incomes'. How sweet it i. Money deducted from my income paid for both of these retirements now I get to pay taxes again on the same money.

Sep 29, 2020 12:21:33 #

1alpha7 wrote:

You complain that Trump avoids paying taxes! But, ... (show quote)

easy to find... seems everyone but trump has released tax returns.. Why???

This is for a couple of years, if you want other years, they are public also.. look and you can see..

https://thehill.com/homenews/campaign/452259-biden-releases-tax-returns-showing-steep-rise-in-income

Former Vice President Joe Biden on Tuesday released his tax returns from 2016 to 2018, showing his income increased significantly after leaving office.

Biden's federal tax return for 2016, his last full year as vice president, showed adjusted gross income of nearly $400,000, while his 2017 federal tax return reported adjusted gross income of more than $11 million.

His 2018 federal tax return reported adjusted gross income of nearly $4.6 million.

Biden filed his tax returns jointly with his wife, Jill, during those three years

The release of the documents comes during the former vice president's 2020 presidential campaign. Many of the other Democratic presidential candidates released their tax returns earlier this year.

Biden's income of $15.6 million in 2017 and 2018 greatly exceeds the incomes reported on the tax returns of other prominent 2020 candidates, including Sens. Bernie Sanders (I-Vt.), Kamala Harris (D-Calif.) and Elizabeth Warren (D-Mass.), as well as South Bend, Ind. Mayor Pete Buttigieg.

Harris and her husband reported the next highest amount of income in 2018, just under $1.9 million.

The former vice president's campaign said that the Bidens' income in 2016 primarily came from Joe Biden's salary as vice president and Jill Biden's salary as a professor at Northern Virginia Community College.

The majority of the Bidens' post-presidential income — more than $10 million in 2017 and about $2.3 million in 2018 — came from book payments and paid speaking engagements.

Joe Biden also earned about $370,000 in 2017 and about $405,000 in 2018 from being a professor at the University of Pennsylvania. Jill Biden continued teaching at Northern Virginia Community College in those years.

The Bidens had effective tax rates of 23.5 percent, 33.9 percent and 33.4 percent for 2016, 2017 and 2018, respectively. They donated to charity 1.5 percent of their adjusted gross income in 2016, 9.2 percent in 2017 and 6 percent in 2018.

During the 2008 campaign, the Bidens faced criticism for regularly reporting annual charitable contributions of less than $1,000 in preceding years. In 2018, the Bidens donated a greater percentage of their income to charity than many of the other 2020 presidential candidates did.

The former vice president's campaign said the couple filed amended 2017 and 2018 tax returns following a "comprehensive review" of their tax filings.

The original 2017 tax return unintentionally double-counted a charitable donation and failed to include income and associated withholdings from the last few weeks that Joe Biden served as vice president.

The original 2018 tax return included a deduction for a donation to a British charity associated with Prince Harry that doesn't have a 501(c)(3) designation.

In addition to releasing his tax returns from 2016 to 2018, Joe Biden also released a financial disclosure form that covers the period from Jan. 1, 2018 through May 31, 2019.

Biden's campaign said the form shows that the former vice president earned about $3.2 million through an S-Corporation during that period for writing and speaking engagements. Many of the fees he was paid for speaking engagements were part of his book tour.

Biden released his tax returns on an annual basis while he was vice president, and also released 10 years of tax returns in 2008. That contrasts with President Trump, who has not made any of his tax returns public.

Sep 29, 2020 12:26:01 #

Radiance3 wrote:

===============

Ah, frosty, you are becoming desperate.

Ah, frosty, you are becoming desperate.

\\LOL,, you silly lady you..

Do you think that simply releasing his own tax records he would make the NYT look false???

bet he will not release his records short of a court order and even then appeal the order for years via his never-ending staff of lawyers..

Sep 29, 2020 12:27:13 #

EN Submarine Qualified wrote:

Right on. message to the freeloaders.

If I make it for another month, I will be 86 years old. 43 years in the service and industry. Retired in 1994. Live on pension and SS. Still pay both state and federal income taxes on both 'incomes'. How sweet it i. Money deducted from my income paid for both of these retirements now I get to pay taxes again on the same money.

If I make it for another month, I will be 86 years old. 43 years in the service and industry. Retired in 1994. Live on pension and SS. Still pay both state and federal income taxes on both 'incomes'. How sweet it i. Money deducted from my income paid for both of these retirements now I get to pay taxes again on the same money.

Yes, that does PO all of us..

If you want to reply, then register here. Registration is free and your account is created instantly, so you can post right away.