Another $2.7 Trillion In U.S. Debt: Fed Quietly Revises Total US Debt From 330% To 350% Of GDP

Oct 12, 2015 22:23:21 #

10/12/2015 Fed Quietly Revises Total US Debt From 330% To 350% Of GDP, After "Discovering" Another $2.7 Trillion In Debt

Everyone has seen the chart of "Total Credit Market Instruments", which as of its most recent update on March 31, 2015, was just over $59 trillion, or 330% of US GDP.

All Sectors; Credit Market Instruments; Liability, Level 2015:Q1: 59,045.73 Billions of Dollars

http://research.stlouisfed.org/fred2/series/TCMDO

For those who have not seen it, as well as for those who are familiar with this chart, take a long look, because this is the last update of this particular data series, pulled straight from the Fed's Z.1 Flow of Funds (section L.1), you will ever see.

FEDERAL RESERVE STATISTICAL RELEASE

http://www.federalreserve.gov/releases/z1/20150611/z1.pdf

So did the Fed spontaneously terminate the reporting of what until the second quarter's update of the Flow of Funds, was the most comprehensive official summary of Household, Financial, Corporate and Government debt in existence? And if so why?

Many Fed watchers assumed that this is precisely what happened, and indeed, searching high and low for the infamous L.1 Section revealed nothing.

We can only assume that the vocal outcry that emerged in the aftermath of the Fed's release of its Q2 Flow of Funds statement missing this most critical of data sets on September 18, was so loud that three weeks later, this past Friday on October 9, the Fed released an official follow up explanation what exactly happened.

Here is what happened to the missing so very critical data series, straight from the horse's mouth:

Board of Governors' statistical release on the Financial Accounts of the United States

http://www.federalreserve.gov/releases/z1/z1_technical_qa.htm

Q: In the September 18, 2015 release of the Z.1 Financial Accounts of the United States, some tables in the summary section on credit market instruments seem to have disappeared. What happened to these tables and where can I find the equivalent data series?

With the September 18, 2015 Z.1 release, the classic presentation of the instrument category "credit market instruments" has been discontinued and replaced with two new instrument categories, "debt securities" and "loans".

Reporting debt securities and loans separately brings the Financial Accounts more in line with the international standards for national accounts. The debt securities instrument includes open market paper, Treasury securities, agency- and GSE-backed securities, municipal securities, and corporate and foreign bonds.

The new loans instrument includes depository loans not elsewhere classified, other loans and advances, mortgages, and consumer credit. Together, debt securities plus loans include all of the financial assets or liabilities previously included in credit market instruments.

While the underlying instrument categories that make up the sum of debt securities and loans are the same as those in old "credit market instruments" concept, changes to a few of these categories make the new sum of debt securities and loans larger than in previous publications.

This change has had three major impacts on the table structure of the publication: (1) summary tables focusing on "credit market instruments" have been eliminated; (2) remaining summary tables have been renumbered; and (3) new instrument tables for debt securities (tables F.208 and L.208) and loans (tables F.214 and L.214) have been created.

That's the "what", as for the why, note what the Fed said above: "the new sum of debt securities and loans larger than in previous publications." Which means that not only did the Fed stop reporting a consolidated total debt series, it admits that the actual debt was higher. Some $2.7 trillion higher.

Oops.

Here is the Fed's mea culpa on that particular topic:

Q: Why is the level of total debt outstanding in the September 18, 2015 release of the Z.1 Financial Accounts of the United States so much higher than it was in the previous Z.1 release?

Total debt outstanding was revised upwards due to methodology changes to both Treasury securities and security credit. Total debt outstanding is now the sum of two new instrument categories: debt securities (table L.208) and loans (table L.214). The aggregate of these instrument categories was previously called credit market instruments.

Treasury securities, part of the debt securities instrument category, now include non-marketable Treasury securities held by federal government defined benefit retirement plans (FL343061145).

The inclusion of federal government defined benefit retirement plans resulted in an upward revision to the level of federal government debt of about $1.408 trillion for 2014: Q4.

See the published FEDS Note "Federal Government Defined Benefit Retirement Plans" for more details

Federal Debt in the Financial Accounts of the United States

http://www.federalreserve.gov/econresdata/notes/feds-notes/2015/federal-debt-in-the-financial-accounts-of-the-united-states-20151008.html

In the domestic financial sector, borrowing previously classified as security credit liabilities (see release highlights) are now included as part of loans for the securities brokers and dealers sector. These are: (1) U.S.-chartered depository institutions loans for purchasing or carrying securities (FL763067003);

(2) foreign banking offices in the U.S. loans for purchasing or carrying securities (FL753067003); and (3) Households and nonprofit organizations cash accounts at brokers and dealers (FL153067005). The revision to broker dealer debt for 2014:Q4 was roughly $962 billion.

