Invested In Stocks? Better Read This.

Nov 30, 2017 15:59:34 #

Bad Bob wrote:

Ya think tRump will kill the Obama bull market?

Trump has nothing directly to do with the stock market.

The stock market has nothing directly to do with the economy.

Under Obama, 8 years of the slowest growth in history

More businesses closing than opening, first time in history.

The stock market and GDP increase has everything to do with the market responding to Trumps promises to reduce taxes, most every gain is due to futures.

The increase in GDP us directly related to Trump unwinding over 600 business killing regulations.

Your statement is nothing more than troll bate, and you proving you are completely ignorant to how Americans economy Operates.

Climb back under your rock.

Staying with msnbc, ABC, CBS, NBC news has made you a mushroom.

Mushrooms are kept in the dark, and fed nothing but shi#

Nov 30, 2017 16:24:47 #

Bad Bob

Loc: Virginia

jack sequim wa wrote:

Trump has nothing directly to do with the stock ma... (show quote)

Oh but I get the real news from Fox & Friends.

Nov 30, 2017 16:27:40 #

Bad Bob wrote:

Oh but I get the real news from Fox & Friends.

OK Helen Keller, deaf and dumb.

Nov 30, 2017 16:34:55 #

Bad Bob

Loc: Virginia

jack sequim wa wrote:

OK Helen Keller, deaf and dumb.

And gave my 10 votes to Hillary.

Nov 30, 2017 16:37:03 #

Bad Bob wrote:

And gave my 10 votes to Hillary.

Good job, you and 300,000 others like you. 😃

Nov 30, 2017 16:41:00 #

Nov 30, 2017 18:15:58 #

Bad Bob wrote:

Ya think tRump will kill the Obama bullshit market?

I fixed your post to reflect an accurate description.

Nov 30, 2017 19:20:16 #

Bad Bob wrote:

Ya think tRump will kill the Obama bull market?

1. Politicians do not control markets, no matter what you want to believe.

2. What 'looks' like a bull market is actually being driven by the massive currency inflation undertaken by the Federal Reserve since the derivatives crash of 2007.

3. Even if he wanted to, President Trump is unable to 'kill' or otherwise influence the current market that in no way was influenced by Obama or any other President. Why not? Refer to point 1.

4. The current stock market is inflated like a gigantic balloon and is destined to burst, just like every other 'financial bubble' in history. Like President rump said when he was asked about the economy during his campaign: "Remember the word bubble, remember that you heard it here".

Nov 30, 2017 20:17:16 #

Larry the Legend wrote:

So you just about made up your losses after the big crash then. What would I recommend? Well, I'm not a licensed investment advisor, you understand, but mine's all in silver and bitcoin. I bought the silver at $3 an ounce and the bitcoin was $10 apiece, I think... Of course, it's been a while but it just keeps on keeping on. I'm just sitting back, waiting for the final fiat dollar crash and we get back to some kind of honest money. I really think this might be the one.

No ,no .no. When I said I have almost quadrupled my money I am including my losses in the big crash. I took the figure from the pre crash 2007 and calculated from there. I really have almost, but not quite quadrupled my money. By 2009 I had lost almost half of my money, but by 2011, I was even and it has been all gravy on the way up since then. I am so glad I listened to my own instincts instead of the gloom and doom naysayers.

As I previously said, if you predict a crash every day, sooner or later you will be right, but not today. The Dow was up 331 today. I consider money that I did not make as money I lost. I will tell you this, over the years I have lost far more money acting on a crash that never happened, than I ever lost in a real crash. Many times in years past I felt like the market was way way too high and had to crash and burn, so I jumped out. Then it just kept going higher. I had to get back in at a higher level. The only crash I correctly called and got out on was 1987. Even then I screwed up by not getting right back in.

I also have dabbled in silver. In the short term I have done well, but over the long term not so much. I view gold and silver as doomsday insurance. I have some in case the country goes totally down the tubes, but as an investment precious metals suck. If you got bitcoin at $10 I think you are safe. I see it as a Ponzi investment. Only the early investors will do well.

To get back to stocks. As long as there is an America, over the long term nothing will ever beat stocks. The only other asset class to sometimes compare with it is real estate which has it's own set of risks. I am not smart enough for individual stocks. I love mutual funds, especially index funds.