Similarly, borrowing previously classified as security credit liabilities of the household sector are now classified as loan liabilities. Margin accounts at brokers and dealers (FL663067003) are now included in the household sector's other loans and advances instrument category. This change resulted in an upward revision of $370 billion to the outstanding amount of household sector loans for 2014:Q4.

The bottom line:

The total revision to the level of debt outstanding (debt securities plus loans) due to these methodology changes is approximately $2.74 trillion 2014:Q4.

And so the Fed has managed to kill two birds with one stone: it no longer provides a simple, one-stop-shop way to reconcile the total US credit stock, and it quietly boosted total US consolidated credit by $2.7 trillion to $62.1 trillion as of June 30, 2015.

Luckily, for those who still care about such trivial memorandum items as "data" - made up as it may be - and would like to keep track of total US credit exposure, now better known as total debt and total loans, they can simply add up the two line items, with debt (found here) and loans (found here).

Federal Reserve Bank Saint Louis, All Sectors; Total Loans; Liability

http://research.stlouisfed.org/fred2/series/ASTLL

Federal Reserve Bank Saint Louis ,All Sectors; Total Debt Securities; Liability

http://research.stlouisfed.org/fred2/series/ASTDSL

This is how the old and new data look like: as noted, the consolidated total has risen by $2.7 trillion as of March 31, the last time the Fed reported the "old" series, and is currently a total of $62.1 trillion.

Not surprisingly, with GDP not revised higher, it means that the two most important data sets for the US economy, total debt (or credit) however defined, and total GDP, now look as follows:

The end result is that the ratio of Consolidated Credit to GDP, has quietly risen from 330% to 350%, without anyone in the broader public saying a word and without any of the official institutions, so seemingly concerned about the total stock of global debt, even noticing. And why should they: the S&P500 is back over 2000 so all is well.

Everyone has seen the chart of "Total Credit Market Instruments", which as of its most recent update on March 31, 2015, was just over $59 trillion, or 330% of US GDP.

All Sectors; Credit Market Instruments; Liability, Level 2015:Q1: 59,045.73 Billions of Dollars

http://research.stlouisfed.org/fred2/series/TCMDO

For those who have not seen it, as well as for those who are familiar with this chart, take a long look, because this is the last update of this particular data series, pulled straight from the Fed's Z.1 Flow of Funds (section L.1), you will ever see.

FEDERAL RESERVE STATISTICAL RELEASE

http://www.federalreserve.gov/releases/z1/20150611/z1.pdf

So did the Fed spontaneously terminate the reporting of what until the second quarter's update of the Flow of Funds, was the most comprehensive official summary of Household, Financial, Corporate and Government debt in existence? And if so why?

Many Fed watchers assumed that this is precisely what happened, and indeed, searching high and low for the infamous L.1 Section revealed nothing.

We can only assume that the vocal outcry that emerged in the aftermath of the Fed's release of its Q2 Flow of Funds statement missing this most critical of data sets on September 18, was so loud that three weeks later, this past Friday on October 9, the Fed released an official follow up explanation what exactly happened.

Here is what happened to the missing so very critical data series, straight from the horse's mouth:

Board of Governors' statistical release on the Financial Accounts of the United States

http://www.federalreserve.gov/releases/z1/z1_technical_qa.htm

Q: In the September 18, 2015 release of the Z.1 Financial Accounts of the United States, some tables in the summary section on credit market instruments seem to have disappeared. What happened to these tables and where can I find the equivalent data series?

With the September 18, 2015 Z.1 release, the classic presentation of the instrument category "credit market instruments" has been discontinued and replaced with two new instrument categories, "debt securities" and "loans".

Reporting debt securities and loans separately brings the Financial Accounts more in line with the international standards for national accounts. The debt securities instrument includes open market paper, Treasury securities, agency- and GSE-backed securities, municipal securities, and corporate and foreign bonds.

The new loans instrument includes depository loans not elsewhere classified, other loans and advances, mortgages, and consumer credit. Together, debt securities plus loans include all of the financial assets or liabilities previously included in credit market instruments.

While the underlying instrument categories that make up the sum of debt securities and loans are the same as those in old "credit market instruments" concept, changes to a few of these categories make the new sum of debt securities and loans larger than in previous publications.

This change has had three major impacts on the table structure of the publication: (1) summary tables focusing on "credit market instruments" have been eliminated; (2) remaining summary tables have been renumbered; and (3) new instrument tables for debt securities (tables F.208 and L.208) and loans (tables F.214 and L.214) have been created.

That's the "what", as for the why, note what the Fed said above: "the new sum of debt securities and loans larger than in previous publications." Which means that not only did the Fed stop reporting a consolidated total debt series, it admits that the actual debt was higher. Some $2.7 trillion higher.

Oops.

Here is the Fed's mea culpa on that particular topic:

Q: Why is the level of total debt outstanding in the September 18, 2015 release of the Z.1 Financial Accounts of the United States so much higher than it was in the previous Z.1 release?

Total debt outstanding was revised upwards due to methodology changes to both Treasury securities and security credit. Total debt outstanding is now the sum of two new instrument categories: debt securities (table L.208) and loans (table L.214). The aggregate of these instrument categories was previously called credit market instruments.

Treasury securities, part of the debt securities instrument category, now include non-marketable Treasury securities held by federal government defined benefit retirement plans (FL343061145).

The inclusion of federal government defined benefit retirement plans resulted in an upward revision to the level of federal government debt of about $1.408 trillion for 2014: Q4.

See the published FEDS Note "Federal Government Defined Benefit Retirement Plans" for more details

Federal Debt in the Financial Accounts of the United States

http://www.federalreserve.gov/econresdata/notes/feds-notes/2015/federal-debt-in-the-financial-accounts-of-the-united-states-20151008.html

In the domestic financial sector, borrowing previously classified as security credit liabilities (see release highlights) are now included as part of loans for the securities brokers and dealers sector. These are: (1) U.S.-chartered depository institutions loans for purchasing or carrying securities (FL763067003);

(2) foreign banking offices in the U.S. loans for purchasing or carrying securities (FL753067003); and (3) Households and nonprofit organizations cash accounts at brokers and dealers (FL153067005). The revision to broker dealer debt for 2014:Q4 was roughly $962 billion.

Similarly, borrowing previously classified as security credit liabilities of the household sector are now classified as loan liabilities. Margin accounts at brokers and dealers (FL663067003) are now included in the household sector's other loans and advances instrument category. This change resulted in an upward revision of $370 billion to the outstanding amount of household sector loans for 2014:Q4.

The bottom line:

The total revision to the level of debt outstanding (debt securities plus loans) due to these methodology changes is approximately $2.74 trillion 2014:Q4.

And so the Fed has managed to kill two birds with one stone: it no longer provides a simple, one-stop-shop way to reconcile the total US credit stock, and it quietly boosted total US consolidated credit by $2.7 trillion to $62.1 trillion as of June 30, 2015.

Luckily, for those who still care about such trivial memorandum items as "data" - made up as it may be - and would like to keep track of total US credit exposure, now better known as total debt and total loans, they can simply add up the two line items, with debt (found here) and loans (found here).

Federal Reserve Bank Saint Louis, All Sectors; Total Loans; Liability

http://research.stlouisfed.org/fred2/series/ASTLL

Federal Reserve Bank Saint Louis ,All Sectors; Total Debt Securities; Liability

http://research.stlouisfed.org/fred2/series/ASTDSL

This is how the old and new data look like: as noted, the consolidated total has risen by $2.7 trillion as of March 31, the last time the Fed reported the "old" series, and is currently a total of $62.1 trillion.

Not surprisingly, with GDP not revised higher, it means that the two most important data sets for the US economy, total debt (or credit) however defined, and total GDP, now look as follows:

The end result is that the ratio of Consolidated Credit to GDP, has quietly risen from 330% to 350%, without anyone in the broader public saying a word and without any of the official institutions, so seemingly concerned about the total stock of global debt, even noticing. And why should they: the S&P500 is back over 2000 so all is well.

Feb 28, 2017 07:33:38 #

Feb 28, 2017 07:39:18 #

norte wrote:

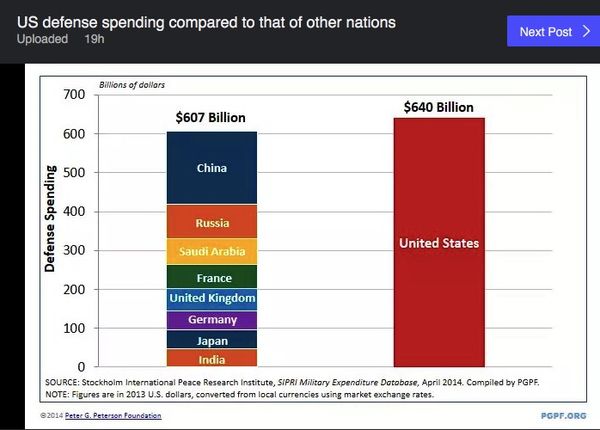

http://i.imgur.com/rVs54bu.jpg

norte, and your point is. The United States lives in a dangerous world.

Feb 28, 2017 09:09:53 #

Feb 28, 2017 09:34:35 #

norte wrote:

One wonders if US wars are the reason why there is terrorism, refugees, US debt, and tyranny.