The secret to stocks is to be able to ride out the inevitable crashes. If you can do that, and stay in when all of the other little fellers have been murdered, than you will do extremely well. My experience during the last crash has confirmed me in this belief. My only difficulty now is my age. I am not as rambunctious to survive a downturn as when I was young, but I ain't ascared.

Nov 30, 2017 20:32:57 #

Bad Bob

Loc: Virginia

son of witless wrote:

No ,no .no. When I said I have almost quadrupled m... (show quote)

What are you YTD Gaines Witless?

Nov 30, 2017 21:21:44 #

son of witless wrote:

No ,no .no. When I said I have almost quadrupled m... (show quote)

See, I don't value my investments in silver and bitcoin in terms of fiat dollars. I value them in terms of their worth after the fiat US dollar makes it's final crash and burns for good. It's coming, it's as plain as the nose on your face. Even with the world-wide fiat experiment we're seeing today, this cannot last forever. Ever since 1972, when Nixon cut the last ties of the US dollar to the gold standard, we have seen the 'boom-bust' (approximately) seven year cycle time after time. Austrian economists forecast it from many many years ago, and history upholds their predictions.

The only tool the Federal Reserve has to rectify a market downturn is to reduce interest rates and print money. Well, interest rates are currently at or close to zero and the Federal Reserve has been printing trillions for the last ten years. This extra currency has been distributed across the Earth but now it's coming home to roost in the stock markets. That's the 'boom' part of the 'boom-bust' cycle we are seeing now. Yes, we will see 'market euphoria' rise to unprecedented levels as investors 'make' millions on their paper investments. Then the bust will inevitably hit and the whole rotten system will finally, at long last, die a spectacular death. At that point, all those 'paper assets' will find their intrinsic value - zero. Add all the zeros to the end you want, the final value is still zero.

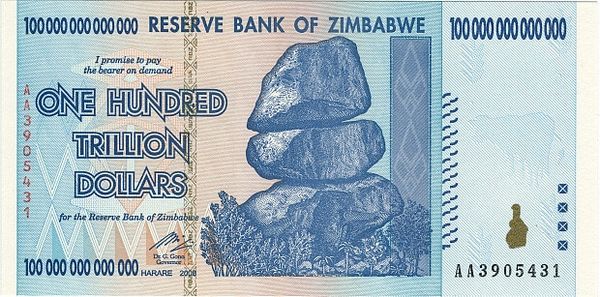

We've seen this before. In the 1920s, the Weimar Republic inflated their currency to the point that people were being paid twice a day to keep up with the ensuing inflation. It took a wheelbarrow full of paper money to buy a loaf of bread in the morning, and two in the afternoon. We saw a similar situation in Zimbabwe from the 1990s through to 2015, when the Zimbabwean economy eventually switched to using the US dollar as currency. At one point in November 2008, inflation was estimated at an annualized rate of 79,600,000,000 (79.6 billion) percent, and the Zimbabwean central bank had actually taken interest rates into negative territory, meaning that banks were literally paying people to borrow and hold money. Even so, by 2009, the fiat Zimbabwean dollar found its intrinsic value, zero. It was literally not worth the paper it was printed on. One of these wouldn't buy a pack of gum:

Nov 30, 2017 21:41:28 #

Bad Bob wrote:

What are you YTD Gaines Witless?

About 18%. If I had not wimped out from old age and begun to protect my gains by slowly transitioning into a bond fund a year or so ago, I would have done much better. The bond fund has been very disappointing. I never liked bonds. I consider them a necessary evil.

Nov 30, 2017 21:52:27 #

Larry the Legend wrote:

See, I don't value my investments in silver and bi... (show quote)

I do not entirely disagree with you. We will have another crash. We always have another crash, but we always recover from them. I agree that the excess liquidity is ending up in the stock market, but I do not see Zimbabwe inflation here. I am more concerned that the economic cycle is due to peak in a year or two. Until then it is party time. Unfortunately we could suddenly downturn in Trump's reelection year.

My theory is that as long as worry worts predict a crash it will not happen because it will keep some money out of the stock market and in their mattresses. And there are $ Billions in mattresses. Only when everyone stops worrying and the mattress money flows into the market, will I worry.

If you want to reply, then register here. Registration is free and your account is created instantly, so you can post right away.