One wonders if US wars are the reason why there is terrorism, refugees, US debt, and tyranny.

It's because, "We The People," don't hold our political leaders, responsible and accountable.

What has changed in 200 years for Terrorism, Barbary Pirates Wars, 1801–1805 and 1815–1816, and resent day Somalia Pirates Wars. ?

Refugees, with any type of war there will be refugees since the beginning of man.

U.S. Debt has been out of control spending since the Carter, Regan, Clinton, Bush jr., Obama had no budgets only controlled resolutions and now the Trump presidency budget.

Yes there has been tyranny under the President Obama.

Feb 28, 2017 09:53:33 #

Whether terrorism, refugees, US debt, and tyranny started 50 years ago or yesterday doesn't make it OK.

Feb 28, 2017 10:15:28 #

norte wrote:

Whether terrorism, refugees, US debt, and tyranny started 50 years ago or yesterday doesn't make it OK.

Whether terrorism, refugees, US debt, and tyranny started 50 years ago or yesterday doesn't make it OK.

Tyranny, terrorism, refugees, started from the beginning of man and his fall from grace . . .

The U.S. Debt started when they borrowed money to start the revolutionary war, to present with all these entitlements and borrowing. Governments don't produce anything, they only collect taxes and redistribute wealth and taxes.

Making U.S. Debt okay, is a different set of situations and conflicts, its only when we American citizens hold our politicians accountable for their hubris actions against other countries, political entanglements and how they spend our taxpayer dollars is an other total set of issues.

All one can do is be aware it exists and speak out against hypocrisy.

Teddy Roosevelt said "Walk softly and carry a big stick," in regards to world events in the 1910's, It's true today as it was then.

Feb 28, 2017 10:20:45 #

The US could cut the military budget by 50% and no nation would be stupid enough to attack the USA. The US has nuclear bombs.

Feb 28, 2017 10:39:57 #

norte wrote:

The US could cut the military budget by 50% and no nation would be stupid enough to attack the USA.

The US has nuclear bombs.

The US could cut the military budget by 50% and no nation would be stupid enough to attack the USA.

The US has nuclear bombs.

The U.S. has chose it's self to be a world superpower, and wether it has nuclear bombs is of no consequence.

Every four years you can vote, or write your congressman or senator, if you disagree.

There are rouge nations like North Korea, Iran, and terrorists organizations that say, death to America every day.

Thats exactly what Obama did, Clinton and Carter did, now the U.S. has to play catch up against, new ICBM's, cruise missiles etc.

This is a repeating cycle the U.S. has been playing for 30 years, how about the islamic terrorist bombing of the world trade center 9/1.

Now that Obama has unleashed the unveiled islamic dogs and illegal executive orders on immigration policy's, which the 4th federal circuit court struck down Obama's immigration overreach.

So now we have home grown terrorists to contend with in these new immigration policy's . . .

Feb 28, 2017 20:02:35 #

Feb 28, 2017 20:10:41 #

Ricko

Loc: Florida

norte wrote:

The US could cut the military budget by 50% and no nation would be stupid enough to attack the USA. The US has nuclear bombs.

norte-so does Russia except they have more than we do. America First !!!~

Feb 28, 2017 20:31:17 #

Is there still a Cold War? If the US has 6000 nukes and Russia has 7000, would anyone win a nuclear war?

Mar 1, 2017 01:28:26 #

norte wrote:

What's your problem.

Say what you really want to say, but you can't,

Out with it, . . .

Mar 1, 2017 02:49:35 #

You know the US has become batshit insane today when:

The answer to endless wars is more wars.

The answer to the police state is more tyranny.

The answer to a dead economy is starting a trade war.

The answer to regulations is more laws.

The answer to endless debt is more debt.

The answer to endless wars is more wars.

The answer to the police state is more tyranny.

The answer to a dead economy is starting a trade war.

The answer to regulations is more laws.

The answer to endless debt is more debt.

Mar 1, 2017 10:06:05 #

norte wrote:

You know the US has become batshit insane today when:

The answer to endless wars is more wars.

The answer to the police state is more tyranny.

The answer to a dead economy is starting a trade war.

The answer to regulations is more laws.

The answer to endless debt is more debt.

The answer to endless wars is more wars.

The answer to the police state is more tyranny.

The answer to a dead economy is starting a trade war.

The answer to regulations is more laws.

The answer to endless debt is more debt.

Is there more, let all come out sounds like you have a litany of grievances, but you can complain, what are the answers to all your grievances ?

Do you even have an answer ? or do you just complain incessantly and berate the subject material.

One Answer would be "A Constitutional Budget Amendment . . .

If you want to reply, then register here. Registration is free and your account is created instantly, so you can post right away.